Westwood Global Energy Group has released its latest tranche of comprehensive quarterly offshore market reports and with it can reveal a few interesting themes and positive indicators that emerged from the first quarter of 2022. Within offshore field development, higher than expected commodity prices since late 2021 is driving an anticipated rebound in subsea EPC spend, as 2022 E&P upstream capex guidance increases 28% year-on-year (YoY). Turning to the offshore drilling rig market, all jackup roads are leading to Saudi Arabia after news that Saudi Aramco is reportedly looking to expand its working jackup fleet from 50 to 90 units by the end of 2024. And finally, 1Q highlights from the offshore wind market cover the latest US auction round, which saw average price per acre soar.

Higher prices driving rebound in subsea EPC spend

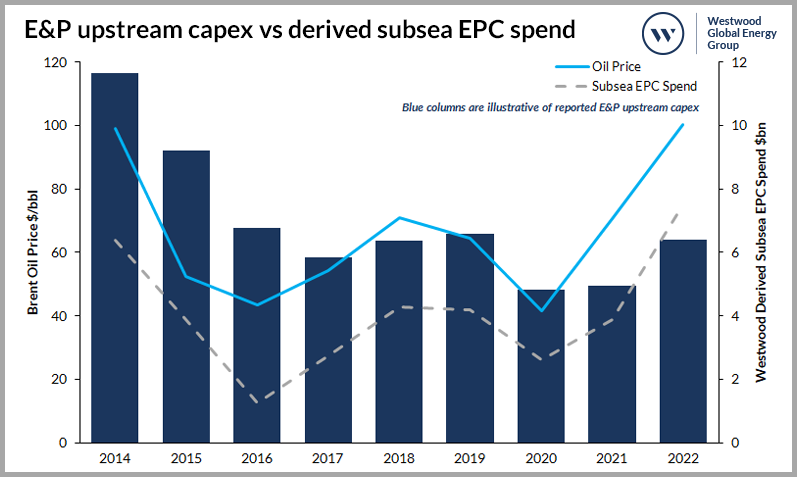

Higher than expected commodity prices since the start of 4Q 2021 is driving an anticipated rebound in subsea engineering, procurement and construction (EPC) spend, as 2022 exploration and production (E&P) upstream capex guidance increases 28% YoY but still lags by 3% on 2019 levels.

As the world emerged from the Covid-19 pandemic in 2021, the oil price rose and E&P companies reported a marginal YoY rise in capital expenditure. However, profit soared, with supermajors reporting an average of US$15.5 billion in 2021 profit as the global energy shortage unfolds.

Figure 1:E&P Upstream Capex vs Derived Subsea EPC Spend

The data considers ExxonMobil, Chevron, Shell, TotalEnergies, BP, Petrobras and CNOOC.

Source: SubseaLogix, Investor Relations, Westwood Analysis

The significant increase in E&P 2022 planned upstream capex is expected to directly impact subsea investment as several announced field development timelines get to a final investment decision phase, with 77 offshore fields expected to be sanctioned this year – a 20% increase compared to 2021. Given this, Westwood anticipates a 97% increase in derived EPC subsea spend from selected E&Ps in 2022, as E&Ps shift focus to prolific capital intensive projects.

The planned increase in upstream spend could provide some respite to the offshore EPC supply chain, as subsea OEM 2021 order intake still lags by 36% on 2019 levels. However, the war in Ukraine could derail a recovering beleaguered supply chain from the impact of the Covid-19 pandemic by amplifying baseline inflation and supply chain pressure for key materials and labour.

All jackup roads lead to Saudi Arabia

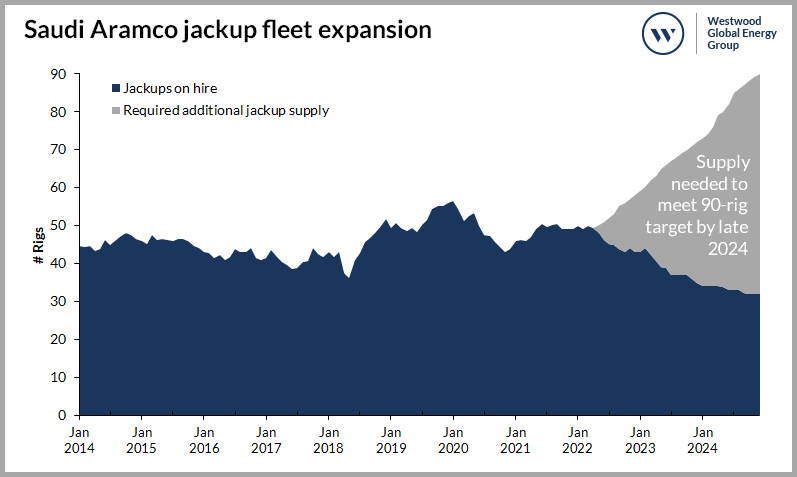

With Saudi Aramco reportedly looking to expand its working jackups from 50 to 90 units by year end 2024, a few rig owners are buying newbuild and long-idled equipment to win as much of the work as possible.

