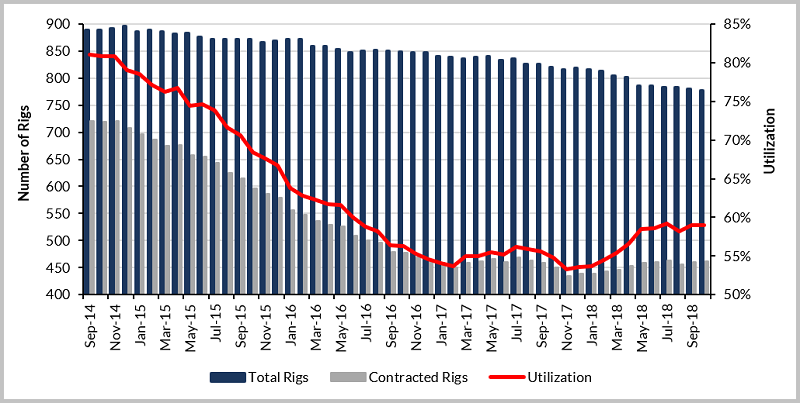

Offshore Rigs – Utilisation moves to 51.7% in February

Since September 2014, generally recognised as the start of the current down turn, worldwide competitive rig utilisation (jackups, semisubmersibles and drillships) reached a low point of 50.3% in January 2017. Since then, some improvement has occurred and in September 2018 utilisation stood at 56.1%, just under a 6% increase from February 2018.

Worldwide Competitive Rig Utilisation (September 2014 – September 2018)

Key Conclusions

- Worldwide competitive jackup utilisation inched up to 56% in September 2018, a 2.2% gain from The April 2018 RigOutlook figure of 53.8%. Since reaching its low point of 50.1% in February 2017 (and again in November 2017), utilisation rose by 5.9%, a modest gain for a 19-month period. While the number of contracted rigs went from 349 to 361 September 2014, jackup supply fell by 52, driven by an increase in attrition.

- Competitive floating rig (semisubmersibles and drillships) utilisation rose by nearly 8% since hitting its low of 45.4% in November 2017. The gain was also a combination of falling supply (249 to 236), coupled with a small demand increase (113 to 120). This fleet also hit a similar low point (45.6%) in February 2017, but has seen multiple peaks and valleys since, with utilisation reaching as high as 53.7% earlier in 2018.

- The day rate improvements reported in the April 2018 RigOutlook for the U.S. Gulf of Mexico jackup fleet and the harsh-environment semisubmersible (semi) fleet in Norway continue to be the only two regions with any significant rate increases. As previously reported, rates for Norway harsh-environment semis have more than doubled, with a few of the most recent fixtures surpassing $300,000. Within the U.S. Gulf of Mexico jackup fleet, a few recent contracts for long-legged units were in the $80,000-85,000 range, a near 25% increase from the $65,000 seen just earlier in 2018.

- Jackup attrition is already on pace for the largest number of rig removals in history, thanks mostly to a 24-rig purge by Borr Drilling and Paragon Offshore after that company sale. During the forecast period, attrition will continue, but we do not expect the levels to be near as high as market improvement will save some units that might otherwise leave the fleet. Some jackup deliveries will take place as a result of rig buying essentially finished units from shipyards, but these will generally take place with a drilling contract in hand. Borr Drilling will continue to take delivery of additional newbuild units as well. Nevertheless, attrition will continue to outpace new market entries.

- For floating rigs, outside of any sales that take place, new deliveries will be limited, although there are three harsh-environment units scheduled for delivery, but all have contract assignments in the North Sea waiting. Otherwise, delivery dates for most of these units will continue to be pushed to the right.

- In several regions, the number of rig requirements continues to increase, but in many cases the resulting contract awards will be to extend already working rigs. In addition, other units will complete contracts and will be released, so the number of incremental rigs added to the working fleet may not be as high as is desired. Even though much of the work is for only 1-2 wells, there are several multi-year plans as well. In the end, the sheer number of drilling plans will ultimately add new rigs to the count. Regions to watch are the Middle East, North Sea, Mexico and West Africa.

For both jackups and floating rigs, the rig market improvement that is often referred to as being underway is not yet here – at least not in terms of rig utilisation and day rates, likely the two most referenced metrics. However, for the first time in the past four plus years, there is a light at the end of the tunnel and assuming no oil price collapse or disrupting political event takes place, utilisation and day rate improvement will begin, but our view is not until at least mid-2019, possibly into the third quarter. Then, however, there should start to be some acceleration in utilisation first, followed fairly quickly by day rates.

For more information on RigOutlook, please contact your regional representative for an overview of the report or other available data including; day rates and contract terms, rig locations, rig specifications and more.

Terms & Conditions

Our standard terms and conditions can be found here.