Since the UK Government announced a further 10% hike to the UK Energy Profits Levy (EPL) – also known as the windfall tax – which took the headline tax rate for UK oil and gas producers to 75% and delayed the closing date until 2028, there has been a steady stream of announcements from North Sea operators regarding their forward drilling plans (or lack thereof) in the region.

The move, aimed at raising cash to aid the UK’s cost of living support programmes, has received backlash with many arguing that it will drive away investment at a time when energy security is more crucial than ever.

Supermajors, mid-sized operators and smaller independents have all voiced concern regarding the new fiscal environment. TotalEnergies, Equinor, Shell and EnQuest (to name a few) plan to reduce UK spending this year, while Harbour Energy blamed the tax changes on its recent job cuts. New reports have also indicated that some of the planned greenfield projects, such as Ithaca Energy’s West of Shetland Cambo development, may now also be in jeopardy of reaching a final investment decision (FID) due to the EPL.

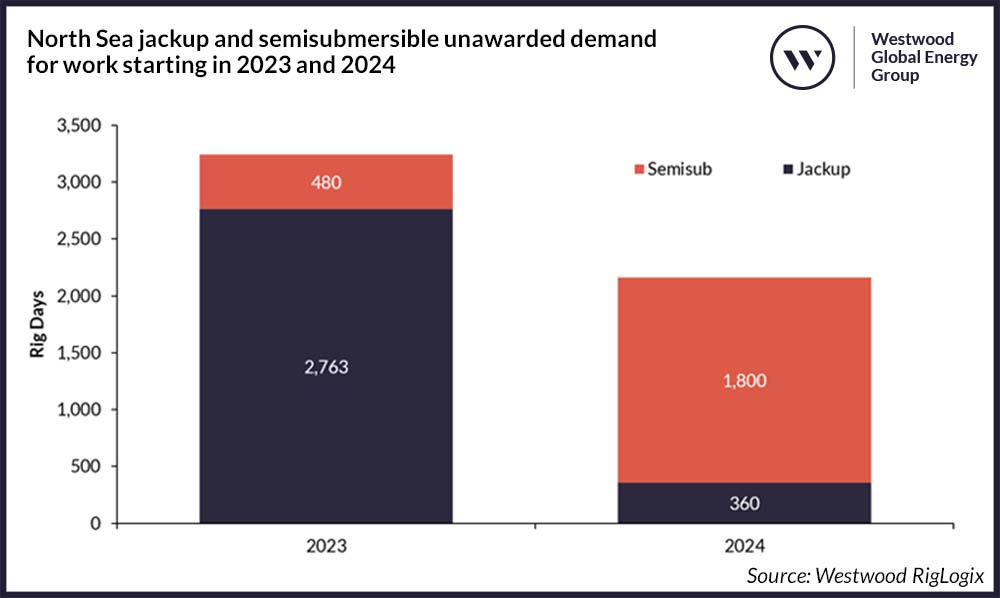

Westwood’s RigLogix solution currently shows a total of 5,403 days, or 14.8 rig years, of British jackup and semisubmersible (semi) demand with a 2023 or 2024 start date and already in the tender or pre-tender/enquiry stage. These include new greenfield projects, as well as brownfield and decommissioning (plug and abandonment) work, that are a mixture of short-term and multi-year duration. However, several of these planned projects may now be in question and the outlook could change drastically if operators decide their projects are no longer feasible in the current financial climate.

Figure 1: North Sea jackup and semisubmersible unawarded demand (tenders, pre-tenders/enquiries, direct negotiations) for work starting in 2023 and 2024

Source: Westwood RigLogix

Recent casualties announced

All of this will have a knock-on effect on already anaemic North Sea rig demand, which was highlighted recently by Apache’s early contract termination of Diamond Offshore mid-water semi Ocean Patriot. The rig is now set to become available in July 2023, over 400 days earlier than planned and Apache stated that the cancellation was off the back of the changes to the EPL.

Additionally, a Letter of Intent (LOI) awarded to a sixth-generation semi by a well-known UK operator, which could have seen the rig fixed until 2030 if all options were taken up, has also been cancelled following a re-jig of the company’s UK drilling plans. The rig will now be available upon completion of its current UK drilling campaign in mid-2024.

