Less drilling, smaller discoveries and lower success rates in 2023, but the appetite for exploration is undiminished in 2024

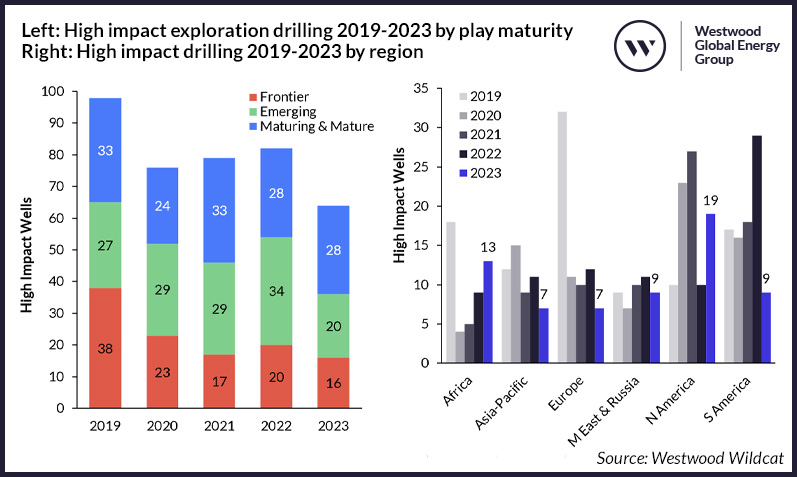

The global high impact well count decreased to just 64 wells in 2023, down from 82 wells in 2022 and the lowest number Westwood has ever recorded (Figure 1). This, despite an oil price of over $100/bbl in 2022, which would normally have fed through into higher exploration spending the following year. The link between oil prices and drilling that has held for many years may finally have been broken as companies balance their exploration ambitions against the pace of the energy transition.

Figure 1: High impact drilling activity matched to previous year Brent oil price ($USD). Source: Westwood Wildcat

