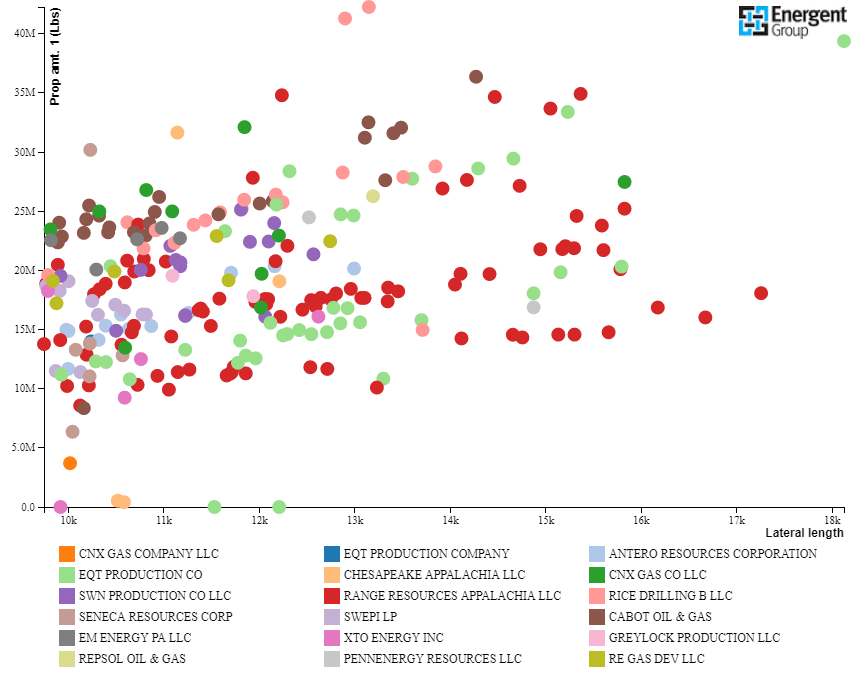

While the Appalachia Basin only accounts for roughly 15% of total proppant usage in the Lower 48, the US Northeast has some of the highest proppant amounts per well. In 1Q18 a typical completion in the Appalachia Basin averaged roughly 16 million pounds, or 8,000 tons, representing a 7% increase year-over-year. Comparatively, the US average is roughly 13 million pounds or 6500 tons. This is partially attributable to specific operators in the region testing longer “super laterals.”

Figure 1. Proppant Amount and Lateral Length Scatter Plot

Source: Energent Group

Sand supplier Hi-Crush said it expects up to 6% growth in sand demand across the Lower 48 in 3Q18, with increased demand stretching to the Marcellus as well. Additionally, US Silica is forecasting higher sand usage in 2019 given the trends towards longer laterals.

Super lateral proppant intensity holds flat

Energent data shows proppant per lateral foot on wells drilled longer than 15,000 feet have actually held relatively steady year-to-date in 2018 when compared to wells fracked during full-year 2017. This implies that operators are increasing proppant intensity, but more on wells with lateral lengths less than 15,000 feet.

Wells greater than 15,000 feet averaged 57% greater proppant amounts than wells ranging from 11,000 to 15,000 feet. However, when broken down for proppant per lateral foot, a standard indicator for completion intensity, the increase in super lateral proppant amounts reduces to 17% growth, on average.

Antero Resources says it has increased its proppant loading per foot in the Marcellus by 23% to over 2,000 pounds per foot from 2016 to 2017. The operator expects proppant loading to increase. However, the company just drilled its first lateral greater than 15,000’ in the Marcellus during the 2Q18.

Appalachian operators, like Range Resources, Antero Resources, and EQT, continue to talk about reductions in cost per foot while maintaining or increasing EURs. More importantly, it has yet to be seen if proppant loads will increase simultaneously with longer laterals, and how that will impact the well economics and total well costs.