High impact exploration has seen average discovery sizes decline year on year from nearly 500mmboe in 2019 to 220mmboe in 2023 whilst overall finding costs have gone up by a factor of six in the same period.

6th June, London UK: The latest analysis from Westwood Global Energy Group (Westwood), the specialist energy market research and consultancy firm, reveals that despite favourable oil prices in 2022, high impact exploration drilling in 2023 declined by 21%, due to energy transition strategies, industry consolidation, rising well costs and reduced activity in former hotspots.

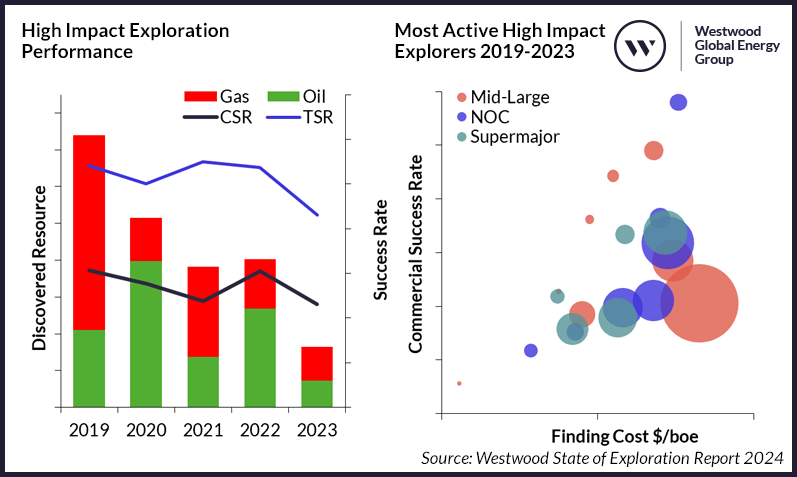

Left – High impact exploration discovered resource & success rates, 2019-2023.

Right – Performance metrics for most active high impact explorers, 2019-2023.

Source: Westwood’s State of Exploration Report 2024

Further 2023 analysis reveals that the commercial success rate is down seven percentage points on the previous year – the lowest since 2018. Fewer giant discoveries (>500mmboe) have resulted in a year on year decline in the average discovery size, down from nearly 500mmboe in 2019 to ~220mmboe in 2023, the smallest since 2014. At the same time overall drilling finding costs have increased by a factor of six since 2019 to $1.2/boe. The commercial success rate in frontier plays returned to the long-term average at <10%.

In addition, the findings also highlight a decrease in the number of companies participating in high impact drilling (down from 99 in 2019 to 68 in 2023), with supermajors and NOCs continuing to account for the majority of high impact well equity, at ~60% between 2019-2023, and leading the way in terms of both discovered resource and commercial success rate.

There is still cause for optimism, however. Recent discoveries in Namibia’s Orange basin demonstrate that there are still significant volumes of hydrocarbons to be found and cycle times are reducing, with oil discoveries achieving first production, on average, a year faster than gas discoveries.

Graeme Bagley, Head of Global Exploration and Appraisal at Westwood said: “The relationship between exploration drilling and the previous year’s oil price has broken. High oil prices previously led to high levels of exploration drilling. The appetite for exploration is still there but energy transition strategies are having a significant impact on the way the companies choose to replenish their reserves base, with industry consolidation and new technologies also having apart to play.”

The State of Exploration 2024 report is now available for subscribers to Westwood’s Wildcat product. Non-subscribers can look to purchase the full report here. Westwood will also discuss the findings in its State of Exploration webinar on 20th June, sign up here.

ENDS

About Westwood Global Energy Group

The energy landscape is changing; and Westwood Global Energy Group is evolving in-step to answer the strategic, commercial and technical questions industry stakeholders face each day. As trusted advisors to companies in key energy transition and oil and gas sectors, Westwood Global Energy Group scrutinises and integrates parts of the energy system that others don’t.

From Northwest Europe E&P and energy transition technologies to global exploration and offshore and subsea equipment, we dig deeper, reach further and join up previously unconnected information to help our clients thrive through the energy transition. From the depth of our data to the insight from our industry experts, our commercial advisory to our quantitative techniques and databases – we insist on excellence in everything we do.

Westwood Global Energy Group is headquartered in London and has offices in Aberdeen, Houston and Singapore.

Media contact

Victoria Chilton, Aspectus Group

[email protected]

m: + 44(0)7546566966