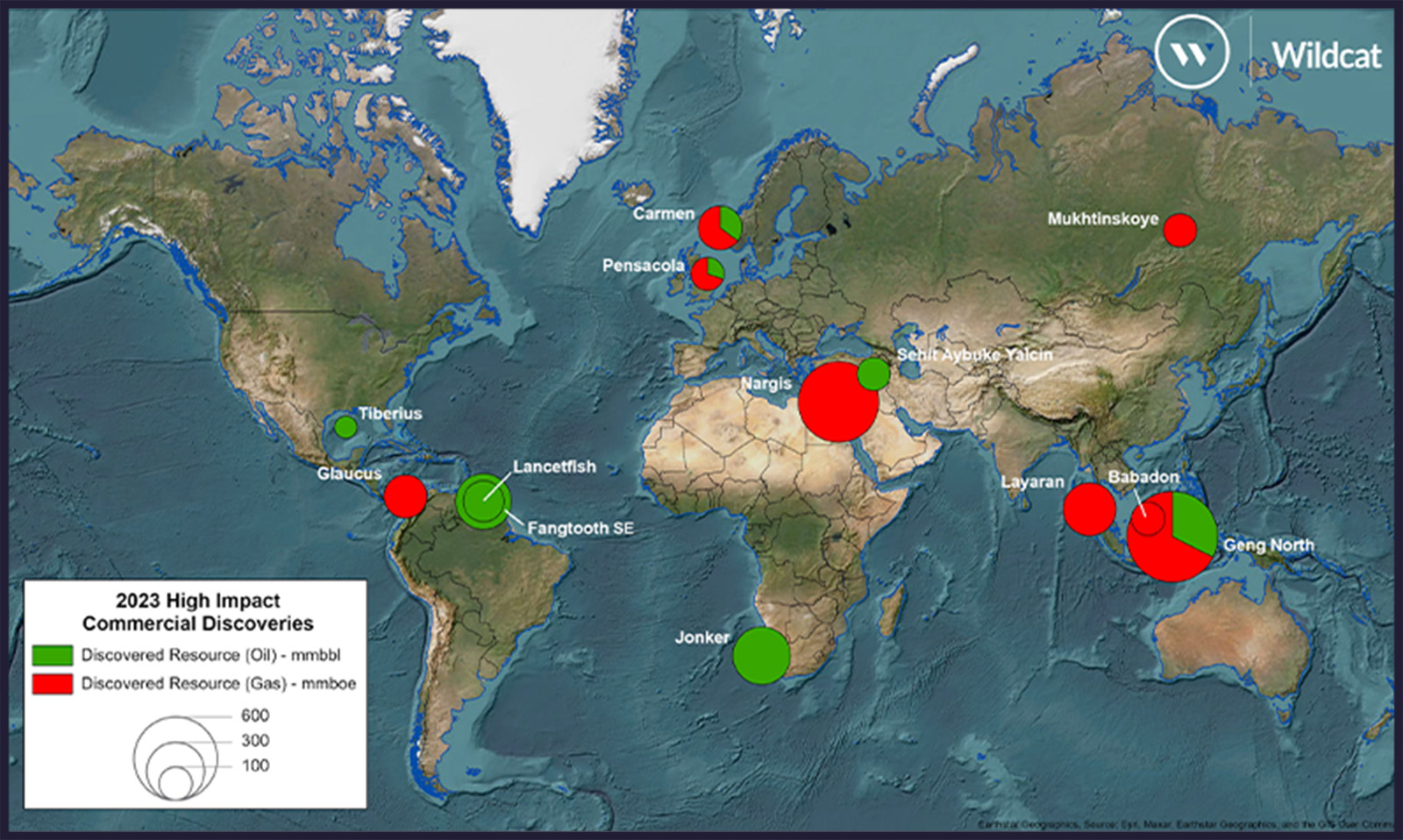

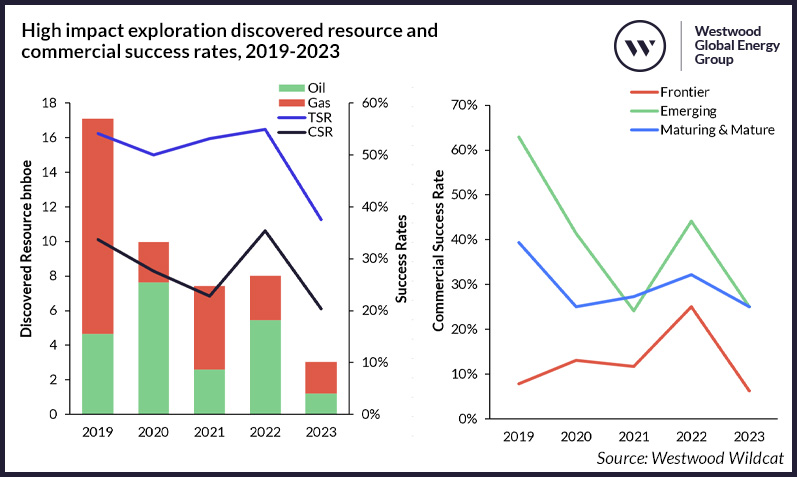

There were 13 potentially commercial discoveries (Figure 2) from the 64 high impact wells completed in 2023, discovering a preliminary estimate of ~1.2bnbbl (40%) oil and ~11tcf (60%) gas. This was a 62% decrease on the 8bnboe discovered in 2022 from the 29 commercial discoveries (Figure 3). The average discovery size fell to ~235mmboe from ~275mmboe in 2022 whilst the commercial success rate was 20%, down 15 percentage points from 2022 and the lowest commercial success rate recorded since 2016 (Figure 3).

Figure 2: Map showing potentially commercial discoveries from the high impact well programme in 2023. Source: Westwood Wildcat

Figure 3: High impact exploration discovered resource and commercial success rates, 2019-2023. Source: Westwood Wildcat

The drop in exploration drilling has been driven by a slowdown in South America especially, with just nine wells completing in 2023 compared to 29 in 2022, which was a 10 year high (Figure 4). High impact drilling in Guyana was down ~60% on the previous year whilst Brazil was down ~80%. In 2023, the Stabroek JV in Guyana placed a greater focus on appraisal and development drilling with only four exploration wells drilled compared to 10 in 2022. In Brazil, the only two wells to complete were in the outboard of the Campos Basin, with neither well delivering any commercial success.

In North America the story was quite the opposite, with drilling increasing from 10 wells in 2022 to 19 wells in 2023. This was almost entirely due to IOCs returning to complete commitment drilling programmes in the Mexican Campeche Salt Basin. High impact drilling activity in the USA and Canada remained on par with 2022.

