In this inaugural edition of Westwood’s quarterly Land Rig newsletter, authored by Todd Jensen, we look at the impact of several major news stories, including the decision of OPEC+ to stick to its production output policy and the IPO of ADNOC Drilling. We also detail key M&A activity that took place this quarter, with the market showing signs of recovery as several significant acquisitions were announced, including Ensign Energy Services acquisition of Nabors Canadian drilling assets. If you enjoy this first edition, you can sign up to receive notifications of updates and new content, here.

As we enter the fourth quarter of 2021 the energy industry continues to recover from a tough 2020 where the Covid-19 pandemic and subsequent low oil price put paid to many drilling and development programs. Onshore drilling activity has increased somewhat in 2021 supported by strong demand for oil & gas which has seen oil prices hit a seven year high of over $80 per barrel. However, operators remain cautious and highly selective with the drilling campaigns that they progress while drilling remains constrained in OPEC+ countries due to the decision not to significantly boost output amid increasing demand. Several significant acquisitions have taken place across the board with companies looking to balance the books and invest in energy transition and decarbonising focused asset portfolios.

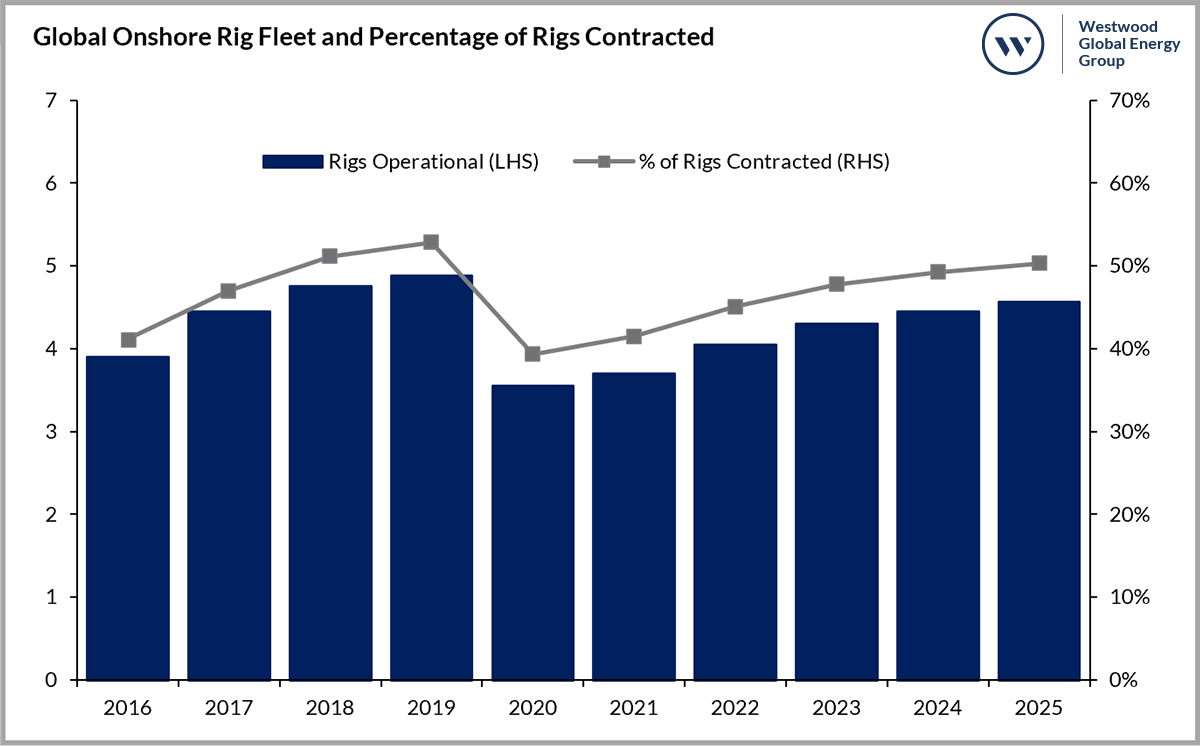

LHS- No. of Rigs Operational (‘000s), RHS- % of Rigs Contracted (%)

Source: Global Land Rigs, Westwood Analysis

Key M&A

- UAE’s ADNOC raises $1.1 billion in IPO for 11% of ADNOC Drilling

- Patterson-UTI acquired Pioneer Energy Services for $278 million, adding 17 rigs to its fleet.

- Ensign Energy Services acquired Nabor Industries Canadian subsidiary for $93.25 million, adding 35 rigs to its fleet.

Contract awards

- CNOOC sign an agreement with Iraq Drilling Company to drill 150 wells on the Buzurgan oilfield

