Introduction

The key story of the last three months has been the rapid rise in oil and gas prices following Russia’s invasion of Ukraine. In December 2021, Brent oil prices averaged $74 a barrel, and by March 2022 they averaged $118, highlighting just how dramatic an impact the invasion had on global prices. Several steps undertaken to lower oil prices, such as the International Energy Agency (IEA) announcing that its members, including US and Japan, have agreed to release 60 million barrels of oil from emergency reserves have had a limited impact on pricing to date. Later in the quarter, focus turned to OPEC+ who on 31 March 2022, announced it was to stick to its quota production growth of 400,000 barrels per day for April rising to 432,000 barrels per day for May 2022.

As oil prices crossed the $100 barrier in February, Westwood commented on how the higher oil prices would impact the land rig market. While we expect to see a stronger upswing in activity than expected, several bottlenecks remain, preventing as quick an upswing in land rig activity as the current oil prices seem to warrant.

Oil and gas prices for the rest of the quarter are hard to predict, with much resting on how the conflict in Ukraine evolves, though the continued reduction of OPEC+ quotas and the actions of the US to release additional reserves could begin to alleviate some of the supply pressures.

Middle East

UAE continues spending spree as it plans upgrade to 5 mmbbl/d production capacity

Several countries in the region continued to award contracts as part of their push towards production capacity increases. Like 4Q 2021, Abu Dhabi National Oil Company (ADNOC) led the way, awarding further contracts in its bid to reach 5 mmbbl/d capacity by 2030. This growth target will lead to demand for hundreds of wells to bolster production. The total value of ADNOC’s drilling-related framework agreements and procurement awards since November 2021 has now reached c.$10 billion.

Table 1: ADNOC Contract Awards 1Q 2022

| Service | Value ($million) | Company | Contract Duration (Years) |

| Well Testing | $169 | NESR AlMansoori Al Ahlia | 5 |

| Wireline Logging and Perforation Services | $1,940 | ADNOC Drilling Schlumberger Halliburton Weatherford | 5 (+2) |

| EOR | £227 | RobtStone | |

| Cementing | $658 | Halliburton Baker Emirates Western NESR Emjel | 5 (+2) |

ADNOC also announced plans to tap into its unconventional oil resources, estimated at 22 billion barrels and is currently engaging with potential international partners and operators to support the development. This follows ADNOC’s recent statement that Abu Dhabi’s estimated unconventional gas resources stand at almost 160 trillion cubic feet. While no time frame has been advanced for the development of these resources is yet to be announced but encouraging production results have been seen in the Al Dhafra region, west of Abu Dhabi, where ADNOC is carrying out de-risking activities.

ADNOC Drilling, the largest national drilling company in the Middle East with 99 rigs, showed signs of recovery from the covid pandemic and oil price downturn with a net profit of $604 million for 2021, 6% up compared to the $569 million made in 2020. The stronger earnings have been attributed to improvements in performance for onshore operations and higher income from its oilfield services business. ADNOC Drilling’s 12-month revenue increased year on year by 8.2% to $2.27 billion.

Saudi Arabia signs multiple contracts, but trouble looms

Another country that has seen significant investment is Saudi Arabia as they aim to reach 13 mmbbl/d of crude production capacity while also substantially increasing their natural gas output. In January the company announced that they had signed 50 agreements at the In-Kingdom Total Value Add (iktva) Forum and Exhibition.

Major signings include:

- Schlumberger – Partnership on climate leadership and digitalization through localization initiatives

- Cameron/TechnipFMC/Baker Hughes – Wellhead equipment localization procurement agreements

- Larsen & Toubro – Pressure vessel fabrication localization

- Sutherland Global Services – Smart City services localization

- Tanajib Cogeneration Power Company – Tanajib cogeneration and desalination agreement

- Honeywell – Localization of process automation solutions

- Alfanar Company – Carbon fibre investment collaboration

Following this, Schlumberger announced the award of a contract for a gas drilling project in Saudi Arabia, though the exact project was not named. The integrated project scope encompasses drilling rigs and technologies and services, including drill bits, measurement while drilling (MWD) and logging while drilling (LWD), drilling fluids, cementing, and completing wells.

In late March, Saudi Aramco had a setback as its key oil facility in Jeddah was attacked by the Houthi rebels, causing a fire in two storage tanks. The Houthis also claimed attacks on the Saudi capital of Riyadh and the city of Dhahran, home to Aramco’s headquarters.

Middle East – Other news

Kuwait Oil Company (KOC) announced that it is preparing to award contracts for the supply of 63 oil drilling rigs with a total value of $4.6 billion. The company is currently reviewing bids from 24 foreign and two local companies with each bidding company allowed to bid for the supply of up to eight rigs. The rigs are required to be delivered within five years.

