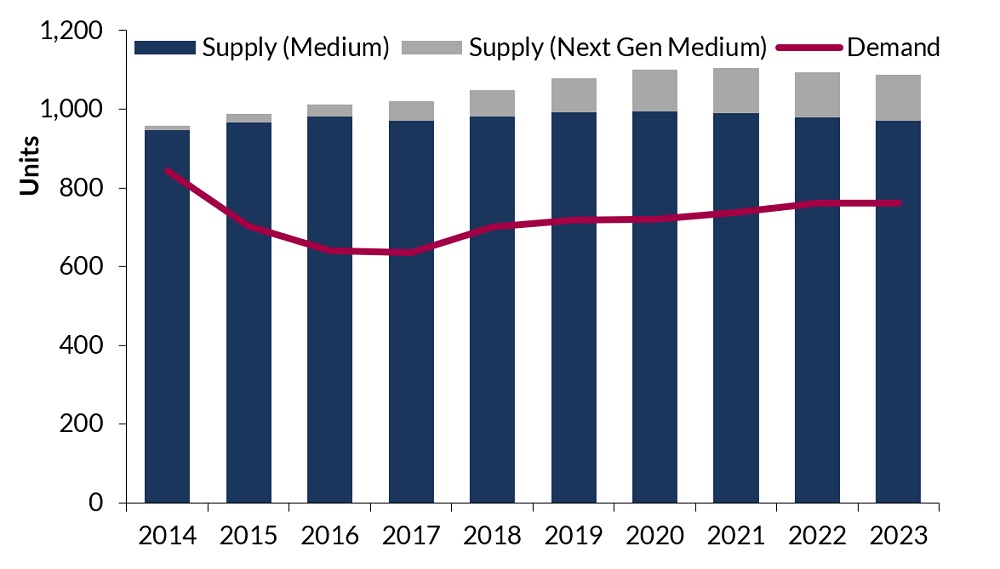

A Slow and Measured Recovery but Turbulence Remains for Offshore Helicopters

October 2018, the offshore helicopter market continues to struggle with low utilisation as a consequence of over-ordering during the peak oil and gas years, despite continued but conservative optimism on the mid-term growth potential.

Many of you will be familiar with this scenario with other asset classes in oilfield services, however unlike many of these, helicopters tend to have long service lives. This means that in the absence of significant external factors such as new regulations or E&P activity, little can be done to alter the current chronic over-capacity situation and the movement of helicopters within the supply chain at a heavily reduced cost.

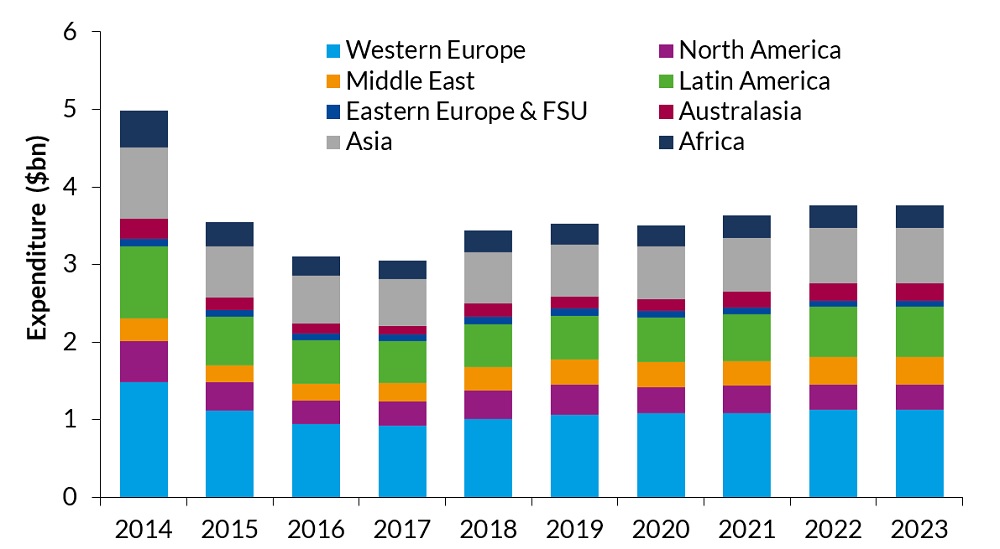

Global Offshore O&G Medium Class Helicopter Expenditure by Size 2014-2023

Key Conclusions Include:

- Offshore oil & gas helicopter expenditure to total $18bn over 2019-2023

- Westwood expects $130m of offshore wind related helicopter expenditure over the forecast, with a CAGR of 17%

- Global utilisation to 68% and 63% over the forecast across the medium and large helicopter fleet

- Western Europe looks to remain as the largest region by expenditure, accounting for 30% of the global total

- North America is to see negative growth, despite several deepwater projects going ahead, due to the number of platforms being removed from the Gulf of Mexico

- Greenfield projects in Brazil, as well as the rapid expansion of Guyana’s oil sector, will see Latin America grow at a 4% CAGR, second only to Australasia’s 11%

In our latest report, Westwood’s World Offshore Helicopters Market Forecast (2019-2023) goes some way to supporting industry consensus for the future demand of helicopter operations and specifically identifies the risks and the opportunities for rotorcraft operators within oil and gas and offshore wind. Indeed, the five-year period to 2023 forecasts a total of $18bn of expenditure on helicopter operations versus $16bn over 2017-2022 as last reported in 2017. Whilst for oil and gas, Westwood sees this as mostly incremental growth – new developments as opposed to any major change in outlook for existing operations – it provides a welcome outlook.

Global Offshore O&G Helicopter Expenditure by Region 2014-2023

These new oil and gas opportunities lie within non-traditional and undeveloped areas such as the Guyana or East Africa and one would expect newer, ‘super medium’ fleets with modern safety and comfort standards and lower operating costs to be favoured over the older ‘heavy’ fleets.

A total of 62 next generation medium aircraft are currently on order and expecting delivery over the next 3 years. However, it should be noted that early in 2018, ExxonMobil announced a 5-year agreement with Bristow for three medium AW139s to service its Liza development (Guyana), rather than any of the 12 H175s Bristow currently has on order.

Offshore wind continues to increase in relevance and scale with 5,661 turbines to be installed globally over 2019-2023 accounting for $32m of construction related helicopter spend and whilst the UK continues to dominate activity for both O&M and construction activity, other regions are also set to experience rapid growth, albeit on a much smaller scale.

Following on from previous restructuring and reorganisation, operators and other stakeholders are now better positioned than ever before to weather the ongoing turbulence but remain at risk where a lack of capital discipline combined with spare capacity, lower contract values and a more competitive environment combine.