- Saipem signed a 15-month onshore drilling contract in the United Arab Emirates

MENA

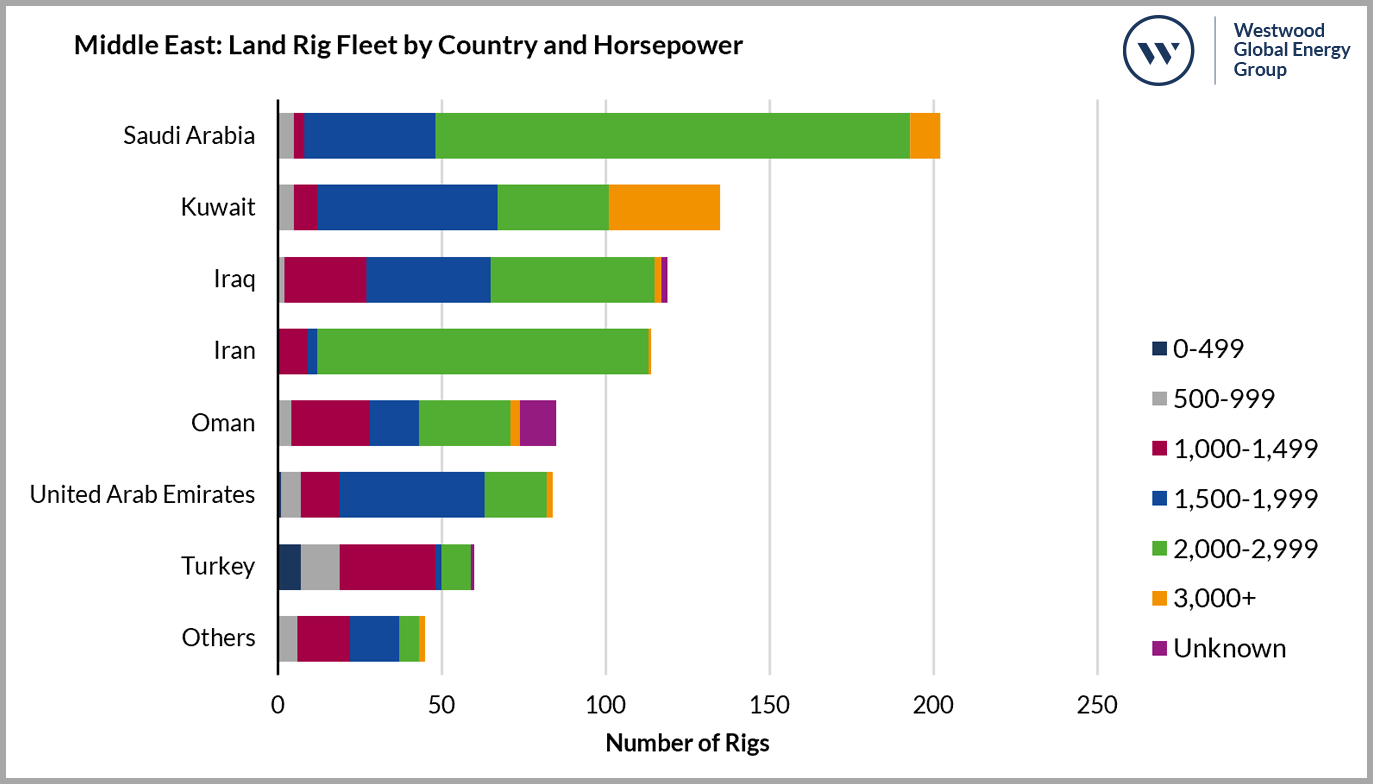

OPEC+ decided to stick to its current output policy following an increase in demand for petroleum products despite pressure from some members. This decision has contributed to rising oil prices, which as of mid-October stand at just over $84 per barrel. In July 2021 OPEC+ agreed to increase production by 400,000 bpd each month until April 2022, with the output restrictions fully ending in September 2022. This agreement was set up to phase out production cuts of 5.8 mmbpd which were agreed in the Spring of 2020 as the Covid-19 pandemic gripped the world. As the output restrictions come to an end several key drillers within the MENA region, including Iraq, Saudi Arabia and the UAE are expected to ramp up drilling activity as they target capacity increases.

As part of a wider trend among NOCs in the Middle East to divest stakes in their oil & gas assets to help diversify sources of income, Abu Dhabi National Oil Company (ADNOC) announced an IPO of its ADNOC drilling unit, raising over $1.1 billion. The company listed an 11% stake equating to 1,760,000,000 ordinary shares valued at $0.63 per share. Following the listing on the local stock exchange, ADX, ADNOC owns 84% of ADNOC Drilling, Baker Hughes will retain its 5% acquired in October 2018 through its strategic partnership with ADNOC while Helmerich & Payne will hold 1% through its IPO cornerstone investment. ADNOC Drilling is the largest national rig company in the Middle East by fleet size, boasting 107 rigs, 67 of which are land drilling rigs. Of the 107 rigs, 96 are owned and 11 rented.

In July 2021, it was reported on numerous news sites that Oman state energy firm OQ is considering selling its drilling subsidiary, Abraj Energy Services for similar reasons. However, as of October, no official announcements have been made. Abraj Energy Services hosts a fleet of 21 land drilling rigs in Oman, with two new rigs being added to the fleet as recently as Q1 2021.

SDX Energy remains active in North Africa, drilling the successful IY-2 development well followed by the unsuccessful Hanut-1 exploration well in South Disouq, Egypt. The Hanut-1 exploration well reached a total depth of 6,000 ft on 17 August 2021. In Q4 2021, SDX Energy is set to initiate a four well development program in West Gharib, Egypt, as well as drilling two further wells onshore Morocco following three successful wells, OYF-3, KSR-17 and KSR-18 in H1 2021. It is understood that SDX Energy will utilise the 1,000 HP Star Nile Drilling Oil Services unit 5 in Egypt and the 800 HP, Star Valley Drilling Ltd unit 101 for the Morocco drilling program.