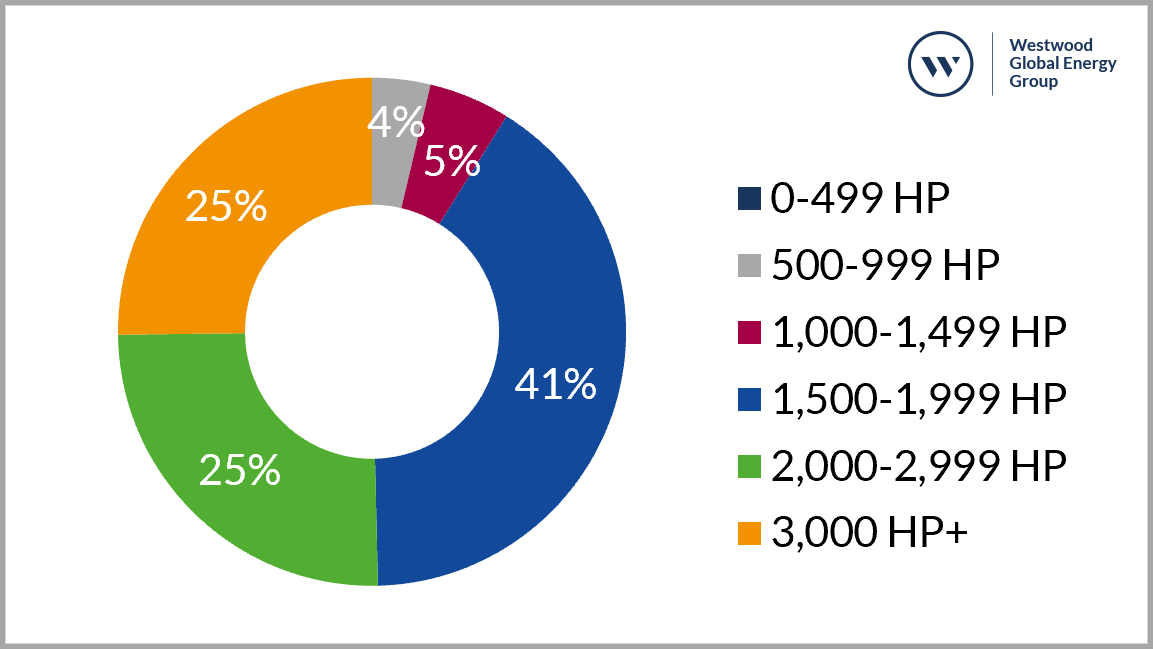

Figure 1: Existing Kuwait rig fleet by horsepower category

Oman saw commitment from Shell and its Block 10 partners, OQ and Marsa LNG, who are set to invest $2 billion over the 18-year tenure on developing key facilities required for the gas rich onshore acreage. Shell will hold a 53.45% operating interest in Block 10, with OQ and Marsa LNG holding 13.36% and 33.19% respectively.

Also in Oman, Medco signed a two-year extension for the services of the Abraj Energy Services owned 1,000 HP, Abraj 105 land rig for the development of the Karim Small Fields. Abraj Energy Services is the market leader in Omani drilling services, hosting 21 land rigs in Oman.

North Africa

Significant rise in interest onshore Egypt

Egypt has seen positive signs of investment with seven companies being awarded acreage in the latest licensing round and committing to spending $250 million on exploration activities. Eight licenses were awarded, four onshore and four offshore, to Eni, BP, Apex International, Energean, INA Nafta, Enap Sipetrol and United Energy Group. Onshore, Eni was awarded Block 7 in a 50:50 partnership with privately-owned Apex and Block 9, which it will operate with 100% interest and Energean, was awarded Block 8 in partnership with INA Naftaplin, while Hong Kong-listed United Energy landed Block 11.

