FPS Market Rebounds as Order Value is Expected to Total $59.2bn over the 2018-2022 Period

Westwood Energy’s World Floating Production Systems Tracker Q4 report provides a positive outlook on the number of units and the value of orders expected over the 2018-2022 period. The FPS market continues on the steady path to recovery that began in 2017. However, the 2018 order value was negatively impacted by the lack of FPS orders from Petrobras. Despite this, the state-controlled company is expected to lead the way over the forecast, as contracting activities are expected to accelerate in 2019, with nine contract awards anticipated over the next 24 months.

Westwood forecasts a 21% increase in forecast expenditure compared to the Q1 2018 edition of this report, as E&P companies opt to restart development plans for projects that were put on hold due to the oil price downturn. The underlying macro-economic environment to develop various standalone offshore fields remains positive, as various integrated services have helped to improve efficiencies and reduce cost.

In total, Westwood expects 62 units to be installed over 2018-2022 with a value of $58.2bn, while units expected to be ordered over the same period (73 units) have a total value of $59.2bn.

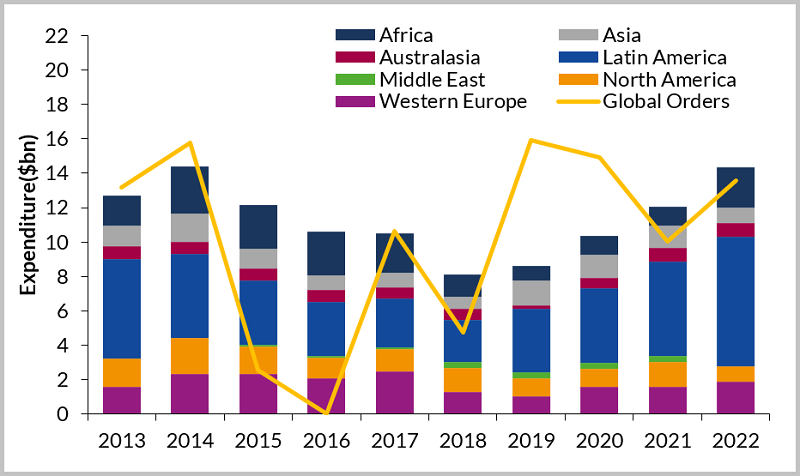

Phased FPS Capex by Region and Global Order Value 2013-2022

Key Conclusions:

- FPS orders over the 2018-2022 period are expected to total $59.2bn, with 2019 accounting for 27% ($15.8bn) of expected order value.

- Backlog values reached a cyclical low of $8.1bn in 2018. However, consistent levels of ordering will boost expenditure and activity into the 2020s.

- Latin America will continue to dominate the FPS market over the forecast period, accounting for 40% ($23.5bn) of vessel expenditure based on installation activity and 44% of backlogs. This is driven by ExxonMobil’s continued investment in the Starborek block offshore Guyana and increasing levels of activity expected in Brazil. Notably, Petrobras recently announced a five-year Capex plan of $84.1 billion, representing a 13% increase over last year’s plan.

- Africa will represent the second largest region for forecast expenditure. However, political uncertainties and continued project delays represent a downward risk to expenditure in the region over the forecast.

- North America is expected to see a strong return to investment, as several recently discovered reserves, including Chevron’s Ballymore and LLOG’s Kings Landing project, will boost expenditure in the region.

FPS Market Coverage:

- Installation Capex forecast by region and type.

- Unit installation forecast by region and type.

- Order Capex forecast.

- Analysis of the FPSO leasing market.

- Summary of 2018 orders and units onstream.

- Comparison between reports – highlighting major FPS related activities by quarter.

Analysis is based on Westwood’s Sectors FPS database, which details more than 650 FPS projects that are updated and tracked daily. The World Floating Production Systems Tracker is essential for anyone evaluating investment opportunities in the FPS sector, including growing firms seeking competitive advantage across segments, investment banks and advisory firms wanting to improve their understanding of the business, and industry analysts seeking a competitive edge.

If you are evaluating current or future investment opportunities in the FPS sector and need to understand the future spend outlook or a unit-by-unit specification assessment, please contact us.