15th January 2018

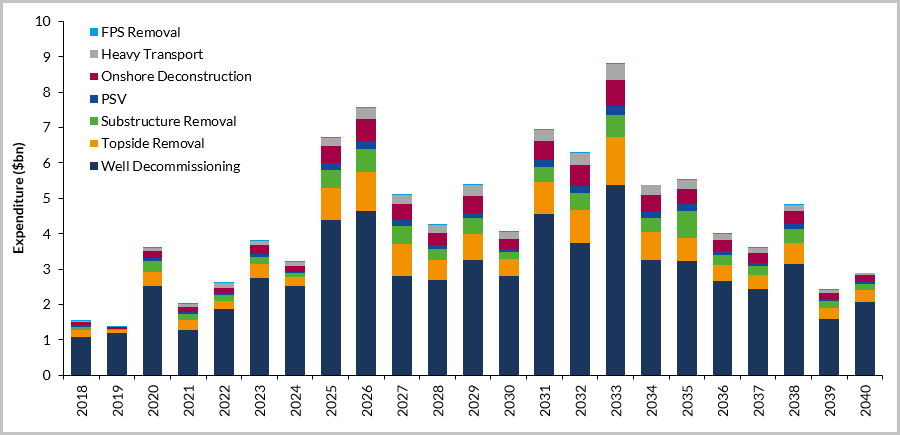

Decommissioning – it’s now a word well entrenched in the mind set and indeed the operations of those involved in the North Sea Oil & Gas industry. With c.$102bn of decommissioning related expenditure forecast to 2040 in Western Europe, it represents a significant opportunity for a supply chain which has proven itself willing to adapt to the increasingly challenging physical and commercial environment in the mature North Sea basin.

Western Europe Decommissioning Expenditure by Workscope

Western Europe Decommissioning Expenditure by Workscope

Source: Westwood Analysis

The nature of decommissioning presents a very different dynamic to the field development of the E&P sector where the asset or field owners’ strategy is to minimise the ultimate costs / liability involved in removing infrastructure safely and in accordance with appropriate regulations. Meanwhile, the supply chain stands to benefit from meaningful revenue streams and is gearing-up accordingly. However, in a volatile and weakened commodity price environment, the key challenge is for the supply chain to present efficient, cost effective solutions to the E&P operators, whilst still being able to achieve reasonable profitability.

In Western Europe, there are currently c.5,600 surface wells and a further c.2,600 subsea wells which all require Plug and Abandonment (P&A) as part of the decommissioning process – current methods for this typically require the use of a cement plug delivered from a dedicated rig. As the volume of P&A activity gathers pace, many believe the traditional methods present opportunities for innovation such as the use of alternative barriers to cement or chemical barriers which isolate the reservoir itself as opposed to at the well bore. If these technologies can be delivered without the use of a dedicated rig, clear time and cost savings will be achieved for the asset owners.

Public bodies and corporates are also assessing how removal of structures (both offshore and the processing onshore) can be best addressed in a cost-efficient manner. Westwood estimates a total of c.4.3mil tonnes of infrastructure will be removed through to 2040 in Western Europe. This infrastructure has to be taken onshore to be processed and it is perhaps not realistic to do all this using reverse installation techniques and heavy or single lift vessels, so there exists a real need for innovative approaches to offshore dismantlement delivering increasing amounts of small or medium sized pieces to onshore facilities. The local ports (e.g. Scottish and English) should develop new strategies to breakdown and recycle (where possible) the tonnage in a cost-efficient manner, thereby making themselves more competitive to ports in other jurisdictions when decommissioning contracts are awarded in the North Sea. We have already seen Forth Ports and Lerwick Port Authority enter into joint ventures with Tier 1 contractors to deliver strategies in this regard. We expect to see further Tier 1’s emerge as decommissioning specialists and align themselves with existing facilities across the UK. This will come on the back of planned investment into increased water depths, strengthened quay sides and suitable hazardous waste management facilities at several UK ports with a focus on becoming decommissioning ready.

It is, however, not just those in the field who must adapt to a market which is expected to drive meaningful levels of activity in the North Sea, if commodity prices continue to be weak. Banks, investors, accountants and the legal community all need to best understand how to advise their clients through the challenges decommissioning presents. The Oil & Gas industry could not exist without the provision of capital and professional services from these communities. It is therefore crucial for all stakeholders to embrace decommissioning with an innovative approach in order to optimise the commercial outcomes.

*Westwood Analysis

Ian McDonald, Manager, EMEA Consulting

[email protected] or +44 (0)1224 502644