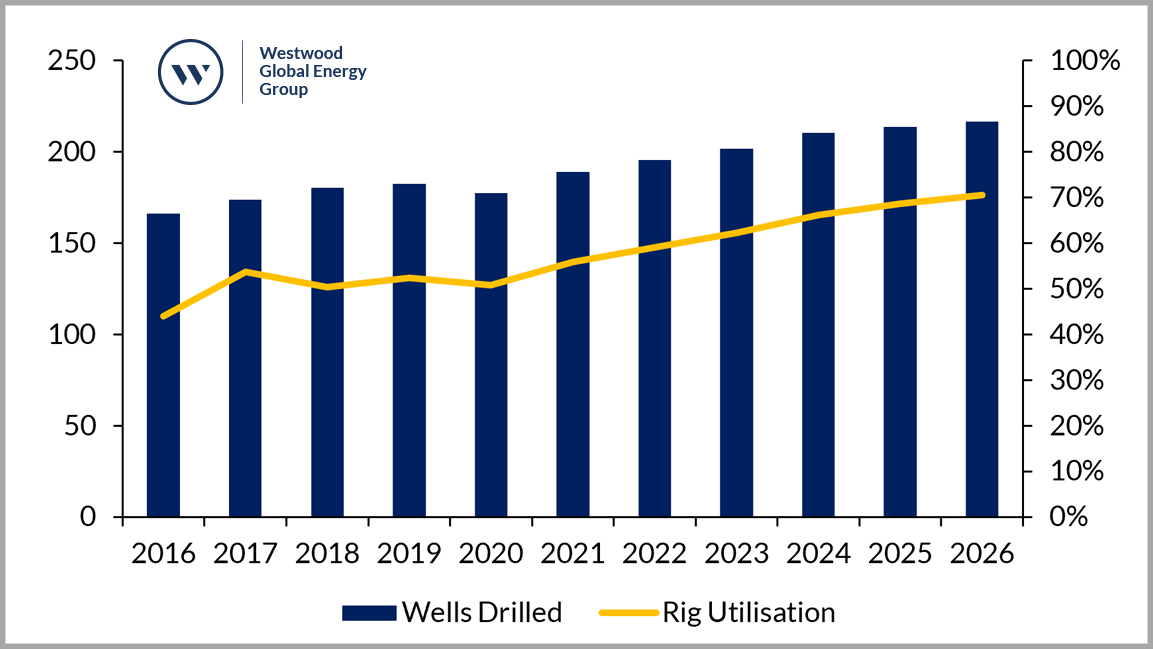

Figure 2: Egypt wells drilled and rig utilisation outlook

Apache backed up its announcement from December 2021 that it is set to invest $3.5 billion in Egypt’s Western Desert, with subsidiaries Khalda Petroleum and Qarun Petroleum revealing plans to drill 127 wells during 2022 and 2023. Khalda is set to invest $900 million, including the drilling of over 100 exploration and development wells, with targets to reach production of 132,000 bbl/d of oil and 631 mcf/d of natural gas. Qarun plans to drill 27 new exploration and development wells as part of a $242 million investment, aiming for production of 20,500 bbl/d during 2022/23. Apache and its subsidiaries already have over 10 rigs contracted in Egypt, mainly from the Egyptian Drilling Company.

Pharos Energy completed a farm-out deal with IPR Lake Qarun Petroleum, a subsidiary of IPR Energy, in relation to the El Fayum and North Beni Suef concessions. IPR Energy gained a 55% interest and operatorship of the assets for a payment of $5 million, $2 million was received as a deposit on signing of the farm-out agreements.

United Oil & Gas’ ASD-2 development well was drilled by the 1,500 HP, Egyptian Chinese Drilling Company owned ECDC-6 rig and commenced production at an initial rate of 2,100 bopd. United then contracted the 2,000 HP, Sino Tharwa-1 rig for the drilling of the ASV-1X exploration well. As a result of sustained high oil prices, United has added a fifth firm well into its 2022 drilling campaign, the Al Jahraa-14 development well, which is due to be drilled after ASV-1X.

SDX Energy made progress on its 13-well Egyptian drilling campaign focused on the Meseda, Rabul and South Disouq fields, as it aims to increase production from the fields from c.2,100 bopd to c.3,500-4,000 bopd by early 2023. All three wells were drilled by the Star Nile Drilling Oil Services owned 1,000 HP, SNOS-5 rig.

SDX also utilised the 1,500 HP, Sino Tharwa Drilling Company owned, Sino Tharwa-2 rig to drill the SD-5X exploration well targeting 11 bcf of gross un-risked P50 reserves in the Warda prospect. The second planned well for the South Disouq block is the SD-12X East well on the Sobhi field, planned for mid-April.

North Africa – Other news

In Libya, National Oil Corporation (NOC) owned Zallaf E&P and Sirte Oil Company are looking to award engineering and construction contracts for the Chadar and Arshad projects. Zallaf E&P is finalising a development plan for the Chadar oilfield and Sirte Oil Company has concluded engineering studies on gas exports from the Arshad field. The Chadar field, in block NC126, was discovered in 1968 by Mobil, but was never developed. The plan will see hydrocarbons piped to facilities at Waha Oil Company’s Al Faregh oilfield, 45km east. The contract being offered includes FEED plus EPCC work. Sirte Oil’s Arshad field project requires five new gas wells at the 56-year-old field to be tied back to facilities at the Al Istiqlal field. The wells will be linked to a new manifold and transported to the facility via a new 22.5 km, 12-inch pipeline.

In Morocco, SDX is planning five wells to be drilled over two campaigns, targeting shallow biogenic gas to be tied into the company’s existing infrastructure at low cost. On top of this several wells will be worked over to maximise production and recovery. The rig contract has not been announced, however SDX had been using the 1,000 HP, Star Valley Drilling rig 101 for its 2021 drilling campaign.

