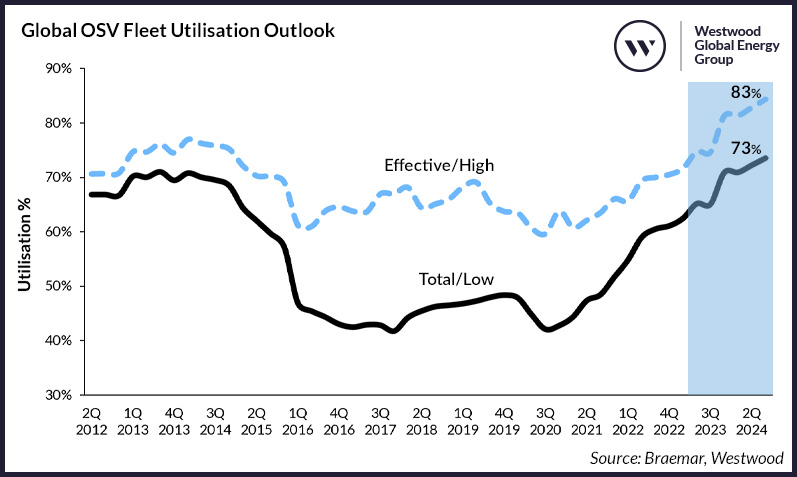

Higher levels of offshore activity coupled with the increasing scarcity of premium vessel supply are expected to see effective utilisation reach 83% by the end of 2024.

Higher levels of offshore activity

Offshore engineering, procurement and construction (EPC) investment for 2023 is forecast at a whopping $62.5 billion, of which $29 billion has been awarded year-to-date. The remainder of 2023 is expected to witness another $33.3 billion of offshore EPC spend. The top three spending regions are estimated to be the Middle East (48%), Southeast Asia (20%) and Latin America (8%), by operators such as Saudi Aramco, North Oil Company and PetroVietnam.

Offshore Upstream EPC Spending

*Projections are based on our base case outlook which assumes an average of US$80/bbl for 2023 and above US$65/bbl for 2024/27.

Source: Westwood SubseaLogix & PlatformLogix

Global offshore drilling rig contracting activity has also markedly increased this year, with 125 years of rig backlog added in the last quarter alone. ADNOC secured the most rigs during the quarter for jackups to work offshore the UAE. Another notable trend is the extended duration of new contract fixtures and tenders, as operators seek to secure long-term capacity.

Marketed jackup utilisation is consistently above 90% of late and average dayrates continue to head north with recent fixtures recorded at $165,000/day. Drillship utilisation finished off the quarter at 97% and dayrates for new fixtures averaged nearly $425,000/day. Meanwhile marketed sixth generation harsh environment semisubmersible utilisation and dayrates have reached their highest in years due to increasing demand globally. This segment recently recorded a clean rate fixture of $500,000/day for the first time since 2015.

Utilisation is expected to remain strong for all three rig types. More supply will be required to meet growing demand and Westwood expects further upward movement in dayrates over the next few years off the back of these expected supply challenges.

Active PSV fleet on the rise

Responding to increased levels of offshore activity, more vessels have been put to work. The global offshore support vessel (OSV) active fleet rose to 3,077 vessels, the majority of which are platform supply vessels (PSVs).

Over the past 12 months, PSVs across all categories – most notably in the 2-4,000 dwt PSV group – saw a substantial increase in active fleet size, while Anchor Handling Tug Supply (AHT/S) vessels had a marginal net increase, with highest growth in the AHTS 12-16,000 bhp segment. The growth in the active fleet can mostly be attributed to vessels migrating to the Middle East GCC (Gulf Cooperation Council) after increased drilling activity in this region.

Of the 620 laid-up fleet, around 40% are premium vessels (aged under 15 years). This is a 24% drop from last year due to the increasing pace of vessel reactivation. Conversely, the deep layup fleet – vessels aged over 15 years and laid up for three years or more – has grown by 19% since last year. Given the increased cost associated with reactivation and age, deep layup vessels are not considered as part of total utilisation figures.

OSV utilisation driving upwards

Global effective utilisation (excluding laid up vessels) dipped slightly to 72% in the last quarter, as increased activity was offset by the growth in the active fleet. Future utilisation is contingent on continued fleet rationalisation. Westwood expects effective utilisation to reach 83% by 3Q 2024 with total utilisation at 73%.

Global OSV Fleet Utilisation Outlook

Source: Braemar, Westwood

In the low-case outlook, which assumes no further scrapping, improving demand alone would increase utilisation to 75% by 2025. In the high-case outlook, utilisation could reach 86% should the entire laid-up fleet be removed from the market. Westwood’s mid-case outlook, assuming scrapping of the laid-up fleet aged over 15 years, will result in 83% utilisation.

As highlighted in last year’s insight, continued growing offshore demand and improved utilisation rates are good indicators for vessel owners. However, complying with local content, age restrictions and low emission requirements from operators, maintains pressure on owners with ageing fleets.

Over the next two years, more than 600 vessels will be older than 15 years and considered non-premium. With only 25% of newbuild vessels in the Tier 1 category (likely to be delivered in the next 12-24 months), this suggests that the premium fleet will shrink significantly over the next few years without substantial numbers of new orders. The concerning lack of under 15-year-old supply is forcing E&Ps to re-evaluate age restrictions for future operations.

Offshore field development and drilling data is derived from SubseaLogix, PlatformLogix and RigLogix and features in the Global Offshore Navigator quarterly report. Joint authored by leading experts from Braemar and Westwood, the report provides informed data and analysis on key themes, drivers of demand and in-depth OSV market trends. For more information, click here or contact [email protected].