Offshore MMO: Leaner Supply Chain to See $376bn of Expenditure Over Next 5 Years; Wind Opportunities Emerging

The latest edition of the World Offshore Maintenance, Modifications & Operations Market Forecast is now available. The report, which is complemented by an online data platform (SECTORS), shows $376bn of global O&G MMO spend over the 2018-2022 forecast period, while offshore wind O&M presents a $28bn market opportunity over 2018-2022.

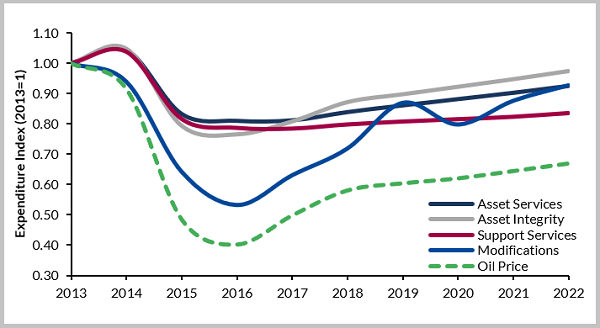

Offshore O&G MMO Expenditure Indices by Service Line 2013-2022

Key Conclusions:

- O&G market to total $376bn over 2018-2022, with a 3.4% CAGR.

- Global fixed and floating platform population to increase from 8,139 to 8,477.

- Asset Services to account for 58% of total MMO expenditure.

- Asset Integrity to be boosted by emphasis on ‘maintenance optimisation’.

- Modifications spend saw dramatic decline through the downturn but is expected to see a strong recovery through the forecast period.

- Offshore wind to see 36 GW of capacity additions to 2022, overall O&M expenditure of $28bn over the same period.

The offshore MMO market has seen a turbulent few years, with operators stripping back non-essential maintenance regimes and demanding significant pricing reductions for any greenlit work. A much leaner supply chain has emerged following the downturn. While there is not expected to be much respite in these pressures from operators the O&G MMO market is expected to average 3.4% growth per annum, totaling expenditure of $376bn over the next five years.

As we emerge from the downturn, Westwood also expects to see strong growth for asset integrity as operators look to optimise their maintenance regimes – thereby maintaining production while keeping control of brownfield expenditure. This service line is likely to see the strongest recovery towards pre-downturn levels, despite sustained lower pricing, of the O&G services covered in the report. Meanwhile, asset services and support services, which are more labour orientated, are expected to see more measured growth profiles out to 2022. Modifications, on the other hand, saw a dramatic decline (-43%) in expenditure over 2014-2016, due to operators shelving non-essential plans. Over the forecast period, many of these delayed modifications are expected to now go ahead.

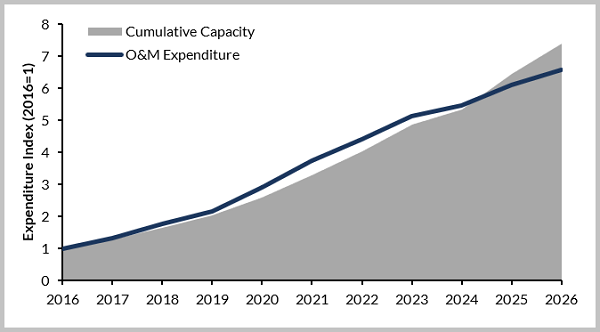

Offshore Wind O&M Expenditure and Cumulative Capacity Indices 2016-2026

For the first time, Westwood has included offshore wind operations & maintenance (O&M) expenditure in this report. The market is expected to total $71bn over 2018-2026, and therefore represents a significant opportunity for MMO players in the O&G space. We have already seen some of the major O&G players diversifying into renewables, including Aker Solutions, Wood, Petrofac and Fluor, although this has been primarily EPCI focused. However, as the market matures, the offshore wind O&M market is expected to be an increasingly attractive proposition for MMO firms.