In Tunisia, Zenith Energy, contracted a 750 HP workover rig to commence operations on the ROB-1 well. This will be followed by drilling of the ROB-3 development well in the Robbana concession, targeting three proven hydrocarbon-bearing reservoirs in the Cretaceous Upper Meloussi sandstone formation. ROB-3 is scheduled to be drilled in June 2022.

Sub Saharan Africa

Bevy of contract awards as first oil development project in Uganda moves forward

TotalEnergies and CNOOC announced the official launch of the Lake Albert Development Project, onshore Uganda, along with confirming that a final decision had been taken with investment set at $10 billion. The project will see two oil projects developed, Tilenga, operated by TotalEnergies, and Kingfisher, operated by CNOOC. Development of the Lake Albert Development Project will include construction of the East Africa Crude Oil Pipeline (EACOP), a 1,443km export pipeline to Tanzania. Production is expected to begin in 2025 and reach 230 kbbl/d.

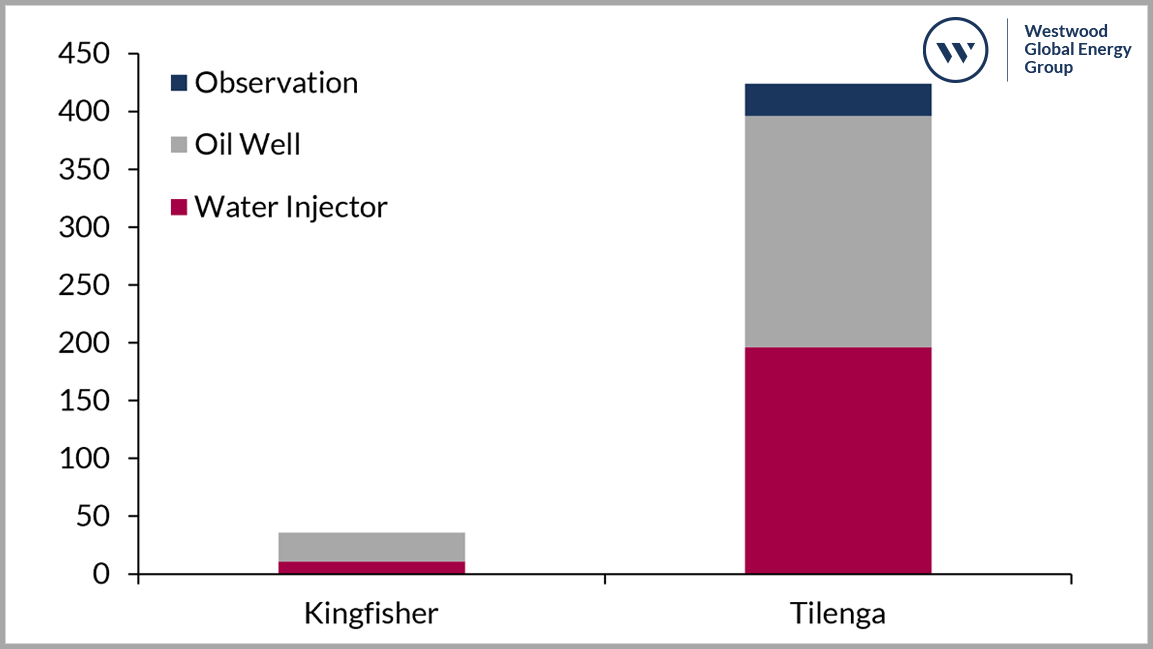

Figure 3: Initial wells planned for Lake Albert Development

In January, TotalEnergies announced plans to award two pipeline supply contracts worth a combined $300 million for the EACOP. At the time the frontrunners to secure the contracts included Russia’s ChelPipe, Greece’s Corinth Pipeworks and Metal One, a joint venture between India’s Welspun Steel and Japan’s JFE Steel. Following Russia’s invasion of Ukraine, ChelPipe are reportedly no longer in the running. The first delivery of pipe is due in mid-2022 with the last batch set to be delivered in 3Q 2023.

In February Chinese Offshore Oil Engineering Company (COOEC) signed a contract with CNOOC Uganda to provide EPC services for the Kingfisher oilfield. The contract commits COOEC to complete the work within 36 months plus two months for commissioning, this will ensure first oil in 2025. COOEC’s work scope covers building a central oil processing plant, located on the Lake Albert Buhuka Flats, with a daily capacity of 40,000 barrels, as well as the construction of four well pads. Infield flowlines, a water intake station, ground facilities and export pipelines. The field will have c.20 production wells and 11 water injection wells drilled from onshore pads.

