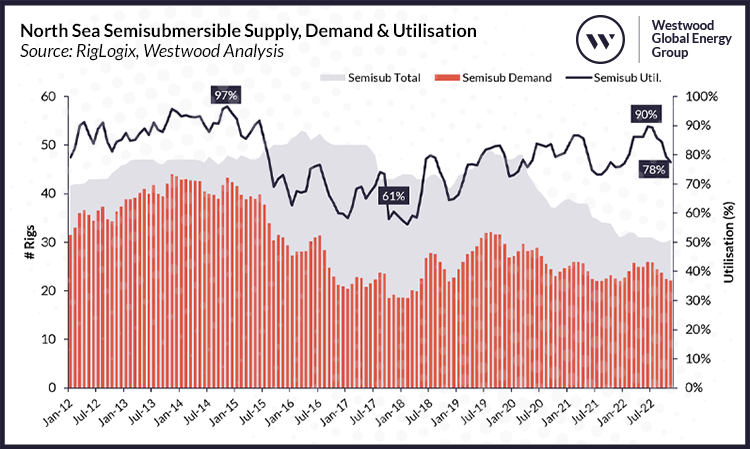

Utilisation of North Sea semisubmersibles (semis) as well as award activity during 2022 have shown improvement, but 2023 demand outlook is uninspiring and could result in more units leaving the region next year.

According to RigLogix, North Sea semi supply has shrunk by 36% or by 17 units between January 2015 and November 2022, following a prolonged lack of demand for these units, especially in the more mature UK sector. The semi market remains seasonal, with higher utilisation witnessed in the spring and summer months and lower utilisation in the months of harsher weather.

In July of 2022 however, this rig segment hit committed utilisation of 90%, which is the highest figure recorded since June of 2015 within the region. As we are now in autumn, demand has subsequently declined and utilisation is now sitting at just 78%, with nine units currently idle, two of which are cold stacked.

North Sea Semisubmersible Supply, Demand & Utilisation

Source: RigLogix, Westwood Analysis

More rigs exiting the region

While many other regions in the world are now recording consistent committed rig utilisation highs in the 90% arena, Northwest Europe in comparison, is lagging. This has led to more units leaving or being bid outside the region for new contracts with longer terms and higher dayrate potential, and the same can be said for the North Sea jackup segment too.

So far this year, Island Innovator and Deepsea Bollsta have left for new campaigns in Africa, and rumours suggest a third unit is planned to leave for Africa next year, while another may pick up a campaign in Australia, starting in the second half of 2023.

This further shrinking supply, will help to buoy utilisation in the near-term but could pose availability issues further down the line if demand picks up, which Westwood predicts may be the case from early 2024.

Healthy 2022 award activity

There has been an uptick in North Sea semi awarded days. Year to date 2022 new contracts total 7,399 rig days (Norway accounting for 5,661 days and the UK 1,738 days), which is the most awarded in a year since 2018 (7,592 days) and the third highest since 2012 when 20,993 days of backlog was secured in the region. And, of course, with less than six weeks left in the year, more fixtures could still be made, and the total may rise further.

North Sea Semisubmersible Contract Awards

Source: RigLogix, Westwood Analysis

During the third quarter of 2022, the North Sea semi market fixed 3,899 days of contract backlog, which is the highest number of days fixed during a single quarter since 2012. The average contact duration is also on the rise and is currently sitting at 264 days year to date, which is also the longest it has been since 2012.

Recent fixtures have also shown upward movement in dayrates too. Transocean Norge could earn an average dayrate of $408,000 under a new deal with Wintershall Dea and OMV in Norway assuming all project approvals are given, while market sources suggest a recent fixture for Transocean Barents in the UK sector will be above $300,000 per day.

However, 37% of backlog awarded so far this year will not begin until at least 2024 and the current visible outstanding demand for North Sea semis in 2023 doesn’t look quite so promising.

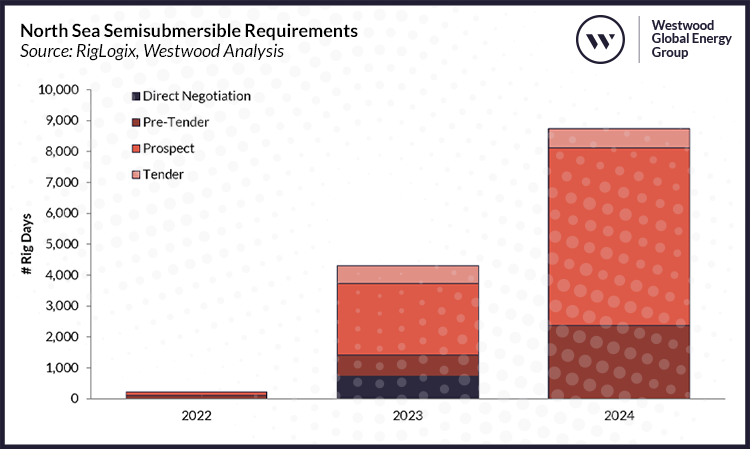

Low demand visibility for 2023

RigLogix currently records just under 2,000 days of demand outstanding for work likely to be awarded in 2023, consisting of pre-tenders, tenders, and direct negotiations. Additionally, there is prospective demand for approximately 2,300 further days of work yet to be tendered.

This outstanding demand equates to a total of just over 4,260 days of potential work, which is almost 64% less than the visible demand outlook for 2024. Additionally, average contract duration of this outstanding demand is just 171 days, around 43% lower than this year’s current figure.

During 2024, Westwood expects to see several new Norwegian developments move ahead because of the tax incentives that were implemented by the government during 2020. Meanwhile there are a variety of longer term UK campaigns likely to start-up, consisting of plugging and abandonment (P&A) work as well as development projects.

North Sea Semisubmersible Requirements

Source: RigLogix, Westwood Analysis

There are four semis in the region that currently have free and clear availability, but as previously mentioned, two of these are expected to mobilise for work in new regions and the other two are rumoured to be in the running for new deals in the UK. There are four further units that could also become available during 2023 if extensions or new work are not secured, and a handful of other units that could also move into the North Sea from China, Canada, and other regions should demand call for it.

The market fundamentals within this segment are showing potential for a tighter market, but likely not until 2024 unless further demand for 2023 emerges. This will of course depend on other factors, such as the response to the additional hike in windfall tax on UK oil and gas profits, as well as the Norwegian government’s plans to phase out its tax relief package that was introduced as part of its response to the Covid-19 crisis in 2020.

Until the market constricts, Westwood believes drilling contractors will continue to assess opportunities for their harsh-environment assets in other regions where longer term and more fruitful opportunities are appearing, which poses a few questions: once out of the market, how long will it take for these rigs to return to the North Sea? If demand does indeed continue to grow from 2024 onwards, will there be enough supply to cover it? And just how much will operators be willing to pay to secure drilling assets for their campaigns in a considerably tighter market?

Teresa Wilkie, Research Director – RigLogix

[email protected]