China National Offshore Oil Company (CNOOC) signed an initial agreement with the Iraq Drilling Company to drill 150 wells on the Buzurgan oilfield. The first phase of the contract will involve drilling 71 wells, the second phase is set to be launched at a later date. The Iraq Drilling Company is also in talks with Eni for a contract to drill 37 wells on the Zubair oilfield. According to Westwood data, Iraq Drilling Company’s fleet of 43 land drilling rigs accounts for 36% of drilling rigs in Iraq.

In other contract news, in early October 2021, Saipem announced the signing of a 15-month onshore drilling contract in the United Arab Emirates, further details on this are yet to be published. Also, EOG Resources reported plans to drill two horizontal wells in Oman’s Block 36 by mid-2022, in the Rub Al Khali basin. The Rub Al Khali basin has proven prolific in Saudi Arabia and Abu Dhabi.

Source: Global Land Rigs, Westwood Analysis

Shell sold its Western Desert assets in Egypt to a consortium made up of Cheiron Petroleum and Cairn Energy in a deal worth an initial $646 million, with additional payments of up to $280 million between 2021 and 2024. David Thomas, Chief Executive of Cheiron, said, “We have an aggressive work program planned and, in the very short term, will be significantly increasing the pace of development and exploration drilling across the concessions to rapidly boost the oil and gas production rates.” Details of the program are yet to be announced.

Sub-Saharan Africa

The delayed Ugandan Tilenga and Kingfisher projects, operated by TotalEnergies and CNOOC respectively, are moving closer to FID but remain held up by legislative and land issues. The project will target oil in the Tilenga complex and Kingfisher field before transportation to the Tanga port in Tanzania via the 1,445 km East African Crude Oil Pipeline (EACOP). The development will see 426 wells drilled on 31 well pads and is expected to cost $15-20 billion. Chinese company ZPEB, a subsidiary of Sinopec, is set to provide the drilling rigs, tubular running and fishing services in a deal worth $210 million. Uganda has three bills still to pass and Tanzania needs to gazette two bills before work can begin. It is understood the bills will be passed before year end allowing work to begin.

