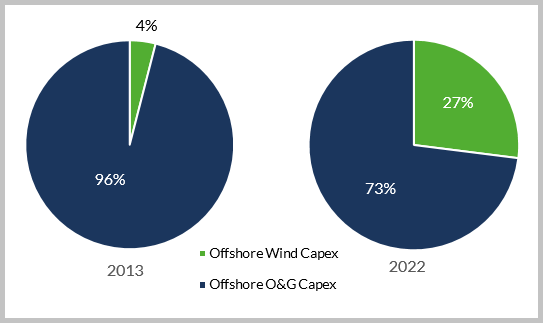

Offshore Wind Forecast to Account for Over A Quarter of Overall Offshore Capex by 2022

Based on a thorough review of latest project data, Westwood forecasts over 15,300 turbines to be installed over the 2018-2027 period with a total global cumulative capacity to reach just under 113 GW by 2027, inclusive of projects at the concept and speculative stages of development.

Overall spend associated with offshore wind development over this period is expected to total €464bn. To put this in context, with the current growth expectations offshore wind will account for 27% of total offshore capex (oil & gas and wind combined) by 2022. This compares to just 4% in 2013.

Offshore Capex: Wind vs Oil & Gas

Offshore Capex: Wind vs Oil & Gas

This growth will provide opportunities across the marine equipment and engineering sectors. Recent years have seen the diversification of a number of oil & gas companies into the offshore wind sector providing a variety of services including heavy-lift, cable manufacture and installation/burial, fixed platform structures and also site survey and geotechnical data analysis involved in the early stages of project development.

Key projects expected to contribute to expenditure in the near-term include the 1,386 MW Hornsea Project Two and 860 MW Triton Knoll (Phase 1) developments offshore the UK, and the 497 MW Hohe See (Hochsee) and 448 MW Borkum Riffgrund 2 developments offshore Germany, as EU countries look to meet their 2020 renewables obligations. China is also expected to see a significant increase in offshore wind capacity as it seeks to diversify its energy mix and reduce C02 emissions. Projects expected to contribute to expenditure in the near-term include the 300 MW Laoting Bodhi Island and SPIC Jiangsu Dafeng H3 developments.

Global capital expenditure forecast to reach a period peak of €57bn in 2025, driven predominantly by additional capacity in the UK, China, Germany, Netherlands, the USA and key projects such as the 2.4 GW Dogger Bank and Hornsea Project Three developments offshore the UK, and the 900 MW He Dreiht development offshore Germany.

Some Key Conclusions:

- Total Capex over the 2018-2027 period is expected to amount to almost €464bn.

- Global cumulative capacity is expected to rise at a CAGR of 20% over 2018-2027 from 22 GW to over 112 GW*.

- Global operational expenditure over the 2018-2027 period is expected to amount to over €80bn*.

- The UK, China, and Germany will continue to dominate the offshore wind market over the next decade, accounting for 61% of capacity additions from projects past the concept stage of development over 2018-2027.

- Westwood estimates that almost 37 GW of additional capacity over 2018-2027 is likely to come from projects currently at the concept and speculative stages of development.

* Figures are inclusive of projects yet to develop past conceptual phases.

Since the Q4 2017 edition of the report, Taiwan now features in the report as a separate market, previous part of the Rest of the World segment of the market. Key projects expected to contribute to capital expenditure in Taiwan over the 2018-2027 period include Ørsted’s development in the Greater Changhua region, comprised of four projects with a planned capacity of at least 2 GW. When including concept and speculative projects, Westwood expects that cumulative capacity in Taiwan is likely to reach just under 5.7 GW by 2027. The Dutch government held a zero-subsidy tender for its 700 MW Hollandse Kust Zuid 1 & 2 acreage in December 2017, and is currently in the process of selecting a winning bid, with the development currently expected to be fully commissioned in 2022.

Westwood’s report features an in-depth Capex analysis, including a component breakdown and country-specific commentary, reflecting on announced renewables obligations. Tracking the industry on a project by project basis, Westwood offers a comprehensive view on the significant opportunities for the wind supply chain over the next decade. Given the increased focus on renewables, the industry will continue to attract investment from utilities and large engineering and service contractors, as well as upstream oil and gas companies.

Report Contents:

- Key Drivers and Indicators

- Global to Country Capex and Opex Market Forecasts

- Segment Market Forecasts

- Project Listings