Introduction

Since the oil and gas downturn of 2014 there has been significant pressure on drilling service costs, including land rig day rates. The world has seen pandemics, significant military conflicts as well as renewed efforts to transition the world away from oil and gas, all of which have deeply impacted the cost of oil and gas projects. One of the most significant costs on any onshore oilfield is the cost of hiring a rig to drill the well and, as a result, there is a need for land rig operators, as well as oil & gas operators, to understand the market for land rig day rates, something Westwood Global Energy Group’s (WGEG) new day rate dataset can supply. Offering a quick, easy-to-use analytical tool, that allows clients to see day rates for each individual rig, based on the rig specification and the day rate expectations of the country it is currently based in.

At launch, the day rate expectations for Latin America and MENA regions, as well as the USA, will be included within the Global Land Drilling Rig (GLDR) tool, with plans to add the rest in across the course of the year in the following order:

- MENA, Latin America and USA

- Canada

- Australasia

- Western Europe

- Africa

- Asia

- Eastern Europe & FSU

This white paper is intended to give you an introduction to Westwood’s global land rig day rate database and highlight the initial findings, as well as outlining the methodology that has been applied.

Download the PDF Terms and Conditions of Use

Methodology

Before the data gathering process began all the rigs in the GLDR Tool were categorised into six groupings based on their drawworks HP – (0-499, 500-999, 1,000-1,499, 1,500-1,999, 2000-2,999 and 3000+). These HP ranges were used to get our initial dayrate values for each country, with research indicating that drawworks HP is one of the most important factors in determining a dayrate. The dayrate information itself has been gathered primarily via an extensive consultation exercise with industry professionals, predominantly operators, rig managers and rig company business development managers to help develop a picture of the respective dayrates in each country, for each HP Category. Rather than a single figure a range is utilised for the dayrates:

| Country | HP Range | Dayrate Range ($) |

| Country X | 0-499 | 8,000-10,000 |

| Country X | 500-999 | 10,000-12,000 |

| Country X | 1,000-1,499 | 12,000-,14,000 |

| Country X | 1,500-1,999 | 14,000-17,500 |

| Country X | 2,000-2,999 | 17,500-20,000 |

| Country X | 3,000+ | 17,500-20,000 |

Example dayrate range by HP category

Where known dayrate information was unavailable for a specific country, the dayrate range has been calculated by taking a regional average of the known low and high points in the dayrate ranges populated for other countries in the same region:

| HP Range | Country X Dayrate Range ($) | Country Y Dayrate Range ($) | Regional Average ($) |

| 0-499 | 8,000-10,000 | 10,000-12,000 | 9,000-11,000 |

| 500-999 | 10,000-12,000 | 12,000-14,000 | 11,000-13,000 |

| 1,000-1,499 | 12,000-14,000 | 14,000-16,000 | 13,000-15,000 |

| 1,500-1,999 | 14,000-17,500 | 16,000-19,500 | 15,000-18,500 |

| 2,000-2,999 | 17,500-22,000 | 19,500-24,000 | 18,500-23,000 |

| 3,000+ | 17,500-22,000 | 24,000-27,000 | 20,750-24,500 |

Example dayrate ranges for regional average by HP category

It should be noted however that the regional averages are only used on countries with limited land rig demand with less than ten active rigs. All major countries, including Argentina, Saudi Arabia and the UAE have individualised dayrate ranges.

