Quarterly Summary

After a relatively stable 2024, where Brent crude prices averaged US$81, oil prices fell month on month from US$79 in January to US$75 in February and US$73 in March. This fall reflects the macro environment, where oversupply concerns have pressured oil prices ever lower. From a demand side, the key concerns have been lower Chinese crude imports and the potential of slower global economic growth, due to the potential trade war enacted by the Tariffs imposed by the Trump administration. As a result of these factors, both the IEA and OPEC lowered their demand growth outlooks for 2025 from their initial expectations in January of +1.1 mmbpd (IEA) and +1.54 mmbpd (OPEC) on 2024 to +0.73 (IEA) and +1.4 mmbpd (OPEC) in April.

At the same time as demand expectations are being lowered, supply continues to grow with abundant supply continuing from countries such as Brazil, Guyana, and the US. The OPEC+ group also saw a 400 kbpd increase in production for the quarter, which was mainly driven by Kazakhstan. The group also announced that the eight producers who took voluntary production cuts, totalling 2.2 mmbpd, would begin to unwind them, including an estimated 411 kbpd increment in May 2025.

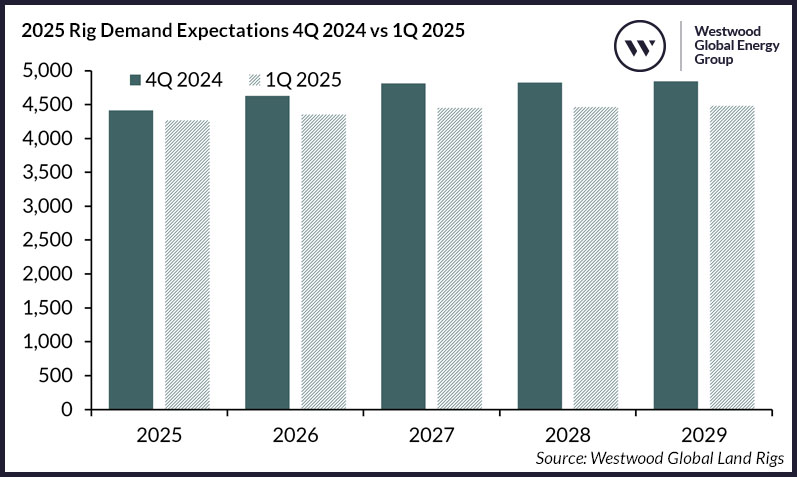

This downward pressure on oil prices, which has continued into April and May, has led Westwood to revise its 2025 rig outlook from a previous expectation of 4,413 rigs to 4,269. Likewise, between 2026 and 2029, there is a downward revision from an average of 4,777 rigs to 4,439. This reflects an expected contraction in rig demand in several regions, with Asia and North America likely to be hardest hit. Despite this contraction, there remains significant global demand for rigs, especially those in the high-spec category (1,500 HP+), that can meet the growing needs and complexities of modern drilling campaigns.

2025 Rig Demand Expectations 4Q 2024 vs 1Q 2025

Source: Westwood Global Land Rigs

The 1Q 2025 edition of the newsletter includes details on major M&A deals, led by the US$10.4 billion merger of Whitecap Resources and Veren in Canada, which was announced in March 2025. Other deals featured include several in the US shale plays, Brazil, Egypt and Nigeria. The newsletter also includes details of recent rig contracting, rig moves and updates on a variety of field developments across the globe.

This edition also includes an update on the geothermal market, which remained busy in the first quarter, with well spuds taking place in many countries, including Germany and the Netherlands. In addition, several projects received approval to progress, including the Newcastle geothermal project in Utah, US. Geothermal exploration acreage was also awarded to countries such as Chile, Tanzania and Zambia.

Ben Wilby

Senior Analyst, Onshore Energy Services

[email protected]

Michela Francisco

Research Analyst, Onshore Energy Services

[email protected]