In March, TotalEnergies finalised a contract with Sinopec for EPSCC services at the Tilenga development in a deal worth $611 million. The contract covers EPSCC work for the oil and gas gathering system on the project. The award follows an earlier contract to Schlumberger, Vallourec and ZPEB for the drilling of 426 wells (200 water injectors, 198 oil wells and 28 observation wells) on 31 well pads. The contract with Schlumberger covers the provision of directional drilling services, upper completions, lower completions, artificial lift solutions, and wellheads for the Tilenga development. It was previously announced in June 2021 that Chinese firm ZPEB will provide the drilling rigs for the project in a contract worth c.$210 million. Drilling is expected to commence in 4Q 2022.

Sub Saharan Africa – Other news

KCA Deutag announced the sale of its Nigerian rig fleet to Geoplex Drillteq in a deal worth $18 million. The sale includes five drilling rigs, one 700 HP, one 1,500 HP, two 2,000 HP and one 3,000 HP units. All five rigs are top drive equipped and have SCR power controllers. The deal has come as part of KCA Deutag’s growth strategy to focus on core markets such as the Middle East where KCA Deutag currently operates 40 rigs.

In Zimbabwe, Invictus Energy signed the 1,200 HP, Exalo Drilling SA owned, IRI 1200 Rig 202 to drill the Muzarabani-1 exploration well, targeting 8.2 tcf of gas and 247 mmbbl of condensate. The contract also covers the possibility of an additional exploration well. The rig, which is currently engaged in operations in Tanzania, is expected to commence mobilisation in May 2022 with drilling scheduled to start in June 2022. Invictus also awarded Baker Hughes an integrated well services contract covering cementing, mudlogging, drilling fluids, tubular running, directional drilling and logging, installation of well head equipment and project management.

Savannah Energy is preparing a multi-well drilling campaign on neglected oil assets in Chads Doba basin, which are currently being acquired from ExxonMobil and Petronas for $626 million. The deal is due to be completed in July 2022. Savannah will spend the second half of 2022 on well optimisation and workover activity before beginning its infill drilling campaign in 2023. The infill campaign will consist of 12 wells per year until 2030. No wells have been drilled on the assets since 2015. The current partners own rigs in Chad, but Savannah intends to run a bid process to bring in a drilling contractor. The acreage consists of seven producing fields including, Kome, Miandoum, Bolobo, Moundouli, Maikeri, Nya and Timbre where 300 wells have been drilled to date.

Kinetiko Energy has announced updates for the Korhaan-3, 4 and 5 wells being drilled in South Africa. Kinetiko has been utilising the Torque Africa Explorations, 140 HP, B21 truck mounted rig to carry out the drilling. Korhaan-5 was drilled to a total depth of 432 metres and will now be logged to establish stratigraphy and gas bearing sediment. Korhaan-4 has been drilled and cased; logging has shown substantial gassy sandstone intervals and flow rate testing is due to take place in late January/early February. Korhaan-3 reached a final depth of 449 metres with gas detected from 177 metres down with more significant gas found from 265 metres downwards. All three wells, Korhaan-3, 4 and 5, will be flow tested to seek stability of flow rates and pressures.

Latin America

Further positive signs for oil and gas developments in Argentina

In February, Argentina started the tender process for a new gas pipeline as it continued efforts to realise the full potential of the Vaca Muerta shale play. Tenaris was reportedly the sole bidder for the tender which covers the supply of 656 km of steel pipelines. Tenaris bid $436.6 million to supply the steel pipelines which will come in 30 and 36-inch diameters, an EPCC contract expected to follow. The pipeline is to start at Tratayen in Neuquen province before crossing Rio Negro, La Pampa and Buenos Aires provinces to reach Santa Fe. An 18-month timeline has been put on the first stage of project, with $1.6 billion of investment required. Once complete the pipeline is targeting an export capacity of 24 mmcm/d. A second stage of the pipeline, requiring an additional investment of $1.9 billion, is expected to follow, increasing the capacity to 44 mmcm/d.