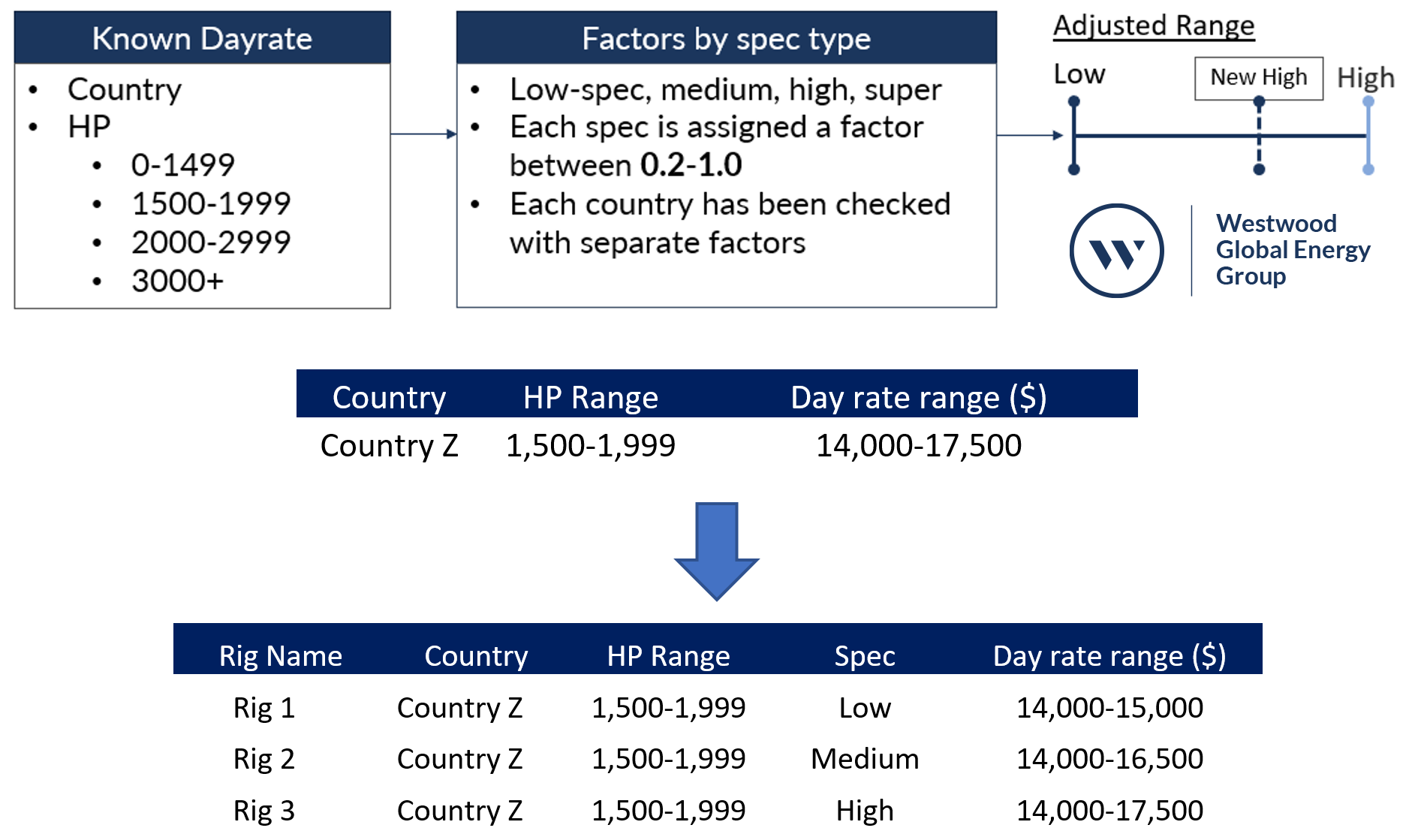

This exercise gives us a starting dayrate range for each country we cover. However, to add extra detail and nuance to the figure, we then consider other parts of the rig equipment which can have some influence on the dayrate (as determined by further consultation), using this to narrow down the dayrate range, depending on the importance of certain rig specifications within each country. This is segmented into four groups, Low, Medium, High, and Super spec.

Westwood Rig Specification Classifications:

| Specification | Definition |

| Low | The rig has a mechanical power system and a generally a low hookload capacity and mud pump operating pressure. Please note only units in the 0-1,499 HP category are considered in the Low category. |

| Medium | These rigs run on an electrical power system, but the specs of the rig equipment fall short of that seen on High or Super category rigs. Also, if we do not have enough information on the rig it is assigned to the Medium classification. |

| High | The rig has an AC power system, a static hookload capacity of 500,000 lbs+, >1,500 HP, and an average mud pump operating pressure of 5,000 PSI. |

| Super | The rig has an AC power system, a static hookload capacity of 750,000 lbs+, >1,500 HP, and an average mud pump operating pressure of 7,500 PSI. |

- For each country, each of the Westwood rig classifications is assigned a factor between 0.2-1.0, which delineates the upper bound of the dayrate range that a rig assigned with that classification can earn within the given dayrate range for its horsepower category.

- The factor applied to each of the rig classifications will vary on a country-by-country basis and is designed to capture factors such as the existing supply and capabilities of the rigs in the market, as well the level of technical requirements within the market. Where possible, these adjustments are made based on targeted industry consultations. There may be little variance in the dayrate in some countries between a rig that is low-spec and one that is high. As a result, both will have the same dayrate range, despite the difference in specification.

- The key driver for the dayrate range assigned to a rig remains the horsepower; the Westwood specification classifications refine the upper bound of the dayrate for the individual rig within the day range for its horsepower category.

Dayrate values will be reviewed on a rolling basis with reviews to be carried out every quarter for each region.