And there may be more casualties to come.

IADC North Sea Chapter reaches out for help

The International Association of Drilling Contractors’ (IADC) North Sea Chapter recently sent a letter to all 650 UK MPs and 129 MSPs warning that further harsh-environment rigs could be “lost for good” due to the windfall tax changes and stated that rigs are just the “tip of the spear” for further oil and gas production, that they are “vital” for decommissioning hundreds of North Sea wells, as well as playing a “critical role in meeting net zero” through facilitating Carbon Capture Utilisation and Storage (CCUS) projects. “Reduction in the available fleet size will severely hamper all of the above,” the letter stated.

North Sea total rig supply has continued to fall since 2017 and is today 40% leaner than it was in March of that year. In the past two years alone, 13 rigs have left the region – either for work elsewhere or through retirement – and two more are already confirmed for relocation later this year to Canada and Namibia, namely semis Hercules and Deepsea Mira.

Figure 2: North Sea jackup and semisubmersible awarded demand and total supply (incl. cold-stacked supply) January 2013-December 2023

Source: Westwood RigLogix

Supply has wilted due to lacking demand for rigs in the region, which is mostly made up of the UK, Norway, the Netherlands and Denmark. A previous Westwood Insight published in late November 2022, shared that despite improving North Sea rig market fundamentals last year, rigs were being enticed abroad by jobs with longer durations and higher dayrates.

This appears to be a trend that will persist this year, especially with the additional dampening of demand appetite because of the amended UK fiscal regime, while Norwegian drilling campaigns also look few and far between. An improvement in development drilling demand off the Scandinavian country had initially been expected to improve during the second half of this year, but now an uptick off the back of the Norwegian tax incentives does not expect to materialise until mid-2024 at least.

In the North Sea, there are currently four cold-stacked rigs (three semis and one jackup) and nine warm-stacked rigs (five semis and four jackups). Only three of the latter have future work in place and two of those will be outside of the region. Additionally, there are 15 further rigs that could roll off contract before the end of this year if follow-on work is not found or if options aren’t declared.

Rig owners look to other areas for work

Industry sources advice that at least two – but potentially more – North Sea semis will likely be confirmed for contracts outside of the region this year. During its 4Q 2022 results call, Transocean CEO, Jeremy Thigpen, stated “we anticipate at least two additional semis will leave Norway in the next 12 months potentially for opportunities in Australia. If this happens, we believe there will be a supply deficit in Norway in 2024.”

In addition, it is understood that another high-specification, harsh-environment semi currently based in the North Sea could be in line to drill in the eastern Mediterranean later this year, which will mean another unit exiting the region for at least a few months. Several North Sea semi contractors have confirmed to RigLogix that they are now bidding their assets for work in areas such as West Africa, Asia Pacific and the Mediterranean due to paltry demand in region.

Meanwhile in the jackup segment, there is a similar sentiment from rig owners, highlighted by Valaris recently confirming that it will preservation stack the Valaris Viking as a cost-reducing measure. The company says it does not see sufficient work in the region to keep all three of its harsh-environment rigs working due to softening North Sea demand from “the uncertainty created by changes to fiscal policy related to windfall taxes”.

Market sources indicate that further North Sea jackups are also being bid on projects outside of the region due to a lack of near-term opportunities. Over the past year alone we have seen six units leave for work in the Middle East, Mexico and West Africa.

Rigs could be lost for good

There is concern that once rigs exit the region, they may not return – especially given the high mobilisation costs incurred with the initial relocation as well as attractive contract terms and dayrates in other areas of the globe such as the Golden Triangle (US Gulf of Mexico, South America and West Africa), the Middle East or Australasia.

A knock-on effect from a continued North Sea rig exodus would be a smaller pool of rigs within the region, meaning less choice and subsequently higher dayrates for those operators that do wish to press ahead with campaigns in the next few years.

Although we witnessed some improvement before the coronavirus pandemic in 2019, rig demand in the North Sea has struggled to recover since the oil price crash in 2014. The added fiscal volatility from the UK will further challenge any previously anticipated recovery expected from the rising commodity prices, as has been the case in many other areas of the world that have seen increased rig demand, utilisation and dayrates.

Teresa Wilkie, Research Director – RigLogix

[email protected]