Following on from our 2024 Floating Wind Survey, Westwood sought to learn if the industry view regarding floating wind has changed over the course of a year.

The floating wind sector achieved several key milestones in 2024, including 9.8GW of new lease awards, up to 11.7GW of tender launches, and the awarding of subsidies for commercial-scale projects in France, the UK and South Korea. Despite these positive developments, overall progress remains slower than initially expected. This is reflected in Westwood’s WindLogix projections for 2030, which have been repeatedly revised downwards in recent years, with total floating wind capacity now expected to reach just 4.5GW by the end of the decade.

Results of the 2025 Floating Wind Survey

To gauge the industry’s response to these mixed developments, Westwood surveyed 166 participants across the global floating offshore wind value chain. The 2025 Floating Wind Survey, ran in association with World Forum Offshore Wind, Norwegian Offshore Wind, Oceantic Network and WindEurope, focused on market sentiment, growth expectations, barriers to growth and keys to unlocking these barriers. Five key themes emerged from the results:

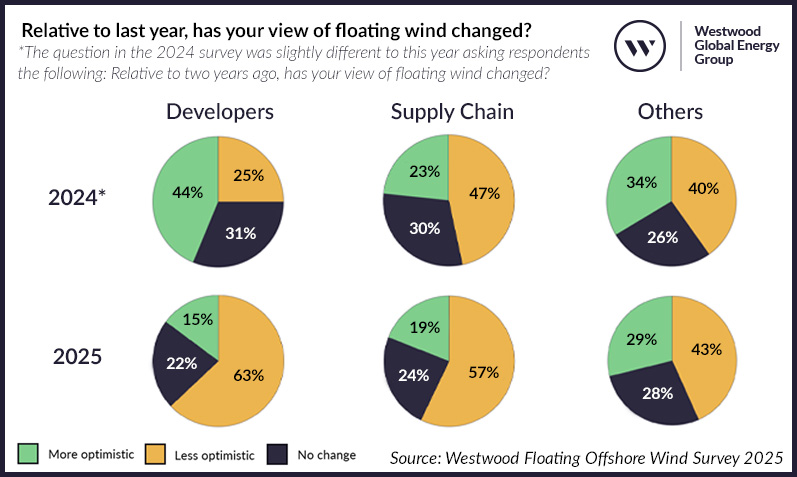

Theme 1: Optimism has declined, especially among developers

Compared to 2024, most respondents reported reduced optimism in 2025, especially amongst developers. Although developers showed the strongest optimism in the 2024 survey, they were now the least optimistic group in the 2025 survey compared to the two other business type categories. Over the past year, we have seen developers resetting their offshore wind ambitions and optimising portfolios to reflect evolving strategies. A focus on value over volume has likely played a role in this changing view.

Relative to last year, has your view of floating wind changed? Source: Westwood Floating Offshore Wind Survey 2025

Theme 2: Global growth expectations tempered

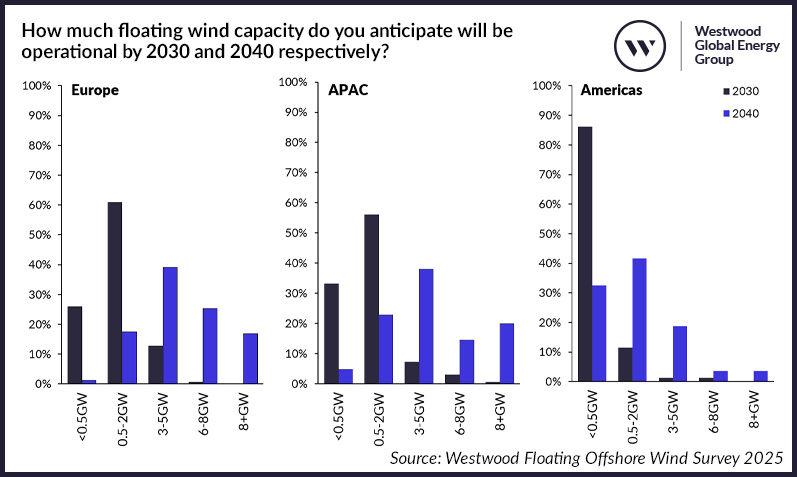

Expectations for floating wind capacity growth have been scaled back compared to 2024 sentiments, especially within the 2030 timeframe. Most respondents now anticipate that global capacity will remain under 3GW by 2030. Longer-term sentiments to 2040 remain more optimistic, although expectations are now more evenly spread across the different growth scenarios of 3-6GW, 7-10GW and beyond 10GW by 2040 – a more conservative response compared to the 2024 survey.