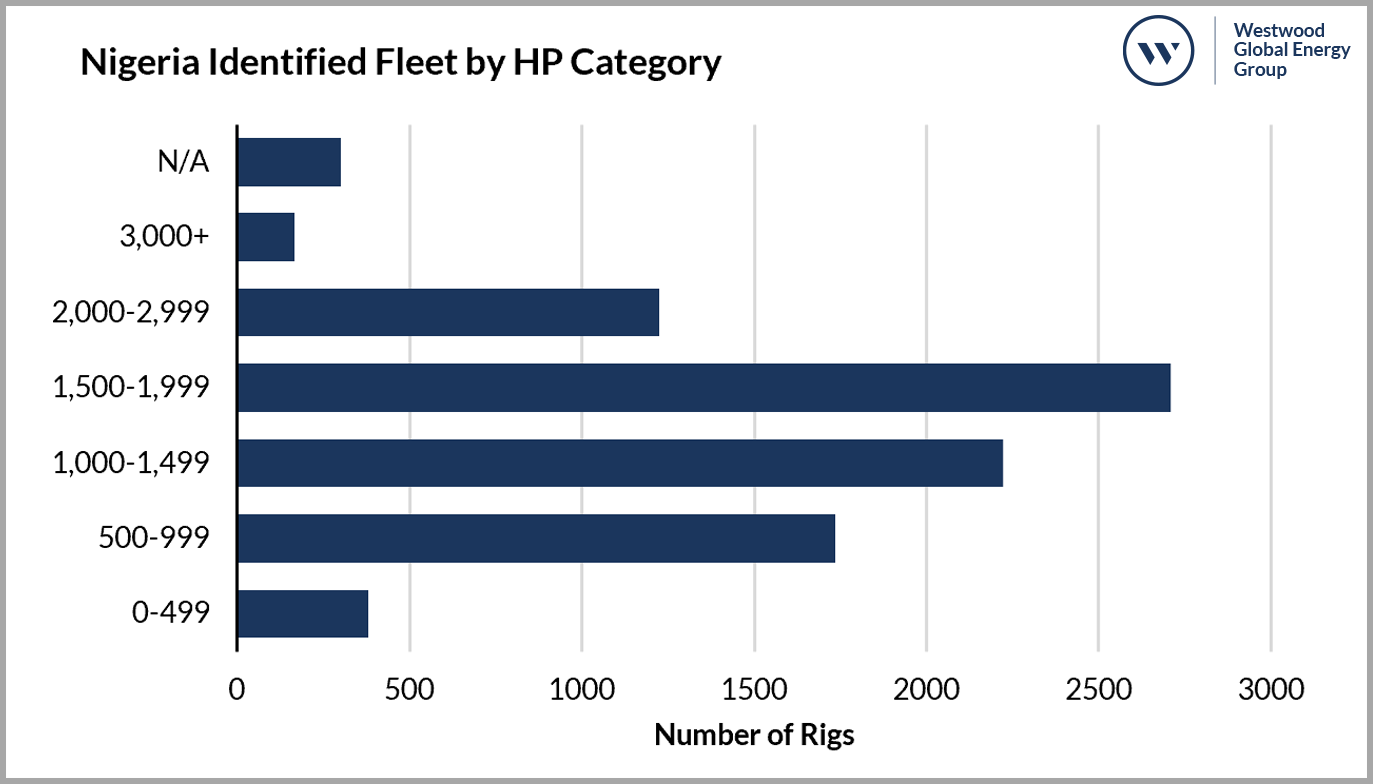

The Nigeria Petroleum Industry Bill (PIB), 2021 has been passed and signed by the National Assembly and President Muhammadu Buhari. The oil and gas industry accounts for just 10% of Nigeria’s gross domestic product, however it also accounts for 90% of foreign exchange earnings and 60% of total income. The PIB aims to increase oil and gas investment in the country by reducing taxes and royalty payments and exempting deep offshore production from taxes. Questions remain over whether this comes too late with major oil and gas producers in the industry looking to transition to clean energy.

Source: Global Land Rigs, Westwood Analysis

In Q3 2021, Reconnaissance Energy Africa continued its tri-stratigraphic well drilling program designed to better understand the Kavanga basin, Namibia. The results of the first (6-2) well were positive showing signs of an active hydrocarbon system. The second (6-1) well completed on 14 July 2021 and is currently undergoing wireline logging, initial results suggest a working hydrocarbon system. Both wells were drilled using the 1000 HP Jarvie-1 land drilling rig.

In South Africa, junior Afro Energy is in the latter stages of signing a rig for a three well exploration program targeting Permian-age coalfields in the Mpumalanga province estimated to hold resources of 4.5 tcf. No awards have been officially announced to date.

Angola announced the results of the 2020 licensing round in the Lower Congo and Kwanza Onshore Basins. Winning operators include MTI Energy (CON5, KON5, KON17 and KON20), Somoil (CON1), Mineral One (CON6), Grupo Simples (KON6), Alfort Petroleum (KON8) and AIS Angola (KON9). All operators will partner with several junior E&P companies. Angola also saw Somoil charter the 1000 HP, Sondagens de Angola owned, Falcon rig to carry out exploration and development drilling in the Zaire province over the next three years. Somoil are aiming to increase production from its Angolan assets by 30% by the end of 2024. According to Westwood data, Angola has a total of five land drilling rigs all 1,000 HP or below, and all owned by Sondagens de Angola.