Africa was the only other region to see an increase in high impact drilling in 2023, with 13 high impact wells completing. This was driven by activity ramping up in Namibia following the frontier successes in 2022, as well as drilling in seven other countries in the continent. Asia-Pacific and the Middle East/Russia both saw a decline in activity, and Europe decreased by 42% with fewer high impact wells being drilled offshore Norway especially.

Figure 4: Left: High impact exploration drilling 2019-2023 by play maturity. Right: High impact drilling 2019-2023 by region. Source: Westwood Wildcat

Frontier exploration remained low with only 16 wells completed compared to 38 in 2019 (Figure 4). Seven of the frontier wells were frontier basin tests, with the remainder targeting new plays in proven basins. There was only a single potentially commercial frontier success at Pensacola in the UK, which unlocked a new Permian carbonate play in the Southern North Sea. All frontier basin wells were unsuccessful, including key basin tests in the Orphan (Canada), Essaouira-Tarfaya (Morocco) and Angoche (Mozambique) basins. After an exceptional 2022 with five potentially commercial frontier discoveries (translating into a 25% frontier commercial success rate), frontier exploration success fell back to historical levels in 2023.

The number of companies with an appetite for high impact exploration continues to fall with 68 companies participating in the 64 high impact wells drilled in 2023, compared to 76 companies in the 82 wells drilled in 2022, less than half of the 164 companies that participated in high impact exploration drilling in 2014.

The most active explorer in 2023 was QatarEnergy with 13 gross wells, followed by Shell who participated in 12 wells.

2024 Outlook

Activity in 2024 is likely to be at a similar level to 2023 with 60-65 high impact wells expected to complete.

Africa should see around 20 high impact wells drilled, driven by the emerging Orange Basin. Galp recently announced an oil discovery at its Mopane-1X, the first well by a company other than TotalEnergies or Shell to test the new Cretaceous plays. Deepwater wells in the South African sector of the Orange Basin, chasing equivalent plays could also be drilled in the latter half of 2024. Further north, ExxonMobil is expected to drill the first exploration well in the Angolan Namibe basin and hopes to drill a well in Egypt’s Herodotus basin.

South America is expected to make a recovery in 2024 with around 15 high impact wells expected compared to nine in 2023. Frontier basin tests in Colombia and Argentina are key wells to watch. Drilling in Brazil will be predominantly in the pre-salt Santos and Campos Basins. Three of the last remaining commitment wells in the outboard pre-salt carbonate play are likely to be drilled by Petronas and Petrobras in what has been a disappointing industry campaign. In the inboard pre-salt, BP is expected to drill its first operated well in Brazil since 2013. Further north along Brazil’s equatorial margin, Petrobras will be seeking to unlock the deepwater potential of the Potiguar basin. In Guyana, the Stabroek JV will look to understand the gas-prone south eastern areas of the block whilst some higher risk wells outside of the core fairway could also be on the cards in 2024. In neighbouring Suriname, further exploration drilling is expected for the Petronas-ExxonMobil JV.

North America is expected to see fewer wells offshore Mexico as the licence round drillout programme draws to a close, whilst drilling will continue at a similar pace in the US Gulf of Mexico. In Canada’s frontier Orphan basin, ExxonMobil’s planned 2024 Persephone well is a key well to watch.

In Asia Pacific, the Sabah Trough in Malaysia will be the location of key frontier tests in 2024 whilst further drilling is expected in the emerging late Oligocene play of the North Sumatra basin on the back of the 2022 Timpan discovery. Whilst a high level of E&A drilling is expected to be maintained across NW Europe, high impact drilling will remain low in 2024 with the focus on infrastructure-led exploration (ILX) opportunities.

High impact exploration results in 2023 disappointed with fewer and smaller discoveries and the lowest discovered volume overall that Westwood has ever recorded. Key basins like Guyana-Suriname, that had been driving exploration volumes are maturing, whilst industry hotspots like Mexico and the outboard plays in Brazil have disappointed. The appetite for exploration is lower than it was but is still there. 2024 will see a similar well count to 2023 however there are several key wells, testing new geographies and ideas that could be game changing (Figure 5).

Figure 5: Key wells to watch in 2024. Source: Westwood Wildcat

Jamie Collard, Wildcat Exploration Research Manager

[email protected]

Andrew Jackson, Senior Analyst

[email protected]