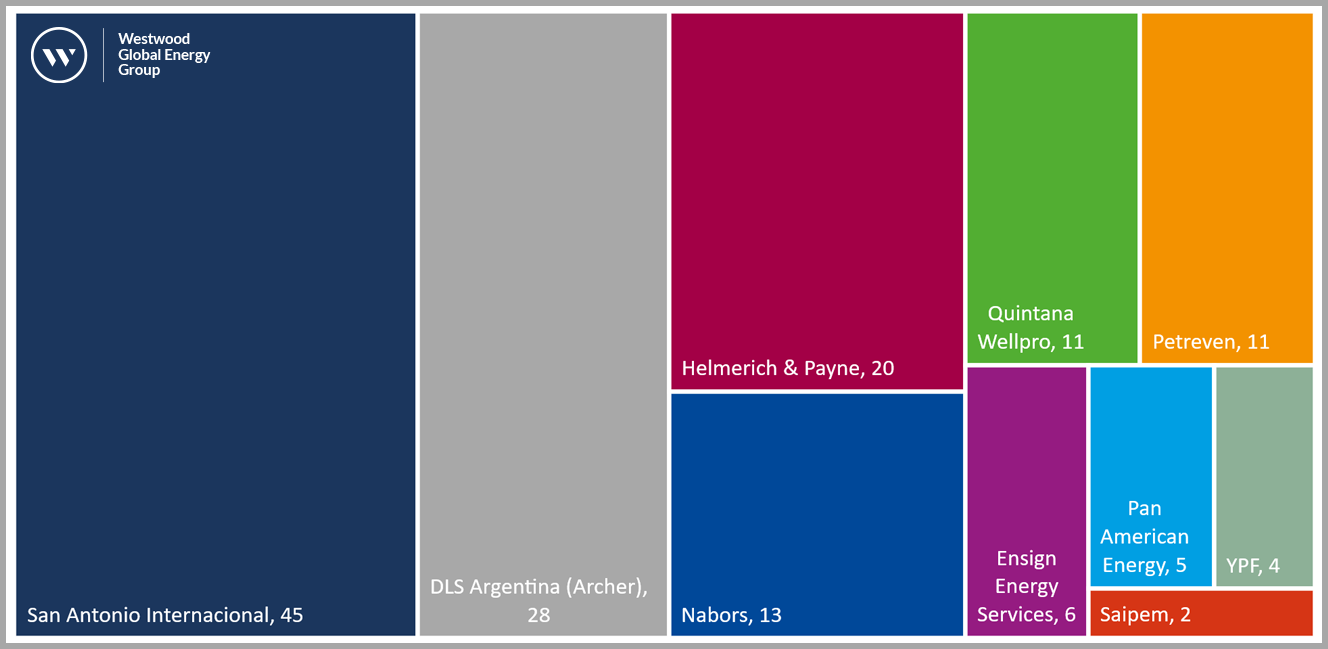

President Energy drilled the DP-2001 and DP-2003 on the Dos Puntitas field, Puesto Guardian concession, Argentina. DP-2001 is onstream with DP-2003 currently undergoing production testing. These wells represent the first commercial oil production from a new well in the concession for 12 years. Both wells were drilled using the 1,500 HP, Petreven owned H-302 drilling rig. In the Puesto Flores concession, Rio Negro, President Energy has been looking to mitigate natural production decline at mature fields. Previously carrying out a successful waterflood programme, President has now received a detailed plan for a secondary recovery campaign. This plan comprises of both utilising existing wells and drilling new injector wells.

Pan American Energy agree a two-year extension with Archer’s drilling services in Argentina, at an improved rate. The extension covers two drilling rigs, 13 workover units and 13 pulling units on the Cerro Dragon field in the Golfo San Jorge basin. The contract now runs until 2Q 2025 and Pan American Energy can adjust the level of activity up or down during the extension duration.

Figure 4: Argentina: Top ten contractors by size

Latin America – Other news

In Brazil, Petrobras announced the sale of its interest in 27 onshore concessions located in Espírito Santo, to Karavan Seacrest SPE Cricare. The average production of Cricaré Cluster from January to November 2021 was c.1.3 thousand bpd of oil and 15.4 thousand cubic metres per day of gas. On top of this, Petrobras also announced in March that it had received binding offers for 28 onshore producing fields in the Reconcavo and Tucano basins from a consortium made up of PetroReconcavo and Eneva. This is part of a large-scale divestment plan so the NOC can focus on deepwater and ultra-deepwater projects.

Melbana Energy’s Alameda-1 exploration well in Cuba, showed evidence of at least three reservoirs. Preparations are currently under way for flow testing the Marti interval. The interval will be plugged and a short side-track well will be drilled to about 50 metres higher than current total depth of 3,590 metres. Flow testing in the side-track is due to being in mid-April. Following the completion of Alameda-1, the Sherritt Drilling Rig-1 will move to begin drilling of the Zapato-1 well.

In January, Canadian oil company Frontera Energy and its partner GeoPark announced back-to-back discoveries in Ecuador with the Jandaya-1 and Tui-1 wells. Frontera Energy and GeoPark both hold a 50% WI in the Perico block with Frontera as operator. Jandaya-1 and Tui-1 were both drilled to a depth of 3,345 metres. Further exploration activities are budgeted in Ecuador during 2022 in the Espejo Block (GeoPark operated, 50% WI) with the acquisition of 60 sq km of 3D seismic to be followed by the drilling of a first exploration well in the block, expected to spud in 2H 2022. James F. Park, Chief Executive Officer of GeoPark, said: “This new discovery in Ecuador is the first exploration success of our very active 2022 work program which includes 15-20 exploration wells.”