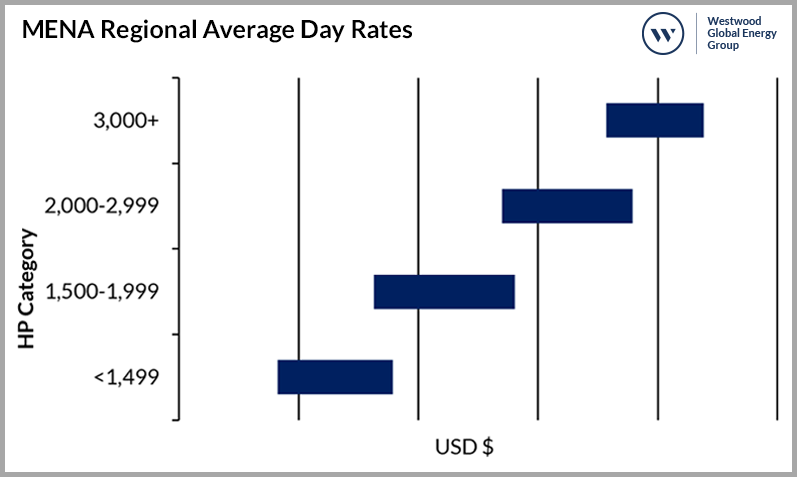

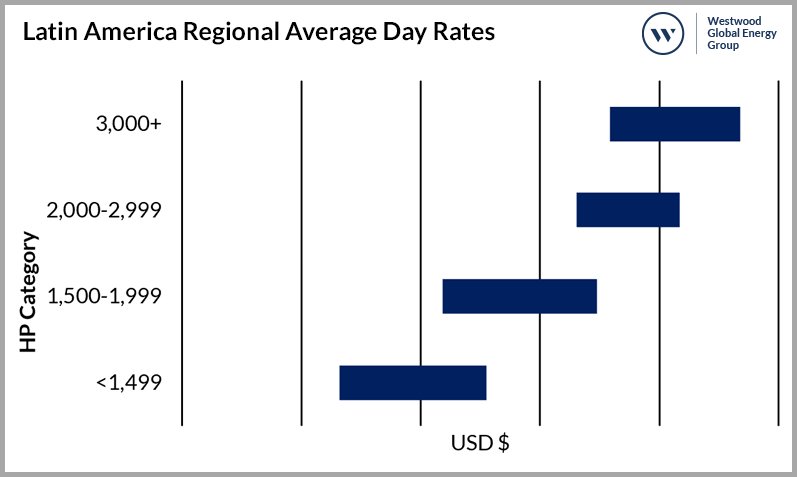

Findings: MENA Dayrate ranges have wider variance than Latin America

As stated above, Westwood began the exercise with two regions that are expected to see strong levels of activity in the coming years – Latin America and the Middle East and North Africa.

The dayrate ranges illustrated in the GLDR Tool are indicative ranges of the present-dayrates obtained by drilling rigs operating in the given country.

In the Middle East and North Africa dayrates see significant variation, particularly between the GCC countries and those elsewhere. GCC countries such as Kuwait can see dayrates of over $50,000 per day for the super high specification 3,000 HP+ rigs they host, whereas countries such as Egypt see lower than average dayrates due to low utilisation rates and an aging rig fleet. In general, North Africa is likely to see more fluctuation in rig day ates due to more short-term rig contracts compared to the Middle East where long contracts are preferred. Contracts in the GCC region are also heavily focused on health and safety and past performance making it harder for new contractors to enter the region. These longer contracts will also mean we expect to see less variation in dayrates over the year as most contracts will be fixed for up to five years.

Latin America as a whole sees less variation across the region than that seen in MENA, but still has significant variance. One key feature of dayrates in the region is the variability of pricing within each country. In countries such as Argentina and Colombia dayrates vary based on location within the country. In Argentina the further south the rig is required the more expensive the workforce and logistics typically are and therefore the higher the dayrate. For example, in the central Province of Neuquen and Rio Negro dayrates are typically lower than those seen further south in the Province of Chubut, increasing further in the far south Province of Santa Cruz. In Colombia there is a higher-than-average dayrate with rates affected by distance to the drilling location with some contractors including the cost of mobilisation within the dayrate cost to make it more affordable for operators.

The countries that see the lower dayrates, such as Peru and Paraguay, host no high spec 3,000 HP rigs therefore we see a lower maximum dayrate caused by the lower rig specifications available.

Day rates are affected by demand, rig specifications and age as well as drilling location and have generally been on a downward trend since the 2014 oil price collapse, with utilisation contracting dramatically across the globe. This has only been exacerbated since the start of the Covid-19 pandemic which caused a further reduction in onshore drilling activity and therefore a reduction in demand. While we expect rig demand to begin to improve globally, spurred on by the unexpected rise in oil prices we do not foresee a rapid increase in dayrates. Utilisation rates remain low globally, giving field operators significant options and bargaining power. At the same time, many contracts (especially those in the GCC countries) are long-term, preventing a change in dayrates until the contract has been completed.

Todd Jensen, Analyst

Onshore Energy Services

[email protected]