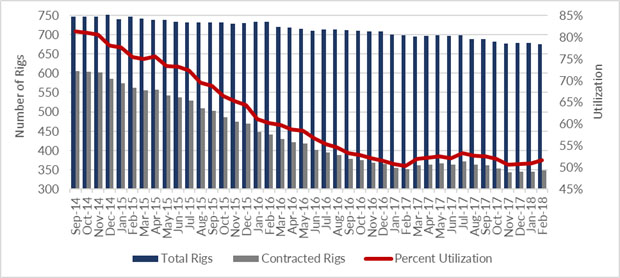

Offshore Rigs – Utilization moves to 51.7% in February

Since September 2014, generally recognized as the start of the current down turn, worldwide competitive rig utilization (jackups, semisubmersibles and drillships) reached a low point of 50.3% in January 2017. It has fluctuated slightly, but has remained in a 3% range since, ending at 51.7% in February 2018.

Worldwide Competitive Rig Utilization (September 2014 – February 2018)

Key Conclusions

- Worldwide competitive jackup utilization remained in the low-mid 50% range from June 2016 through February 2018, despite a lower number of contracted units. Competitive floating rig utilization has ranged from 46-56% during the same period, with the number of contracted units also falling substantially. A supply reduction in both fleets prevented further utilization declines.

- Day rate improvement has occurred in two regions; modest gains have taken place within the U.S. Gulf of Mexico jackup fleet, but rates have more than doubled for the harsh environment semisubmersible fleet off Norway.

- Jackup attrition will continue in earnest during the next year, but will be offset a bit by newbuild deliveries, some of which are required via Borr Drilling agreement with Jurong Shipyard.

- Some regions have plenty of planned rig demand, but the number of incremental rigs this adds to the rig count is expected to be minimal as other working units are released.

- The number of new rig deliveries will continue to be low, although purchases from shipyards and developments in China could increase the number.

As of May 2018, 15 of the 19 marketed harsh environment semis located in Norway were contracted, including four units awaiting contract start. However, only three of the 15 will potentially complete contracts in 2018 and nine of the 15 are committed into 2020 or beyond. With demand for these units expected to continue to grow, operators are now securing contract time for projects that in many cases do not begin for another year or even longer. As a result, day rates have more than doubled from 2016/2017 levels.

In the next year, we do not foresee a large-scale increase in rig demand globally, although there will be pockets of improvements in utilization and/or day rates. Longer term, we do anticipate that more rigs will be put to work and attrition will continue, but a return to the glory days of 90-100% utilization is still a way off.

For more information on RigOutlook, please contact your regional representative for an overview of the report or other available data including; day rates and contract terms, rig locations, rig specifications and more.