Last week in Houston at the Frac Sand Supply & Logistics Conference, all signs pointed towards more sand per lateral foot, more mines in the Permian, and more trucks to deliver frac sand to the wellsite. Frac sand demand in the Delaware and Midland Basins is expected to increase. E&Ps have increased the proppant per lateral foot by 31% in the last year, with public E&Ps citing the transportation and logistics constraint as a concern, not frac sand supply.

Regional replacement?

Based on the 16 mines Energent tracks, the public sand companies, US Silica, Hi-Crush, and FM Santrol are well-positioned to deliver in-basin, regional, and northern white sand to meet all of an E&P’s need. At the same time, the private equity-backed sand mines are likely at a price advantage compared to their public peers.

Several comments were made at the conference to indicate the regional sand companies will be displaced first. The regional sand mines include the mines in Brady, Voca, and Granbury. However, given the production of these central Texas mines, it will likely prove difficult to displace these mines unless a significant cost or efficiency gain is made by switching to the local in-basin sand.

Each company’s Permian strategy is becoming apparent. U.S. Silica’s latest announcement shows the company’s commitment to the Permian’s sand demand.

The $150 million project will be funded with cash on hand and cash flow from operations. The Company has secured customer commitments for the purchase of 1.2 million tons per-year of sand including cash pre-payments, and for up to four Sandbox crews to deliver the sand directly from the mine to customer well sites.

With supply in place across the basin, companies are turning to innovative portable storage and container solutions to deliver and store sand at the wellsite. PropX, ArrowsUP, Sandbox, and others demonstrated their unique approach to meeting the needs of Permian E&Ps. These new solutions will help prepare the industry for OSHA’s upcoming silicosis rules in 2018.

A data-driven approach to demand

E&Ps continue to see the production improvement from high-intensity completions using more sand per well. In one frac sand demand scenario, the forecast is based on a 35% in the number of well completions in the trailing 12-months places frac sand demand near 15 million tons in the next 9 to 12 months.

Another scenario, based on 100% of the uncompleted wells and fulfillment of 60% of the issued drilling permits takes the total frac sand demand to 43 million tons in the next 9 to 12 months.

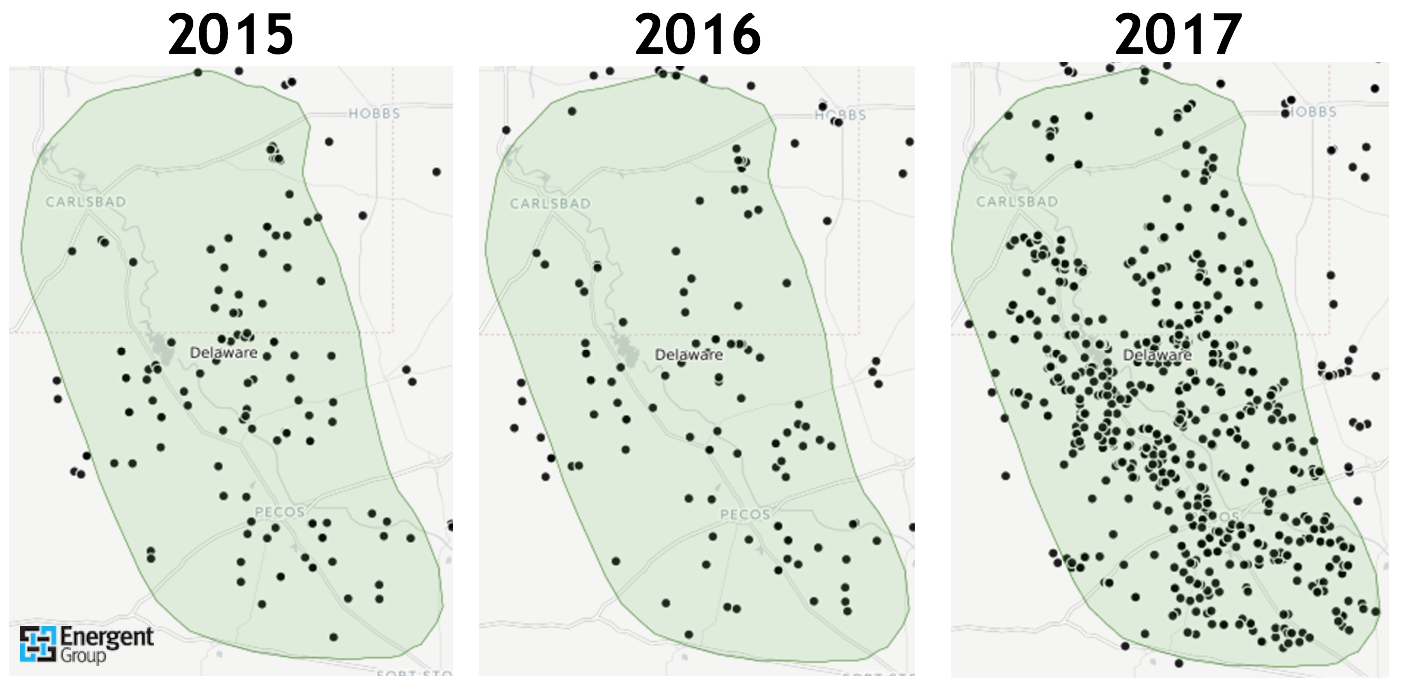

The wildcard in every demand scenario is the number of uncompleted wells. Each Energent method relies on the number of wells rather than the rig count to get a more accurate picture of frac sand demand. The figure below shows the DUC wells in the Delaware Basin by spud date vintage.

Source: Energent Group

With more attention on the frac sand segment, expect more capital and resources to be available to sand, logistics, and trucking companies. The current constraints appear focused on the delivery to the wellsite, so trucking and logistics companies will likely require more people, trucks, and trailers that are ready to move containers of sand.