North America

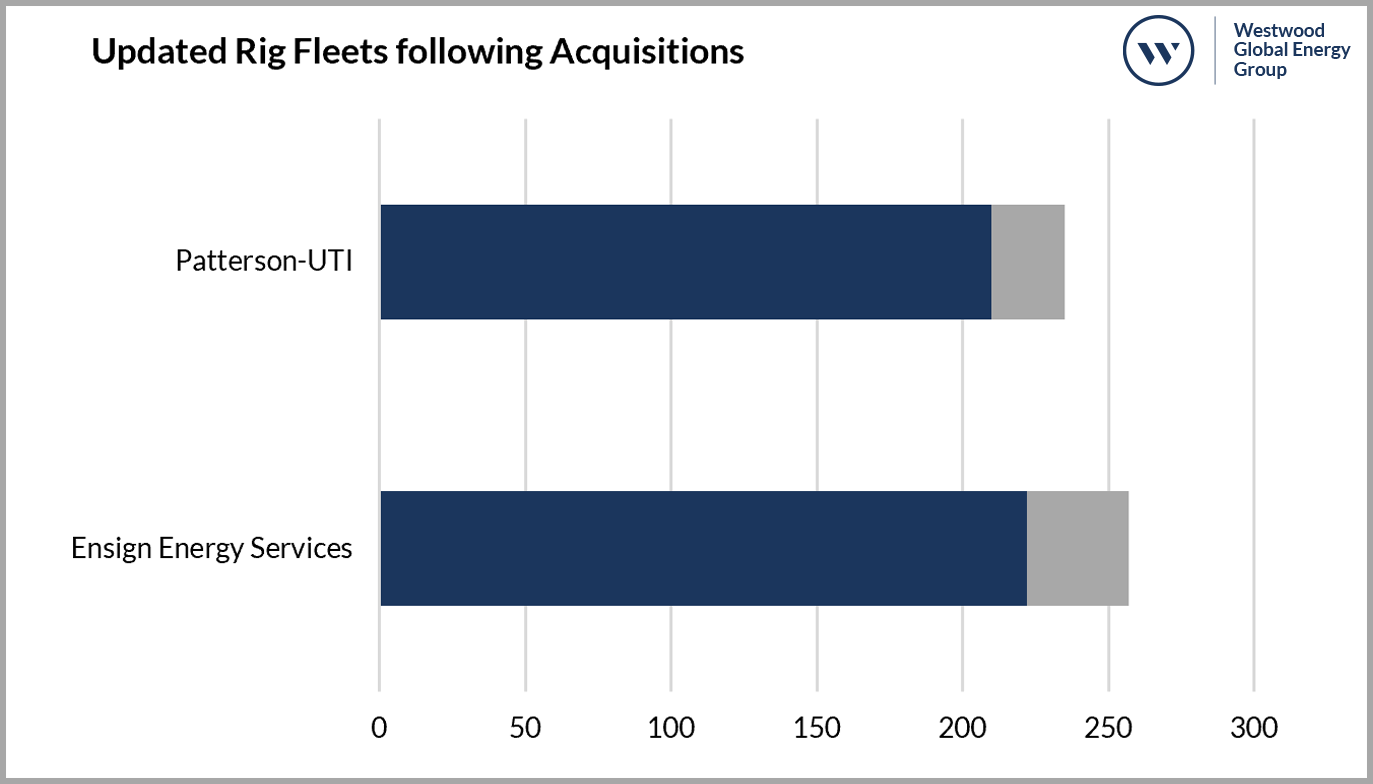

The US has continued to see growth from the lows seen in 2020, though activity remains well below pre-Covid-19 levels. The third quarter saw significant M&A activity within the North American rig market, with a series of deals taking place among some of the region’s largest rig contractors. In July 2021 Ensign Energy Services announced the completion of the purchase of a fleet of 35 land drilling rigs from Nabor Industries Canadian subsidiary in a deal worth $93.25 million. Of the 35 rigs purchased eight are higher spec, >1000HP units and 27 are lower spec, <1,000 HP units. As a result of this deal, Ensign Energy Services global land drilling fleet has grown to 257, of which 216 are located in North America.

Patterson-UTI acquired Pioneer Energy Services in a deal valued at $278 million. The deal sees Patterson-UTI add 17 land drilling rigs to its US fleet, 16 of which are classified as super-spec, as well as eight pad-capable drilling rigs in Colombia. Total consideration for the acquisition included the issuance of 23.6 million shares of Patterson-UTI common stock plus payment of $30 million in cash.

Source: Global Land Rigs, Westwood Analysis

M&A activity was not limited to the rig market either with large-scale divestments in key shale basins from Shell and ConocoPhillips. Shell sold its Permian Basin assets to ConocoPhillips in a deal worth $9.5 billion. The deal, expected to be completed in Q4 2021, includes 225,000 net acres with a current production of 175,000 boepd, as well as 966 km of operated crude, gas and water pipelines and infrastructure. Shell is seen to be accelerating its energy transition strategy with the reduction of 175,000 boepd in production, representing 7% of Shell’s total output and cutting its upstream emissions by 2%. The cash proceeds from the transaction will be used to fund $7 billion in shareholder distributions, with the remainder strengthening the balance sheet. Another Permian Basin acquisition saw Callon Petroleum acquire assets and infrastructure from Primexx Energy Partners for a value of $788 million, adding 35,000 net acres and 18,000 boepd in production to Callon Petroleum’s portfolio. Callon is currently utilising two rigs on the Primexx acreage throughout H2 2021 and into 2022. Callon further focused its portfolio on the Permian Basin with the divesture of its non-core assets in the Eagle Ford basin to an undisclosed party for cash proceeds of $100 million. The Eagle ford assets include 22,000 net acres in the northern LaSalle and Frio counties with net production of 1,900 boepd.

Chesapeake Energy Corporation is set to acquire Vine Energy in a deal worth $2.2 billion. Vine Energy had been focused on the development of over pressured stacked Haynesville and Mid-Bossier shale plays, Northwest Louisiana. Chesapeake Energy had overcome bankruptcy at the start of 2021 and this deal will provide much needed cashflow with the deal set to increase cumulative five-year free cash flow by $1.5 billion. The deal is expected to be completed during Q4 2021 once regulatory approvals and the approval of Vine Energy shareholders has been achieved. Chesapeake Energy’s preliminary plan once the transaction is completed is to operate 10 to 12 rigs in 2022, with eight or nine rigs focusing on its gas assets and two to three rigs on its oil assets.

Other deals include Contangos acquisition of Wind River Basin assets, Wyoming, from ConocoPhillips. The agreement, effective 1 June 2021, will include 446 bcfe of proved developed producing reserves for a total purchase price of $67 million. Whiting Petroleum completed the acquisition of assets in the Williston Basin, North Dakota. Adding approximately 60 prospective drill locations to its portfolio. Whiting Petroleum also sold its only non-Williston basin assets with the sale of its Redtail leasehold interests and related assets, located in the Denver-Julesburg Basin, Colorado.

Earlier in the quarter ConocoPhillips had its permits in Alaska void by a US federal judge, leaving the future of the Willow oil play in doubt. The leases lie in the Arctic National Wildlife Refuge (ANWR) and were awarded under the Trump administration. Under the Biden Administration the leases were reviewed by the Department of the Interior and were subsequently suspended pending review of the environmental and wildlife impact. The $39 billion Alaska LNG project also experienced a setback when the US Department of Energy (DOE) announced it would carry out an environmental impact assessment with the outcome not set to be concluded until December 2022. The Alaska LNG project includes construction of a 1,288 km, 42” pipeline that would export 2.55 bcf per day. This would then be exported via a liquefaction facility which is planned to be constructed on the Kenai Peninsula, Southern Alaska.

Brookside Energy secured the 1,500 HP, Kenai Rig 18 to drill the Rangers well in Oklahoma’s Anadarko basin. This will be Brooksides second well in the SWISH Area of interest following the Jewell well. As of mid-September, work on the well pad was underway and Brookside were awaiting a time slot for the spudding of the well.

