Westwood’s World Oilfield Equipment Market Forecast offers a unique insight into over 50 different equipment types across the upstream oil and gas sector. This report covers new, replacement and servicing expenditure globally, drawing from Westwood’s in-house land rigs, helicopters and upstream infrastructure databases.

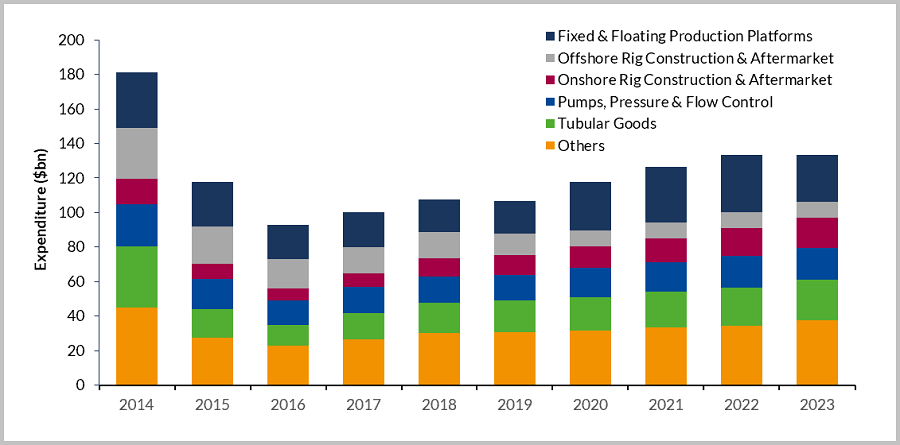

Despite another year of uncertainty, investment continued to recover within the oilfield equipment sector, from a low of $93bn in 2016 to $107bn in 2019. Based on current projections, OFE expenditure is expected to continue to increase into the 2020s, with oilfield equipment expenditure reaching a forecast peak of $133bn in 2023.

Global OFE expenditure vs. major equipment type expenditure 2014-2023

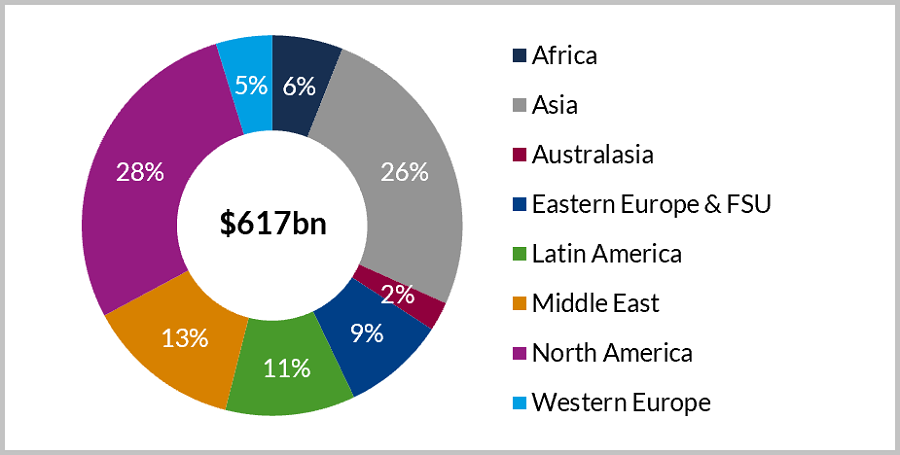

Regional share of global oilfield equipment expenditure 2019-2023

Key Conclusions:

- Global expenditure of $617bn over 2019-2023; an $18bn uplift on the 2014-2018 period.

- Onshore expenditure to total $314bn over the forecast, dominated by tubular goods and rigs & rig equipment – driven by a 32% increase in global onshore drilling.

- Offshore expenditure to be dominated by fixed & floating production platforms, totalling $139bn over 2019-2023 – underpinned by projects offshore Brazil, Guyana and Saudi Arabia.

- China to bolster growth in Asia, as the country solidifies efforts to reduce reliance on hydrocarbon imports through targeting unconventional gas resources.

Global OFE expenditure is expected to total $617bn over the forecast period, with onshore focussed spend accounting for 55% of the total. Within the onshore space, tubular goods and rigs & rig equipment will dominate the market. With areas, due for intensive drilling activity, such as the US and China, driving spend. North America, with the expected continuation of growth in US unconventionals, will make up nearly half of forecast onshore expenditure. Despite a continuation of pipeline capacity challenges in Canada, North America will remain the biggest player in the oilfield equipment market over the forecast, with expenditure reaching $38bn by 2023.

Outside of North America, Asia will be the next largest onshore OFE market – totalling $77bn over 2019-2023. The region will experience a 15% CAGR in spending, with China driving the increase. In an effort to reduce reliance on hydrocarbon imports, the Chinese government has set lofty production targets, with a focus on unconventional gas. In early 2019, CNPC outlined its five-year exploration and development plan to achieve these production targets, the company aims to drill up to 20,000 wells every year through to 2024 – with many targeting shale oil, shale gas and tight gas. China’s largest producer, PetroChina, expects shale gas production to reach 35 bcm per annum by 2025. Sinopec, forecast that total gas production, helped by new additions from unconventional sources, and the ramp-up of production at fields such as the Changqing oil and natural gas field, should see output reach over 200 bcm per annum (c. 3.6 mmboe/d) by 2025. This is still well below output from onshore US and Russia – but comes close to the 3.8 mmboe/d expected for Qatar in the same year. In January 2020, China officially opened its E&P environment and supply chain, allowing foreign players to explore and produce the country’s reserves for the first time. This move is expected to generate further investment into the country’s supply chain and should help the government reduce reliance on gas imports.

The largest component of forecast offshore OFE expenditure will be fixed & floating production equipment, totalling $139bn over the forecast. The floating production platform sector will be bolstered by activity in Latin America, where regional expenditure is set to peak at $15bn in 2022. First oil from Guyana’s Liza development in the Stabroek block was achieved in late-December 2019. Up to five FPSOs are due to be deployed on the block over the forecast leading Guyana’s oilfield equipment expenditure to reach a forecast peak in 2022. Hess recently announced their 2020 investment plans for Guyana, where they have set aside $1.3 billion in capital and exploration spend for the small nation. Offshore Brazil, continued investment into pre-salt oilfields will also bolster regional spend, with FPS expenditure dominating the country’s OFE market.

In the Middle East, brownfield developments in a number of countries, including Saudi Arabia, will support expenditure growth in the fixed production platform sector. Westwood expects a significant number of fixed platforms to be deployed across fields such as Berri and Zuluf, supporting growth in the OFE sector, despite significant downside risk due to regional political unrest.

Western Europe’s spend is driven by activity in the North Sea, where Norway and the UK account for 82% of the total. Fixed and floating production systems will underpin expenditure in both countries, where high-cost projects such as Equinor’s Johan Castberg (Skrugard) and Johan Sverdrup developments will require oilfield equipment over the forecast. Westwood expects Western European expenditure to total $29bn over the 2019-2023 period.

The World Oilfield Equipment Market Forecast takes account of the latest macro-economic trends through daily updated databases and explicit commodity price, global inflation, and supply chain pressure inputs.

| Price | |

|

Single quarter PDF, for up to five users

|

£3,950 |

| Four quarter PDF, for up to five users | £4,950 |