Ecuador’s energy minister has announced the awarding of a drilling contract to CNPC for the Ishpingo oilfield. The contract will allow CNPC to drill 40 wells across an 18-month period. The field, which is part of the heavy oil ITT development in Block 43, onshore Ecuador, started operations in 2020 and is expected to see a substantial ramp up in production as activity continues.

Arrow Exploration is set to spud the RCE-2 well in the Rio Cravo Este field, Colombia, utilising Top Drilling’s Rig 1501, a Lee C. Moore unit with a 500-ton top drive, 1,500 HP and capability to drill to a depth of 16,500 feet. Arrow Exploration and its 50% partner PetrolCo expect drilling to commence imminently. Upon completion the rig will be mobilised to the follow-on RCE-1 well site.

North America

Figure 5: Top 10 Contractors in North America by Fleet Size and Horsepower Category

The Marcellus shale started the new year with two deals in the upstream and midstream sectors. Repsol signed a deal worth $222 million with Rockdale Marcellus to obtain 43,000 net acres with a net production of 79 mmcfd, adding to the 171,000 net acres Repsol already holds in the Marcellus shale. Midstream company, UGI, acquired pipeline operator Stonehenge Appalachia from Stonehenge Energy Holdings for $190 million, obtaining 47 miles of pipeline and associated compression assets with a gathering capacity of 130 mmcfd.

Zephyr Energy completed the acquisition of non-operated working interests in producing and near-term production wells in the Williston Basin, USA, in a deal worth $36 million. The acquisition includes working interests in 163 producing wells with an average working interest of approximately 4%. In addition, 18 drilled but uncompleted wells are scheduled to come online by the end of June 2022, with a further 47 locations to be drilled in the future. Proved reserves acquired were 2.7 mmboe. The acquisition has an effective date of 1 December 2021. In December 2021, production from the acquired assets averaged 1,105 boe/d.

Papua New Guinea’s Oil Search merged with Australia’s Santos offering hope for the development of the Pikka project in Alaska’s North Slope. Oil Search had held a majority, 51% interest in the Pikka development project since 2017 but along with JV partner Repsol struggled to find funding. Estimates indicate Pikka could produce c.80,000 bopd in the early stages of production, topping at 120,000 bopd once development is complete. The first phase of the project is expected to cost c.$3 billion.

88 Energy drilled the Merlin-2 appraisal well in Alaska. The well, drilled by the 600 HP, Doyon Drilling owned, Arctic Fox drilling rig, targeted 652 million barrels of oil in the N18, N19 and N20 targets (Brookian Nanushuk formation) encountered by the Merlin-1 well. However, during testing the well failed to produced hydrocarbons and will now be plugged and abandoned.

Nostra Terra drilled the Fouke-2 well at the company’s Pine Mills oilfield, USA, and reached a total depth of 6,002 feet. Logging indicated 23 feet of pay sand over two reservoir sections within the cretaceous Woodbine sequence. Completion operations have commenced, and the well will be cased and cemented through both pay intervals. Once this is complete the pay sections will be perforated, completion equipment run, and surface production equipment put in place. Production will then go into surface facilities at the Fouke-1 location.

Asia

China’s upstream watchdog, the Ministry of Natural Resources (MNR) announced an auction for two shale gas blocks in South-western China’s Guangxi region, known as Luzhai and Liuchengbei. The 201 sq km Luzhai block has a starting price for bids of $284,425 (1.81 million yuan), increasing by $15,713 (100,000 yuan) for each increment. The smaller, 122 sq km Liuchengbei block meanwhile has a starting price of $174,418 (1.11 million yuan). Both blocks are being offered on a five-year exploration lease, with multiple 5-year optional extensions, however each extension will require relinquishing 25% of the block back to the government.

Eastern Europe & FSU

The first quarter of 2022 has been a challenging one for Eastern Europe with Russia’s invasion of Ukraine leading to big shifts in the energy industry. Several IOCs such as BP, Shell and ExxonMobil exited Russia following the invasion. BP cut ties with its 19.75% shareholding in Rosneft, which also saw chief executive Bernard Looney and former chief executive Bob Dudley also resign from the Rosneft board. BP has yet to announce how it plans to extricate itself but divesting the 19.75% stake will result in charges of up to $25 billion. Equinor will also no longer invest in Russia and will exit its Russian joint ventures. The cooperation covered assets including the North Komsomolskoye oil field development project in West Siberia and 12 exploration and production licenses in Eastern Siberia. Shell ended its involvement in the Nord Stream 2 pipeline and exited its 50% stakes in the Gydan and Salym Petroleum Development Projects.

Novatek subsidiary, Obsky Gas Chemistry Complex (GCC), announced intentions to push ahead with Russia’s first blue ammonia project by stepping up exploration plans for three recently acquire licenses in the Yamal Peninsula, West Siberia. The Obsky, Neytinsky and Arktichesky blocks lie south of the Yamal LNG project operated by Novatek. Obsky GCC plans to drill two exploration wells on the Obsky block during 2022. The first well will target traditional sandstone reservoirs to a depth of 1,750 metres while the second well will be confirmed pending the results of the first exploration well. The operator also plans to drill two Yamal Peninsula wildcats at the Neytinsky and Arktichesky blocks, aiming to test the presence of hydrocarbons to a depth of 2,400 metres.