Saudi Arabia’s NOC has been busy awarding contracts for 11 incremental jackups, with another nine scheduled to be made in 2022. This could be followed by as many as 15-20 new units contracted in 2023. The first 11 awards include four known newbuilds, with more likely to come in the second tranche of awards. There are still 25 jackups under construction that do not already have contracts in place.

Figure 2: Saudi Aramco jackup fleet expansion

Saudi Aramco’s historic and future jackup usage plus future supply needed to meet expansion target of 90 jackups by late 2024. Data correct as of 7 April 2022.

Source: RigLogix, Westwood Analysis

So far Advanced Energy Systems (ADES) is the most active buyer, although Arabian Drilling is said to be acquiring several units. Both companies are continuing with rig inspections. ADNOC Drilling has purchased four of “up to 10” units and could find itself with limited options should rig buys from others for Saudi Aramco work continue at the current pace. Some rig owners suggest ADNOC has had plenty of opportunity to buy units, but that the company has “sat on its hands.” First reports of the company’s desire to purchase rigs first surfaced in August 2019.

These purchases will likely save some units, even maybe a few younger ones, which may have been scrapped otherwise.

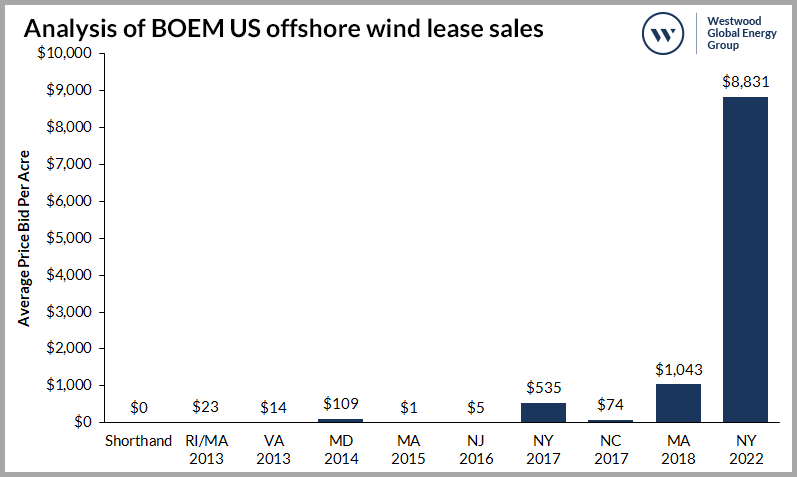

Average price per acre soars in latest US offshore wind auction round

The average fee paid per acre in the 2022 New York Bight auction round was over US$7,788 more than the previous record high of US$1,043 per acre, which was the average price paid in the 2018 Massachusetts auction.

Six lease areas were awarded in the 2022 New York Bight auction round and these areas will account for at least 5.6GW of offshore wind capacity. A total of 25 companies and consortiums had been pre-qualified by The US Bureau of Ocean Energy Management (BOEM) to participate in the auction.

The auction took place over three days and 64 bidding rounds, generating US$4.37 billion in revenue. This was a record-breaking auction round, both in terms of total revenue that was generated, as well as the average amount that was paid per acre.

Figure 3: Analysis of BOEM US Offshore Wind Lease Sales

Source: WindLogix. BOEM, Westwood Analysis

The 2018 Massachusetts auction was the previous record holder, with total bids accounting for over US$405 million and the average price paid per acre totalling over US$1,042. Bight Wind Holdings paid the highest price and purchased the largest lease area. The company purchased a 125,964-acre area for a price of US$1.1 billion. Although they paid the highest overall price, they did not pay the highest price per acre. The highest price paid per acre came from the winning bid placed by Ocean Winds. The bidder purchased a 71,522-acre lease area for a total price of US$765,000. This amounts to a price of US$10,696 per acre.

Full versions of the offshore themes summarised here can be found in the 1Q 2022 Global Subsea Equipment Market Report, Global Offshore Rig Market Report and Global Offshore Wind Market Report. For more information on how to subscribe, please get in touch.

Mark Adeosun, Offshore Field Development

[email protected]

Terry Childs, Offshore Rigs

[email protected]

Bahzad Ayoub, Offshore Wind

[email protected]