21st September 2017

The ongoing reduction in the cost of generating renewable energy continues to make the headlines. Offshore wind has relied on subsidies to be viable in the past and, for the overwhelming majority of projects, this remains the case. In the UK, the support mechanism works by providing project owners with a guaranteed price (strike price) for the electricity generated, and developers competitively bid for these CfD (contract for difference) awards. Therefore, the subsidy is the difference between this strike price and the wholesale electricity price. Each round has a maximum guaranteed price per MWh, but also a maximum overall budget for expected subsidies, so competition for support sees developers bidding below this maximum price in an attempt to secure an award for their project. The most recent awards have caused a significant stir in the industry.

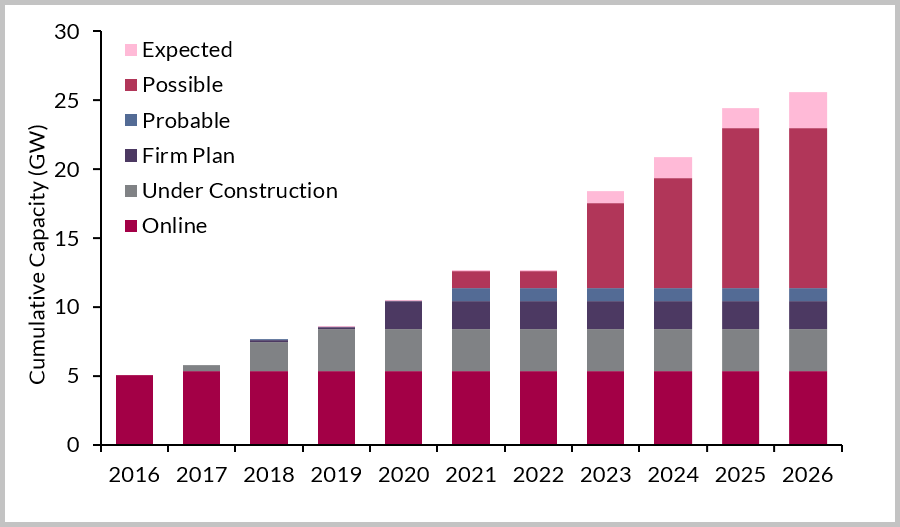

The UK has established itself at the forefront of offshore wind activity with 5.1GW installed to-date. Latest forecasts from Westwood Global Energy Group show that the UK will continue to lead the offshore wind market, with 17.2GW of capacity planned for installation over the 2018-2026 period at a cost of 72bn EUR. When including expected additions from projects at the concept or speculative stages, however, this could rise to 19.8GW, with capital expenditure over 2018-2026 reaching $91bn.

UK Cumulative Capacity by Current Project Status, 2016-2026

The latest UK CfD (contract for difference) auction results were announced last week, with two offshore wind projects (Hornsea 2 and Moray Offshore) securing CfDs at a strike price of £57.50, and a third project (Triton Knoll) securing a price of £74.75. This is a remarkable reduction compared with the first CfD round in February 2015, which saw offshore projects supported with CfD strike prices averaging £117/MWh. Furthermore, it is also substantially below the CfD award to the Hinkley Point C nuclear project at £92.50/MWh. Wholesale prices in the UK have ranged between £32/MWh and £50/MWh over the last five years, which indicates that offshore wind in the UK is now viable at only a fraction of the subsidy provided just two years ago.

The offshore wind sector has benefited from the increased scale of projects, both in terms of overall capacity and capacity per turbine. Westwood data indicates that, until recently, turbines of 3-4MW capacity were the norm for most installed projects. Now, projects at the planning phase are typically evaluating turbines of 7-10MW. Furthermore, the sector has seen intense competition and efficiency gains as major engineering and construction firms are lured by the attraction of what are now multi-billion dollar megaprojects. A cyclical downturn in the oil & gas industry has helped by putting downward pressure on offshore construction and support assets, a number of which serve both the oil & gas and wind sectors.

Whilst the industry was already well ahead of government targets on cost reduction, the latest announcements have taken the industry by surprise. It is not yet clear the extent to which these awards are indicative of a new price paradigm, or if the industry can consistently deliver projects at these levels, but it is a remarkable milestone in the progression of offshore wind to becoming a commercially viable power-generation proposition in its own right.

Steve Robertson, Head of Research, Global Oilfield Services

[email protected] or +44 (0)1795 594734