Gazprom has announced that production at a series of gas-condensate fields in the Yamal Peninsula is expected to come onstream in 2026. The current plans state that Gazprom will drill horizontal development wells into Neocom and Jurassic reservoirs at the Bovanenkovo and Kharasavey deposits on the Yamal Peninsula, and into the Achimov formations on the Urengoy field. Detailed engineering has begun on the project which will require the drilling of around 250 dedicated wells at Bovanenkovo and Kharasavey, with annual production expected to reach around 28 million barrels of condensate.

Before partner Equinor announced they would be divesting from Russia, Rosneft had announced plans to drill seven exploration and appraisal wells over 2022 and 2023 in Eastern Siberia. The programme is set to include three exploration wells in the Markhayansky license area which lies in the Irkutsk region. Four wells are then planned for the Danilovsky and Preobrazhensky licenses. These wells will be Danilovsky- 87 and Danilovsky- 93, Preobrazhensky- 32 and Preobrazhensky- 33. Tenders are currently out for hydrodynamic research during drilling and testing. All territories are hard to access with no year-round roads. The transport routes consist of dirt and country roads. It is currently unclear whether Rosneft will go through with the project alone.

Australasia

Australia has seen a vast number of plans announced this quarter. The predominant focus on these is gas, with the government identifying potential shortfalls in supply in the mid-to late 2020’s, encouraging additional drilling activity to prevent this:

| Operator | Basin | Details |

| Black Mountain Energy | Canning | Aiming to monetise Valhalla-Asgard tight gas asset by listing on local stock exchange. Three wells drilled to date. |

| Buru Energy & Origin Energy | Canning | Positive flow test results from Rafael-1 well. Well to be recompleted to allow individual zonal perforation and testing. |

| Central Petroleum and Peak Helium | Amadeus | 2 sub-salt exploration wells in 2023, fully funded by Peak Helium, targeting helium, hydrogen, and hydrocarbon gases. |

| Empire Energy | Beetaloo | Grants from the Australian government for three appraisal wells, offsetting 25% of the cost of seismic, drilling, fracturing and flow testing. |

| RCMA, Metagasco & Vintage Energy | Perth | Cervantes-1 exploration well to be drilled by Ensign 970, targeting 15.2 million barrels of oil. |

| Shell | Surat | 145 wells by 2024 to ensure gas supply for Queensland Curtis LNG. |

| Strike Energy | Perth | Confirmed presence of high quality, conventional gas in the Kingia and Wagina sandstones at the South Erregulla-1 well. |

| Tamboran Resources | Beetaloo | $7.5 million grant to support up to 25% of the costs of drilling, fracturing and flow testing of the Maverick-1H (M1H) well. |

| Operator | Basin | Details |

Timor Leste

The first well drilled in Timor Leste in nearly 50 years saw Timor Resources make an oil and gas discovery with the Feto Kmaus exploration well, the first of five planned exploration wells in Timor Leste. The well was drilled using Eastern Drillings 1,100 HP, ED-01 rig. Timor Resources and its partner, national oil company, Timor Gap, also drilled the successful Kumbilli-1 well. Contractors involved in the campaign include Schlumberger, Parama Data Unit, Matra Unikatama, Petroil, Saga Trade, York Transport and OTE. Focus has now turned to the third well, Rusa-1, well site preparation.

Western Europe

Activity in Western Europe has remained limited over the last quarter. However, much of the region has seen a major livening of debate around the future of fossil fuels following the Russian invasion of Ukraine, which has revealed just how much the region relies on Russian gas. While this has not translated into significant action yet, there is potential that this could lead to an increase in oil and gas drilling in the region which has seen little

activity in recent years.

Two wells in the UK, which had been due to be plugged and abandoned following a regulatory order, have been given a reprieve. The company responsible for drilling them (Cuadrilla Resources) now has until mid-2023 to evaluate the wells and see if gas can be extracted safely and economically. The wells, which have been met with fierce local opposition since planning stages, were drilled into the Bowland shale 2250 metres vertical depths and a further 750 metres horizontally. Following the drilling light earth tremors were recorded, leading to a suspension of operations at the site and then a fracking moratorium that brought all operations to a halt.

In Austria, the Anshof-3 exploration well, which was spud on 18 December 2021, has been cased and cemented to a depth of 2,499 metres. The RED Drilling Services rig, E-200, was released on 15 January 2022. The well is currently suspended and will be completed with production tubing utilising a workover rig prior to testing and potential production thereafter.