MAY 2024

In April, the Northwest European hydrogen market saw a flurry of noteworthy developments, spanning from funding initiatives, project setbacks, and major infrastructure progress announcements. This month, we will focus on the latest developments from the European Hydrogen Bank, delve into the persistent challenges surrounding offshore hydrogen, and shed light on the ongoing delays facing the German hydrogen market.

Are the results of the European Hydrogen Bank’s pilot auction promising for the wider European hydrogen economy?

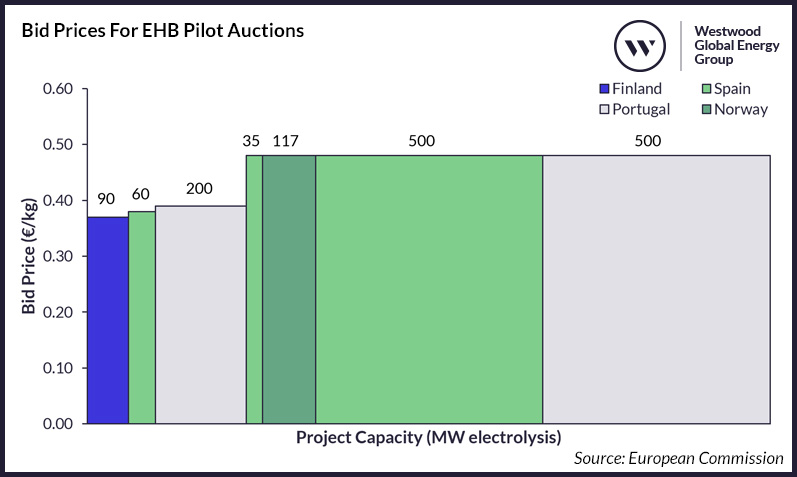

The European Hydrogen Bank (EHB) launched its first €800mn pilot auction in November 2023, drawing significant attention by potentially offering more substantial subsidy support than the US Inflation Reduction Act’s $3/kg production tax credit. The pilot auction attracted immense interest, receiving 132 bids from 17 countries covering 8GW of electrolyser capacity. The results, announced in April, revealed that seven electrolysis projects, totalling 1.5GW, secured funding with bid prices ranging from €0.37-€0.48/kg – significantly lower than the announced ceiling price of €4.50 ($4.81)/kg.

Bid Prices for EHB Pilot Auctions

Source: European Commission

Despite the low subsidy support, project developers are evidently finding ways to make electrolytic projects economically feasible. One potential explanation is the willingness of offtakers to pay a premium for renewable electrolytic hydrogen, perhaps signalling that mandates such as the EU’s requirement for 42% of hydrogen used in industry to be renewable by 2030, are propelling industrial offtakers to transition.

It is not surprising that five of the winning bids, totalling 1.3GW, are in Portugal and Spain, with the remaining two projects in Norway and Finland – countries that boast ample renewable resources and low electricity prices. However, this raises questions about whether developers in other European nations will be able to secure necessary government funding if the existing mechanism favours projects that can progress with such minimal support. While the results underscore the potential economic viability of near-term electrolytic hydrogen projects, it prompts consideration of whether funding mechanisms need restructuring to foster broader participation and reach.

Evidence for the uncertainty of offshore hydrogen projects continues to build

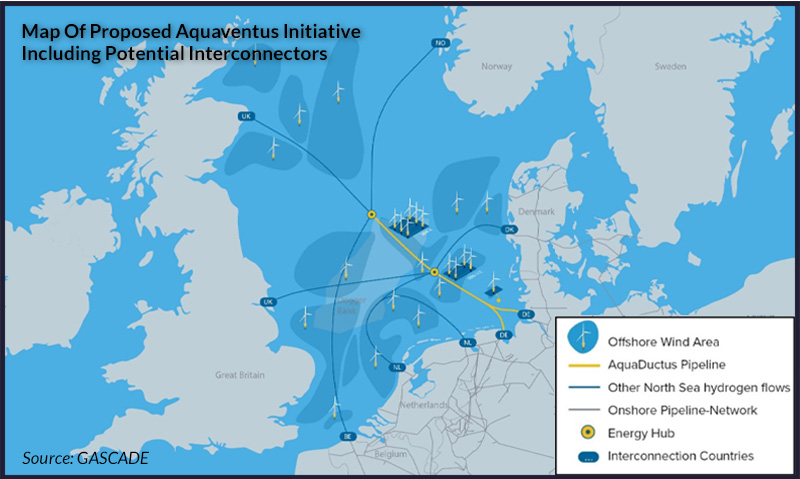

RWE’s AquaVentus is Germany’s largest proposed hydrogen project, aiming to install up to 10GW of electrolyser capacity in the North Sea alongside offshore wind farms by 2035. It includes the pilot AquaPrimus project, a 300MW ‘proof of concept’ expansion, and AquaDuctus, a proposed 400km offshore hydrogen pipeline that aims to evolve into a cross-border ‘Hydrogen Highway’, connecting to offshore hydrogen infrastructure from other European countries bordering the North Sea.