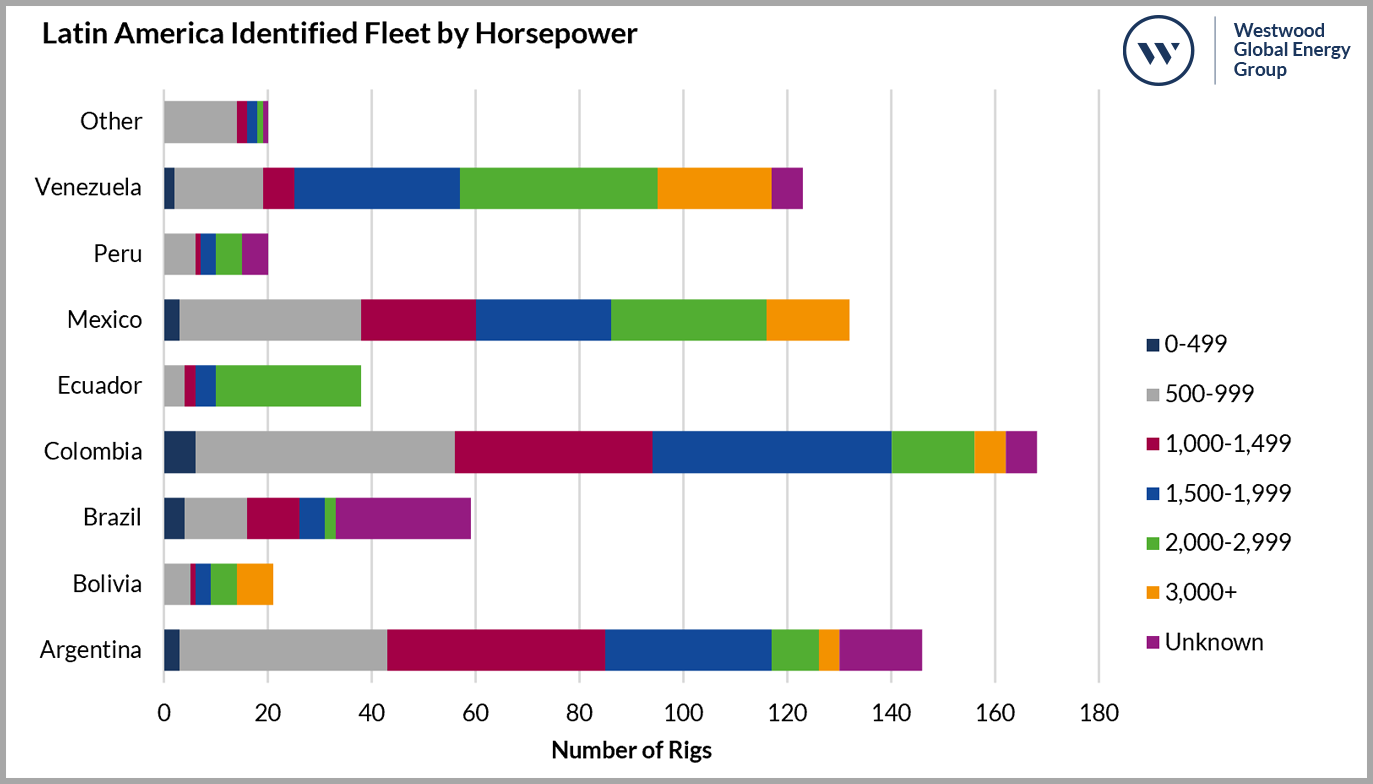

Latin America

Argentina has also seen high levels of activity within the Vaca Muerta shale play. A record 73 oil and gas wells were set to be completed and put on production in Q3. Consequently, production at the shale play, has risen to over 160,000 bpd and is set to reach 200,000 bpd by year end. August saw Argentina’s overall oil production returned to pre-covid values of nearly 525,000 bpd, while gas output also impressed, hitting an all-time high of 1.6 bcfd. The Vaca Muerta operating area contains over 300 wells that have been drilled but remain uncompleted and are yet to be put on production. This number however stabilised in Q3 hinting that completion rates have started to match drilling rates.

On 15 September 2021 the government of Argentina sent a bill to congress to promote hydrocarbon investment and increase domestic production in the Vaca Muerta shale formation and beyond. The Vaca Muerta play is said to hold 16 billion barrels of oil and 308 tcf of gas. Current rules are seen to deter foreign investment with companies unable to remove profits from Argentina and limiting the amount of capital they can borrow to invest in projects. The bill addresses these issues and would allow companies to have greater access to foreign exchange markets as well as increased approval rates for hydrocarbon exports.

Latin America focused, Vista Oil and Gas also grew its footprint in the Vaca Muerta shale play, acquiring ConocoPhillips’ 50% working interest in the Wintershall Dea operated, Aguada Federal and Bandurria Norte concessions. The deal increases Vista’s net acreage by 25,231 acres, now totalling 157,852 acres, and added 150 well locations to its portfolio. Vista are now the second largest producer of non-conventional oil in the play behind YPF. The deal involved no upfront payment, with Vista having assumed the outstanding carrying costs of $77 million that ConocoPhillips agreed to pay Wintershall Dea by covering 50% of the latter’s share in all capital expenditures relating to the assets. ConocoPhillips are seen to be offloading less valuable acreage to account for the two major shale deals made in 2021: the purchase of Shell’s Permian assets in a deal worth $9.5 billion, and the acquisition of Permian focused Concho Resources for $13.3 billion.

