31th January 2018

US onshore oilfield services companies received positive signs from the equity markets this month. Liberty Oilfield Services’ (“LBRT”) initial public offering performance showed promise for the hydraulic fracturing market; up 5% to $22.93. A week later, Vista Proppants & Logistics (“VPRL”) filed for its initial public offering to become the first pure-play regional sand provider of frac sand and logistics.

A critical component for hydraulic fracturing fleets and frac sand companies is the sand supply and infrastructure in the unconventional plays.

Source: Energent Group

Source: Energent Group

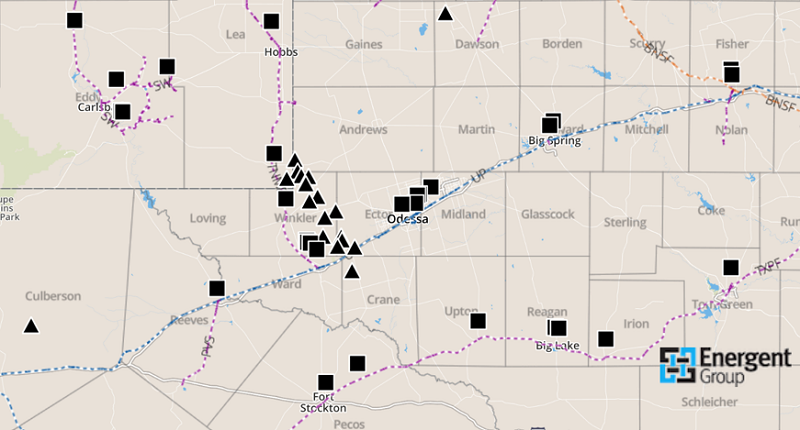

The frac sand supply and infrastructure map for the Permian Basin shows the in-basin sand mines (black triangles) and transload facilities (black squares). Existing rail infrastructure owned by UP, BNSF, and Texas Pacifico controls the delivery (one to a couple of trainloads) and unit (all of one commodity, up to 100-120 trainloads) trains to the Permian. The transload facilities offer near well storage to reduce trucking times to the far-reaching West Texas landscape.

Rise in Last-Mile Logistics

Pressure pumpers, frac sand companies, and third-party trucking or logistics companies are all vying for position within the sand supply chain. Historically, E&Ps relied on the pressure pumper for logistics. However, in the last three years frac sand companies have improved their last-mile logistics capabilities.

Vista, like US Silica, Hi-Crush, Unimin, FM Santrol, and Emerge, knows the critical components to solving the E&P sand supply equation:

- Low cost, proven regional sand

- Integrated logistics that increase efficiencies

- Pad-capable storage solutions

- Premium sand that meets frac design requirements

Low-cost equals low margin?

The low-cost regional and national sand providers were able to raise prices during the downturn. Since 2015, Vista has increased sand prices per ton by 24%. In the last year, Hi-Crush reported a 38% increase in prices. At the same time, lower cost sand has gained credibility in the market in the high and low pressure areas in the Delaware and Midland Basins. For many E&Ps buying northern white, the question is not “if we should try in-basin sand” but “when will we test it on our wells”.

The public frac sand companies have shown an average increase of 9% in gross margin improvement over the last three quarters. The recovery has been much faster for these companies compared other oilfield service segments. The in-basin sand companies that start producing sand in 2018 should see healthy margins too, assuming a price per ton of in-basin frac sand near $50-55 per ton.

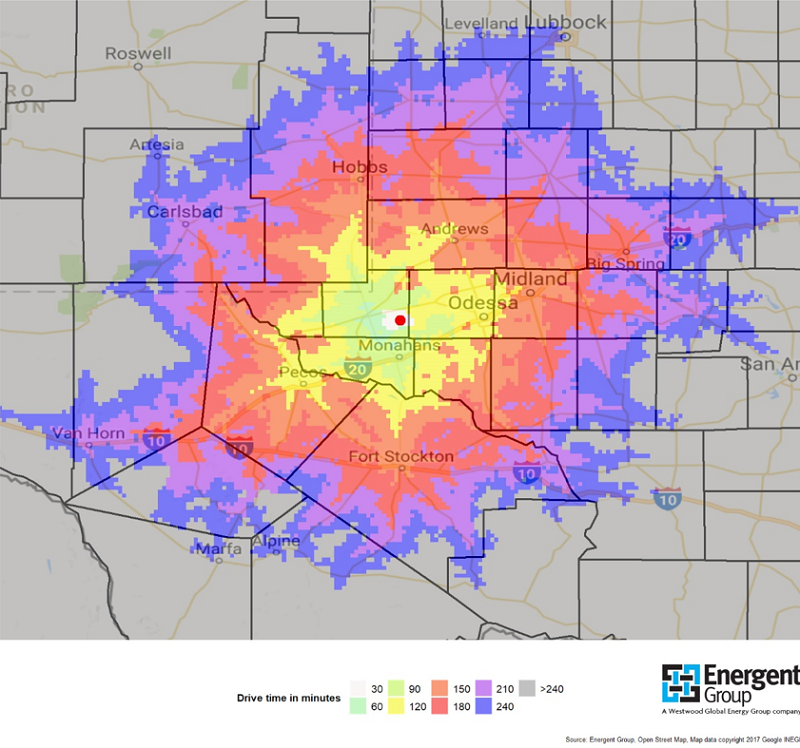

Drive time and distance from the mine to well site will become a critical factor in 2018. The image below shows drive time analysis from one of the Permian mines to wells across the Delaware and Midland Basins.

Source: Energent Group

Source: Energent Group

According to an upcoming Energent Permian Frac Sand report, pricing in the Permian will continue to be competitive as the in-basin mines come online in 2018 and drive the average price per ton closer to $75 per ton from $105 per ton in late 2017. In 2019, the average price per ton should move closer to $65 per ton as adoption of in-basin sand becomes common across E&Ps.

Many expect all the mines to come online as planned. However, Energent’s analysis suggests that not all sand mines are making progress to first sand production. Energent expects several mines to miss their production dates by six months or more due to equipment backlog, infrastructure constraints, and environmental risks. Frac sand buyers are watching the frac sand supply closely to understand potential bottlenecks, identify what operators are changing to finer grade sand, determine supplier cost curves, and forecast upcoming supply and demand scenarios. As sand production increases in the Permian, operators and service companies must be ready for a more dynamic market with an evolving supply equation.

Todd Bush, VP Commercial, North America Research

[email protected] or +1 (713) 714 4583