Map Of Proposed Aquaventus Initiative Including Potential Interconnectors

Source: GASCADE

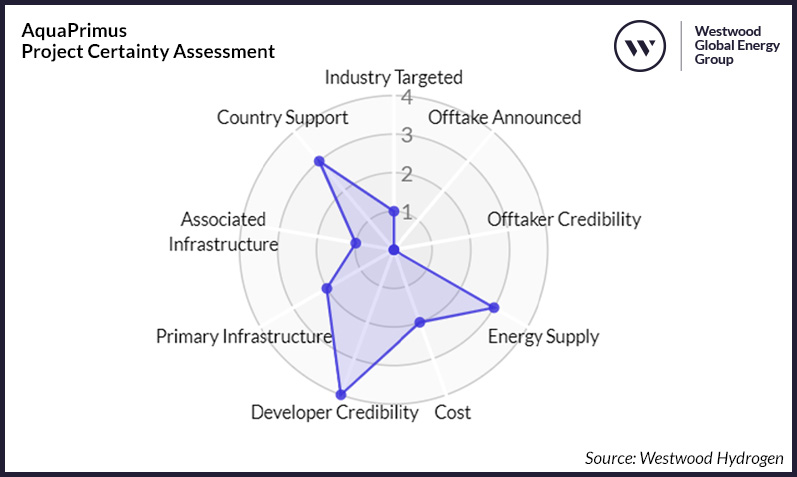

However, the future of AquaVentus is in limbo following the exclusion of its pilot project, AquaPrimus, from the third round of IPCEI funding in April. This setback puts the project’s timeline at risk, as ambitious projects of this scale rely on subsidies for progress. Moreover, offshore electrolysis projects face numerous challenges, including decisions on platform design, electrolyser degradation, high operating costs, and hydrogen transportation requirements. Without successful demonstrations projects to mitigate these complexities and provide evidence for potential commerciality, developers may hesitate to pursue such ventures further.

Prior to this announcement, AquaPrimus had been classified as ‘Risked’ of reaching FID by Westwood in its Hydrogen Project Certainty Assessment[1]. Subsequent phases of AquaVentus were also deemed ‘Risked’, further reinforcing uncertainties surrounding the project’s future.

This situation mirrors a broader trend in offshore hydrogen projects, exemplified by Vattenfall’s decision to abandon its pilot project in March. Originally intended to connect an electrolyser to one of its 8.8MW turbines in the Aberdeen Offshore Wind Farm by 2025, Vattenfall cited inefficiencies in resource utilisation as the primary reason for discontinuing the project.

AquaPrimus Project Certainty Assessment

Source: Westwood Hydrogen

German delays and cancellations are halting progress and ability to meet ambitions

Everything points to Germany being a major player in the global and EU electrolytic and low-carbon hydrogen markets. Germany views hydrogen as central to decarbonising its economy, with the Federal Minister of Economic Affairs stating that “investing in hydrogen is an investment in our future”[2]. The focus is on its highest emitting sectors of power, transport and industry (steel, chemicals and cement).

With high ambitions it is no surprise that the country boasts the highest hydrogen production target in the EU of 10GW of electrolyser capacity by 2030. However, according to the German National Hydrogen Council, Germany should expect to import 50-70% of its expected 56-93TWh (6.4-10.6GW) of demand by 2030. It is taking a diversified approach in sourcing imports (even funding projects outside its borders), relying on its European neighbours as well as countries further afield with MoUs and partnerships announced with Canada, Chile, Namibia, Australia and South Africa.