President Energy has signed a drilling services contract for three wells on the Puesto Guardian concession, Argentina, to be drilled by year end. Site preparation for the first well, to be drilled on the Dos Puntitas field, has begun with the rig due to be mobilised in early October. Each well has an estimated cost of $3.5 million and an expected drill time of 45 days.

Important drilling campaigns were also undertaken in several other Latin American countries, including Cuba where the Melbana Energy operated, Alameda-1 exploration well discovered light oil at depths of just 454 metres. Wireline logging will be required to clarify the extent of the shows, but these are positive signs. Drilling continues down to the primary objective of the Alameda formation. The well was drilled by Sherrit International who provided drilling and rig services for the well, utilising their Rig 1 unit for the operation.

Touchstone Exploration Inc. announced the completion of the Royston-1 exploration well on the Ortoire block, Trinidad and Tobago. The well was drilled to a depth of 10,700 ft by the 1,500 HP Well Services Petroleum Ltd Rig-60. The well was successful, discovering hydrocarbon accumulations in the Lower Cruse, Karamat and Herrera formations.

Brazilian company Eneva has signed the 1,600 HP, QG-8, Constellation Oil Services owned, rig for a seven well drilling program on the 208 bcf Azulao gas field in the Amazonas basin. Eneva will operate the rig from 15 September with the program expected to take 290 days to complete.

Source: Global Land Rigs, Westwood Analysis

Venezuela has suffered significantly in recent years seeing production decline from 2.5 million bpd in 2015 to just 479,000 bpd in April 2021. This decline is due to disinvestment, lack of maintenance and US sanctions. Venezuela currently has 3,700 shut in wells, 2,000 of which lie in the Orinoco Belt. Recent efforts have been made by state owned PDVSA to resume a drilling program in the Orinoco Belt region, which was suspended in 2019, utilising three of its own rigs plus 14 rigs contracted from Corporacion Panthers for $1.5 million each. PDVSA has 97 drilling rigs currently in the Orinoco Belt, all of which are currently not operating. It is expected that 10 of these rigs can be restarted in the short term but maintenance costs are estimated to be $8.44 million.

Asia-Pacific

The Chinese national oil company, CNPC, acquired tight gas acreage previously abandoned by Shell in China’s Sichuan basin. CNPC is looking to develop the Jinqiu tight gas play, this will involve the construction of 30 well pads which will host a combined 93 horizontal wells all within the Jinqiu play. The development comes after recent success in the Jinqiu play at the Yongqian-3 wellsite where flow rates of 11 million cubic feet per day of tight gas were seen in late June. During Shell’s activities in the assets, it experienced time delays due to local protests over land use, CNPC has made an environmental impact assessment for the project public for review and comment to try and avoid this happening again.

In the Asia-Pacific region, Buru Energy announced that the 1,500 HP, Ensign Energy Services Inc rig 963 successfully drilled the Currajong-1 well and is currently drilling the Rafael-1 exploration well in the Canning basin, Australia. Currajong-1 was drilled to a measured depth of 7,677 ft, discovering oil shows, production tests results are yet to be announced. Buru Energy spud the Rafael-1 well on 22 August 2021 but drilling at the well has been slower than anticipated due to the hard formations in the basal Grant and Reeves sections requiring several unplanned bit trips.

In July, the Australian Government approved up to $21 million of grant funding to Empire Energy under the Beetaloo Cooperative Drilling Program. This funding will support drilling and flow testing of up to three horizontal appraisal wells in Empire Energy’s EP187 permit. The first of the three wells is due to be spud in Q4 2021, once all government approvals have been finalised. The Beetaloo Cooperative Drilling Program, announced by the Australian Government earlier this year is part of its Gas-fired Recovery Strategy. It aims to encourage explorers to accelerate work programs and thus increase gas supply for Australia’s domestic demand.

Megha Engineering and Infrastructures (MEIL), through its wholly owned subsidiary Drillmec, is on track to deliver 47 oil and gas rigs to Indian state-owned company ONGC by the end of 2022. The contract, worth $860 million, was signed in 2019 and consists of 20 workover rigs and 27 land drilling rigs.

Australia has seen several M&A updates during Q3. Bass Oil received government approval to acquire an interest in Cooper Basin assets from Cooper Energy. The deal includes participating interests in the PPL 207, PRL 231-233, PRL 183-190 and PRL 237. These assets contain the producing Worrior field, as well as the drill ready Tyrell and Athelstan oil prospects and the Frostfang oil prospect. Having already funded the consideration payment Bass Oil now only need to obtain counterparty financier approval before the deal can be completed, completion is expected in mid-October 2021.

New Zealand Oil and Gas and it’s 50.04% owned subsidiary, Cue Energy Resources completed the Amadeus Basin deal worth $21.05 million with Central Petroleum. The acquisition, effective 1 July 2020, is comprised of a 25% interest in the Mereenie oil and gas field as well as 50% interest in both the Palm Valley and Dingo gas fields. New Zealand Oil and Gas and Cue Energy Resources will also cover operating company, Central Petroleum’s share of exploration, appraisal and development costs up to $29 million. Development activities are set to include four well recompletions and up to 10 new wells.

