19th March 2018

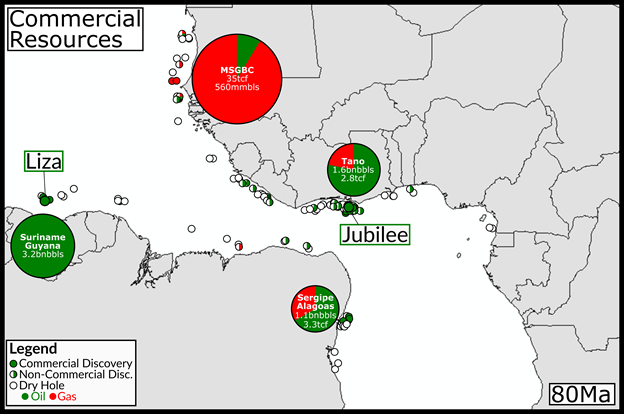

The play opening billion-barrel Jubilee oil discovery in Ghana in 2007 triggered a decade of exploration drilling chasing analogues in the deep water Central Atlantic margins, from Mauritania to Cameroon in West Africa margin and from Guyana to NE Brazil in South America (Figure 1). Many were enticed into the play but the rewards have been concentrated in only a few companies. So what lessons have been learned? First and foremost, if you want to repeat a success, then you need to first understand the geological factors that are needed for the success you are trying to replicate. A new report from Westwood identifies the key success factors.

Figure 1: Late Cretaceous (80 Ma) Atlantic Margin showing the location of exploration wells and commercial resources discovered in the Cretaceous turbidite plays.

Figure 1: Late Cretaceous (80 Ma) Atlantic Margin showing the location of exploration wells and commercial resources discovered in the Cretaceous turbidite plays.

Source: Westwood

78 companies have spent $11.4bn drilling 128 exploration wells in 13 basins along the Atlantic margins in the hunt for the next Jubilee from 2007 to early 2018.

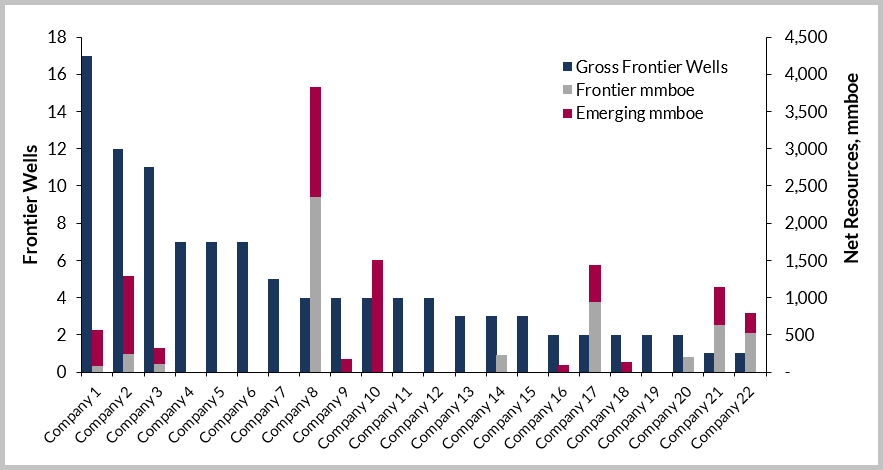

61 wells have been drilled at the frontier stage of exploration, prior to the first commercial discovery being made in a basin. Frontier exploration delivered four commercial basin opening discoveries at a commercial success rate (CSR) of 7% and technical success rate (TSR) of 39%. A total 6.5 bnbbl of oil and 41 tcf of gas have been discovered in the Tano, MSGBC, Sergipe-Alagoas and Suriname-Guyana basins. Nine of the companies that participated in the frontier discoveries captured 74% of the total volume. The companies that drilled the most frontier exploration wells didn’t get the most reward, however (Figure 2).

Figure 2: Gross frontier wells drilled by company in the Cretaceous turbidite plays of the Central Atlantic versus net resources discovered resources from 2007 to 1Q 2018.

Figure 2: Gross frontier wells drilled by company in the Cretaceous turbidite plays of the Central Atlantic versus net resources discovered resources from 2007 to 1Q 2018.

Source: Westwood

The keys to unlocking commercial success in the Cretaceous plays of the Central Atlantic margins lie in participating early in the opening of a new province, being selective, learning quickly the key geological elements needed for success and the integration of geological and geophysical analysis.

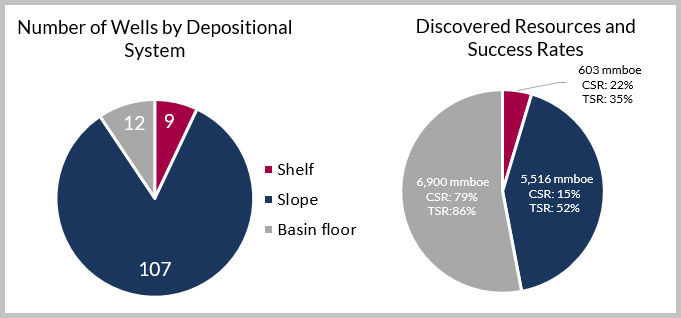

Lessons have been hard-won for many, but there is plenty of running room for the industry. Westwood estimates that 80% of exploration wells have so far targeted the slope areas of the margins (Figure 3). A key lesson is that a large part of the commercial resources in the slope setting are located in areas dominated by normal faulting with gentle slopes, where higher quality deep water reservoir sands can be deposited and optimal conditions for hydrocarbon migration are created. Success rates are lower on steeper, narrow slopes where deep water sands are more confined and traps are smaller.

Significant resources remain to be discovered on the margin slopes and industry attention is also focusing on frontier plays on the ultra-deep water basin floor settings that have a proven high potential but have been tested by only a few wells to date.

Figure 3: Wells in the study area divided into their positions on the depositional system. Only 12 penetrations to date have ventured onto the basin floor yet those wells account for >50% of the total discovered resources and have the highest success rates.

Figure 3: Wells in the study area divided into their positions on the depositional system. Only 12 penetrations to date have ventured onto the basin floor yet those wells account for >50% of the total discovered resources and have the highest success rates.

Source: Westwood

This is an extract from a new research report published in Westwood’s online Wildcat service entitled: ‘Jubilee to Liza, The Keys to Unlocking Commercial Success’

Jamie Collard, Analyst, Global Exploration Research

[email protected] or +44 (0)20 3794 5374