Frac Horsepower

Unrivalled Coverage of Frac Crews and Horsepower

Get in touchClients rely on our frac horsepower expertise to define basin-by-basin supply and demand for the pressure-pumping market. With data and industry contacts, our analyst team shows relationship between E&Ps and pressure pumpers, profiles top frac companies, and assesses the impacts of new products and strategies for the market.

Our specialist’s

latest insights on

Pressure Pumping

View all insights

Commercial Advisory

We offer a range of advisory services in the unconventionals sector. Each engagement is unique, but more common projects include: identifying business opportunities, benchmarking corporate strategies, matching technologies to specific locations, analysing competitive positioning and pricing implications.

Frac Supply

Chain Solutions

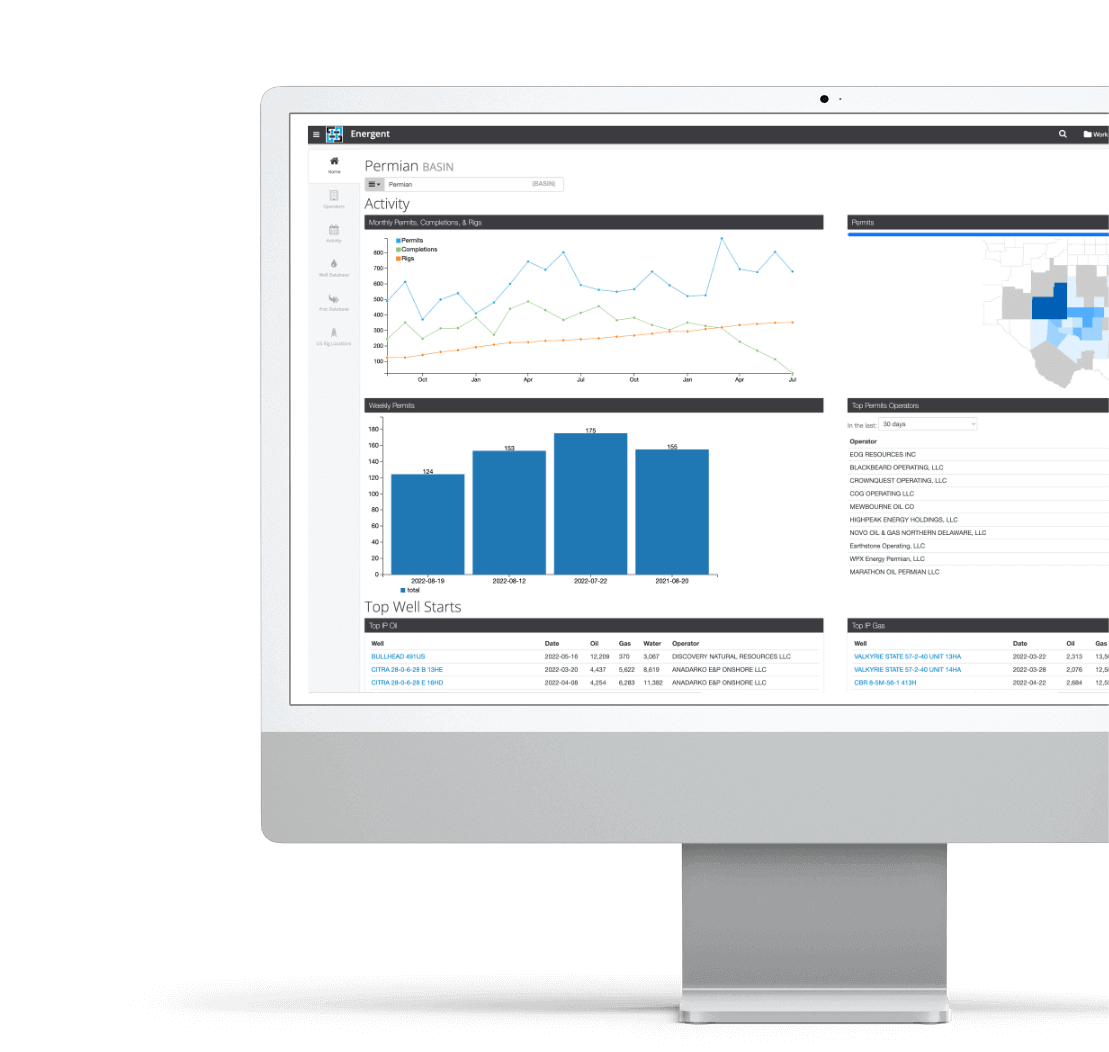

We enable E&Ps, oilfield service providers, and financial institutions to understand frac crews and horsepower by basin. Our solutions cover the entire well lifecycle to know the supply and demand scenario for today’s market.

Speak to a specialist

Our Pressure Pumping

specialist