On a regional basis, Europe and Asia Pacific (APAC) are expected to lead development to 2040, with the largest share of respondents anticipating 3-5GW of operational floating wind capacity in each of these regions by 2040. Notably, APAC received the highest number of respondents anticipating over 8GW of capacity by 2040, with fewer respondents choosing the 6-8GW option. This suggests that respondents had slightly more polarised views of APAC, anticipating either stronger or weaker growth, in contrast to the Europe and Americas regions where respondents’ choices followed a more standard distribution curve (or “bell curve”) tapering off towards the high end of the capacity scale.

Meanwhile, expectations for the Americas falls behind. There is very little capacity expected to be operational in the Americas by 2030, and most respondents expect 2040 capacity to sit in the lower end of options, a sobering reflection of the enduring impact recent US policy support withdrawals have had on market sentiments.

In Europe/APAC/Americas, how much floating wind capacity do you anticipate will be operational by 2030 and 2040 respectively? Source: Westwood Floating Offshore Wind Survey 2025

Theme 3: Shifts in leading markets

Industry sentiment on specific leading markets has also shifted. The UK is still seen as the global leader, but France has also moved into the top three. An interesting caveat is that respondents’ locations have also shaped their views, with a more positive outlook typically being placed on markets in their region. Regardless, the top three markets ranked by respondents – the UK, France, and South Korea – are also the markets where floating wind subsidies were awarded in 2024.

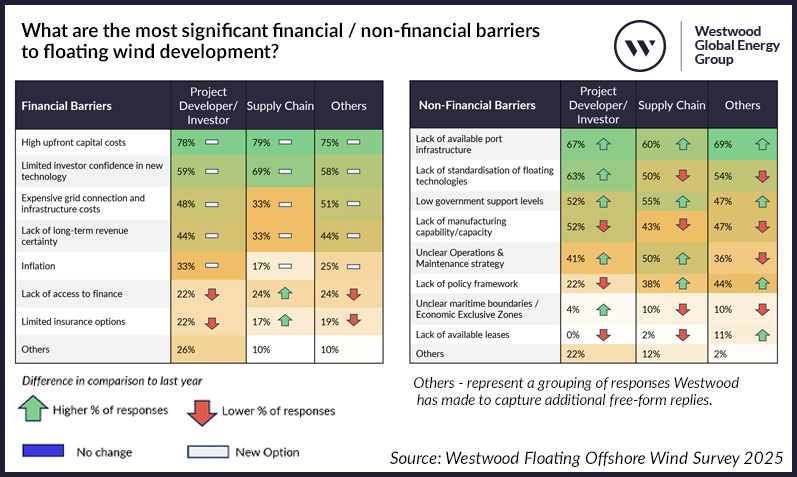

Theme 4: Money, ports and technology as key barriers

Major barriers to floating offshore wind development can be categorised into financial and non-financial obstacles. High upfront costs and limited investor confidence are seen as key financial barriers, with 77% and 61% of respondents highlighting these options respectively. Meanwhile, port infrastructure limitations and lack of technology standardisation continue to be the leading non-financial obstacles to development.

Notably, although inflation has been often cited as a major issue for the offshore wind sector over the past few years, less than 25% of respondents viewed it as a top barrier for floating wind.

What are the most significant financial/non-financial barriers to floating wind development? Source: Westwood Floating Offshore Wind Survey 2025

Theme 5: Dedicated government support and industry collaboration

Survey participants were clear about the role governments need to play, recommending that floating wind be treated as a distinct sector with tailored policy and subsidy frameworks, not a subcategory of offshore wind. This includes launching cost-reduction initiatives specific to floating technologies. Investing in port infrastructure to support industrial-scale deployment was also raised. Ultimately, clear, long-term government commitment is seen as critical to unlocking the floating wind sector’s full potential.

Respondents also recognised the importance of industry-led action. The top priorities include sharing best practices and lessons learned to improve efficiency, collaborating to standardise floating wind platform technology, and forming strategic partnerships on projects to reduce financial risks.

The next steps for floating wind?

In summary, floating wind remains a key technology in the global energy transition, but this year’s survey reveals a clear recalibration of expectations within this decade. Optimism has declined, particularly among developers, and growth projections have softened especially for 2030. Yet progress is being made and is expected to continue, driven by Europe and APAC.

Floating wind will have to overcome cost pressures and infrastructure constraints to unlock its full potential, calling for dedicated government support and collaboration within the industry itself as the sector moves along its trajectory from pilot projects to commercial scale ambitions.

Bahzad Ayoub, Manager – Offshore Wind

[email protected]

Hui Min Foong, Senior Analyst – Offshore Wind

[email protected]