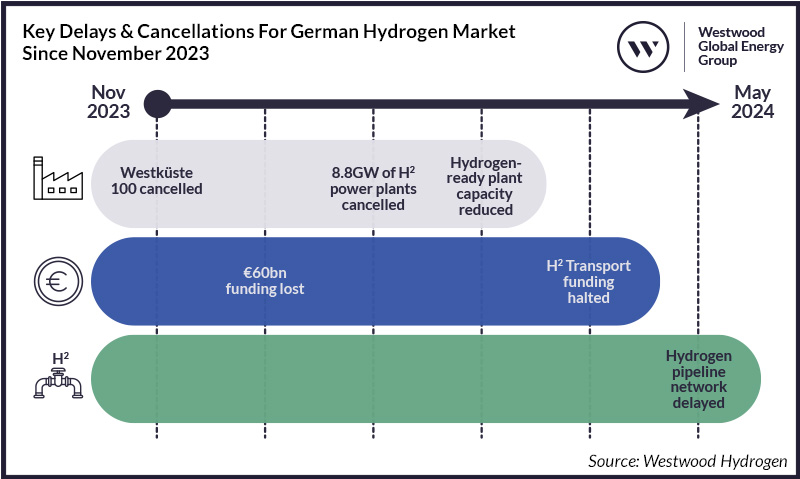

Yet even in the last few months, across the key enablers of the industry’s development – demand, funding and infrastructure – significant delays and cancellations have plagued the German hydrogen development pathway.

Key Delays & Cancellations For German Hydrogen Market Since November 2023

Source: Westwood Hydrogen

Notable stories include Germany’s Federal Constitutional Court ruling in November 2023, which renders the use of €60bn of unused COVID-related debt for the Climate and Transformation Fund (CTF) as unconstitutional. The ruling has significant consequences, requiring the search for alternative sources of funding to support the hydrogen strategy and industrial decarbonisation programmes, or a scaling back of spending altogether.

Delays and revisions to demand-side and infrastructure targets have also been prevalent, with the reduction of planned subsidies in August 2023 from the CTF to construct 23.8GW of hydrogen sprinter (plants that convert pure hydrogen or ammonia to electricity), hybrid (combined renewable power, hydrogen storage and H2 power plant), and hydrogen-ready gas power plants, to the updated target of only 10GW of hydrogen-ready plants in February of this year. The planned construction of the €20bn 9,700km hydrogen pipeline network has also been delayed by five years to 2037, which raises eyebrows on Germany’s ability to meet its import expectations by 2030, with more near-term project developments in question – Salzgitter and Uniper have recently forged a preliminary agreement for the supply of green hydrogen, set to commence in 2028. The collaboration emphasises the need for a pipeline connection between Uniper’s 1GW Green Wilhelmshaven project and Salzgitter, a necessity underscored in a joint statement released in April, where both parties expressed an urgency to establish this vital link as quickly as possible.

Further delays will only put Germany’s ability to achieve its hydrogen targets at even greater risk in what is an already uncertain environment where ambition can start to turn in the direction of infeasibility. Great ambition requires ongoing accelerated progress – Are Germany’s ambitions out of reach?

Key Northwest European Project Watch

Key project announcements and developments in April

| Project | Update |

| AquaPrimus | RWE’s pilot project, part of the wider 10GW AquaVentus initiative, was excluded from the third round of IPCEI funding. |

| Skipavika | Skiga secured financial support for its 117MW project in Skipavika, Norway, from the European Hydrogen Bank, with a winning bid of €0.48/kg. The produced hydrogen will be used to manufacture around 100ktpa of ammonia. |

| Green Wilhelmshaven; SALCOS | Salzgitter AG and Uniper have entered into a preliminary contract for the annual supply of up to 20kt of hydrogen starting in 2028 from Uniper’s new 200MW electrolysis plant in Wilhelmshaven to Salzgitter’s SALCOS programme, which aims to produce green steel. |

| MosaHYc | A final investment decision (FID) has been taken on the €100mn Franco-German hydrogen pipeline project, MosaHYc, which is scheduled to be commissioned in 2027. FID is still dependent on state funding from the German government, according to gas network operator Creos Deutschland. |

| H2Maasvlakte | Uniper’s flagship green hydrogen project in the Netherlands is experiencing delays, pushing the first 100MW phase to 2028, two years later than planned. Primary reasons include the failure to secure a power purchase agreement (PPA) and inadequate offshore wind availability. Consequently, Uniper had to return subsidies granted by the EU, as a PPA was a condition for receiving the grant. |

If you have any project updates that you would like to share with Westwood’s Hydrogen team, please contact Jun using the contact details below.

Jun Sasamura, Senior Analyst – Hydrogen

[email protected]

View all issues of Hydrogen Compass here: