Two significant oil discoveries announced by Shell and TotalEnergies in February 2022 have opened multiple new oil plays offshore Namibia. The excitement is understandable, but how significant could the breakthrough prove to be and what challenges need to be overcome to realise the potential?

Between 2006, when the giant Tupi field was discovered, opening the 30 billion barrel pre-salt play of the Santos basin in Brazil, and 2021, around $30 billion has been spent trying to open new plays in 116 basins around the world. Of the 16 new commercial oil plays that have emerged, the Liza play in the Upper Cretaceous of the Suriname-Guyana basin is by far the biggest, at ~10 billion barrels, with the rest appearing to plateau at ~2 billion barrels of oil or less.

What is known so far about the Namibia discoveries? On 4 February 2022 Graff-1 was reported to have made a light oil discovery in what are assumed to be Upper Cretaceous sands in block 2913A. There are unconfirmed reports of a ~60m hydrocarbon bearing interval and a potential commercial resource of ~300mmboe. Shell is currently drilling a second well at La Rona, which is likely to be appraising the discovery prior to confirmation of the potential for a commercial development. Latest rumours suggest that Graff could have 1 billion barrels of oil and 5-6Tcf of gas.

20 days after Graff was announced TotalEnergies reported that it had made a significant discovery of light oil with associated gas on the Venus prospect, in block 2913B. The Venus 1-X well encountered approximately 84m of net oil pay in a good quality Lower Cretaceous reservoir. No resource figures have been reported, although there are persistent rumours of a multi-billion discovery.

The discoveries are a long-awaited breakthrough for Namibia, and potentially also for South Africa into which the Orange Basin extends. So how big could the prize be?

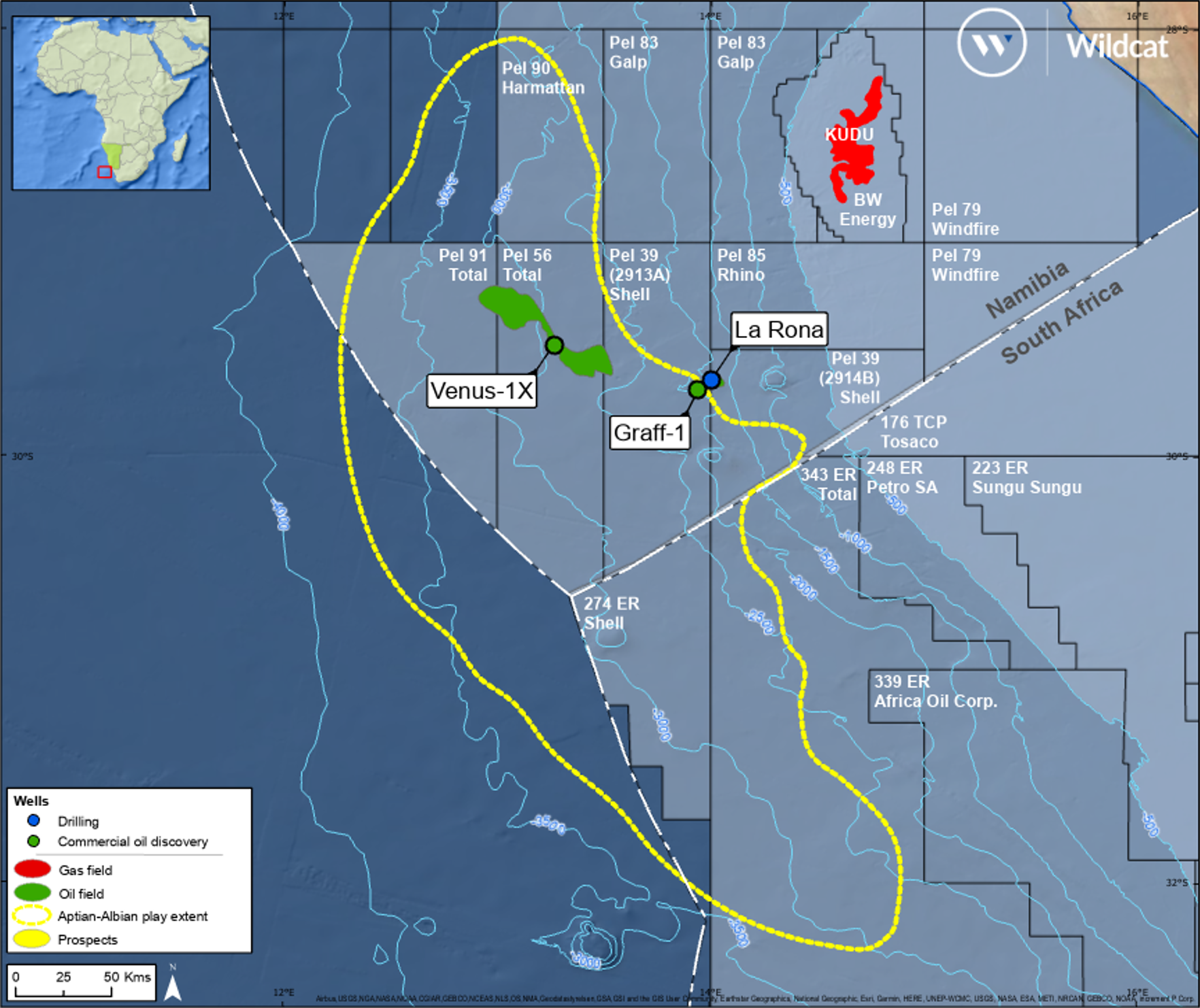

Figure 1: Offshore Namibia and South Africa showing licenced acreage, block operators, possible extent of the Aptian-Albian play fairway and recent discoveries

Source: Wildcat, Westwood Analysis

The discoveries have proved the presence of an extensive, prolific oil kitchen and Westwood analysis suggests that the Lower Cretaceous Venus play has a potential extent of up to ~58,000km², comparable to that of the Upper Cretaceous of Suriname-Guyana. A Suriname-Guyana scale oil province is certainly possible provided that the traps are present and the deepwater reservoirs are widespread and of good enough quality. All the prospective acreage looks to be already taken under fiscal terms reflective of the high-risk frontier nature of the basin prior to the discoveries. What few opportunities for new entrants exist will now carry a significant premium.

There are a number of challenges that will need to be overcome before the scale of the potential prize becomes clear, however.

The Venus discovery is ~325km from the coast and in 3000m water depth and, if it comes into production, will be the deepest water development globally to date. Shell currently operates the world’s deepest water development at Stones in 2900m of water in the US Gulf of Mexico. Deepwater adds cost and engineering complexity to the installation and operation of any project.

The deepwater challenges may be exacerbated by potentially high gas content within the discoveries. Although no detailed information on the properties of the hydrocarbons discovered has been reported, TotalEnergies report associated gas, suggesting either the presence of a free gas cap or a high gas-oil ratio, where significant volumes of gas are dissolved within the liquid hydrocarbons. Development wells will have to avoid any gas cap that may be present. Produced gas will have to be carefully managed and may require reinjection back into the reservoirs until an economic way to produce the gas and take it to market can be established. Gas management has already proven to be a challenge in Suriname-Guyana and some of the discoveries made in Suriname are at risk of being stranded due to the high gas content and absence of a significant local market. Current understanding of the oil and gas source kitchen offshore Namibia suggests that any hydrocarbons generated are likely to have a higher gas content to the south and the east of the discoveries.

Venus is reported to have an areal extent of ~600km. The discovery well encountered an 84m hydrocarbon column, potentially within the thickest part of the reservoir. Away from the discovery well it is likely that the hydrocarbon column is thinner, making economic production more challenging. The number of barrels of oil that can be produced from each well will be critical to the ultimate recoverable reserves and commerciality.

The trap at Venus is understood to be a complex combination trap involving both stratigraphic pinch outs and faults. The complexity may be key to the size of Venus and the configuration may be unique. Whilst it is highly likely that other traps do exist in the basin, individual pools may be smaller than Venus.

Graff is in shallower water, at ~2000m, comfortably within the range of current deepwater developments. Follow on prospectivity has been recognised within an adjacent foldbelt and may already be being tested at La Rona.

The Liza field was on stream within five years of discovery and a similar timeline is possible for Graff and Venus if the volumes can be confirmed and the technical challenges overcome.

One thing is for certain – a new exploration hotspot has emerged.

Graeme Bagley, Head of Global Exploration & Appraisal

[email protected]