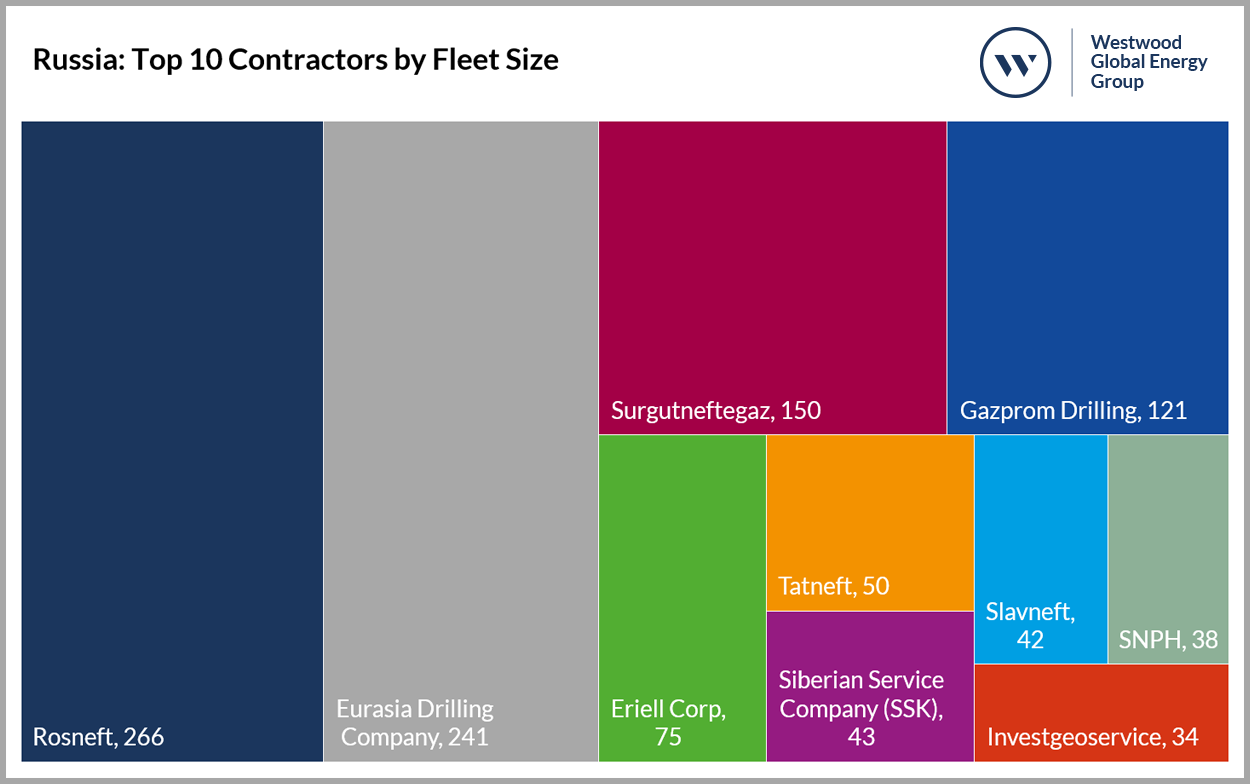

Eastern Europe & FSU

In Russia, Novatek has launched new exploration tenders for three deep wells at the Gydan Peninsular, West Siberia. Novatek is aiming to complete the 143R, 147R and 151R wells over the next year utilising a rig from its long-term drilling contractor Eriell. Five winterised Eriell land drilling rigs are already mobilised in the Utrenneye field, Gydan Peninsular, with Eriell set to mobilise a sixth to drill the exploration wells for the Arctic LNG 1 project. The wells will be drilled to a depth of 12,000 ft and will target the high pressure Achimov formation. Despite the higher risk and expense of drilling into the deep Achimov formations Novatek believe the higher volume of condensate is worth it as condensate can be exported directly to international markets.

Russia’s largest oil producer, Rosneft, plans to drill eight exploration wells across seven blocks in the Yakutia region, East Siberia, between 2022 and 2024. The wells are set to be drilled to depths of about 10,000 ft. Earlier in 2021 Rosneft made a discovery in the Lower Dzherbinsky block with estimated reserves of 75 bcm gas and 10.5 mmbbl condensate. Out of seven blocks in the Yakutia region only the Ygyattinsky, Nyurbinsky and North Olguydakhsky are accessible year-round. The other four are only accessible by temporary winter roads.

Source: Global Land Rigs, Westwood Analysis

Rosneft is also aiming to reverse declining production in the Bashkiria region, operated by its subsidiary Bashneft. Rosneft is set to pay $30 million to drilling contractors for a 22 exploration well program between 2022 and 2024. The wells cover a significant area of Bashkiria and have subsequently been split into several lots to enable different contractors to compete and carry out the work. The wells will have various depths ranging from 1,200 metres to 2,200 metres. Proposals are due to be submitted by 13 September 2021 with the winners being announced in November 2021.

Summary

In the wake of the covid-19 pandemic and the 2020 oil price crash, oil prices are now back on the rise amid increasing demand. The onshore oil and gas industry is regrouping and getting back on track with rig rates across the globe increasing. With drilling programs back underway we expect to see rig utilisation increase, all be it moderately, over the next five years. Despite this the global onshore drilling rig fleet will remain significantly under utilised with only c.50% of rigs forecast to be contracted by 2025.

Todd Jensen

Research Analyst, Onshore Energy Services

[email protected]