Rig activity in the Asia Pacific (APAC) region, which comprises Southeast Asia and Australia, has become much busier in 2022. In Southeast Asia, however, all that activity is not completely due to increasing rig demand from operators. Several cold stacked and stranded newbuild jackups are being reactivated, but for contracts outside the region, primarily in the Middle East.

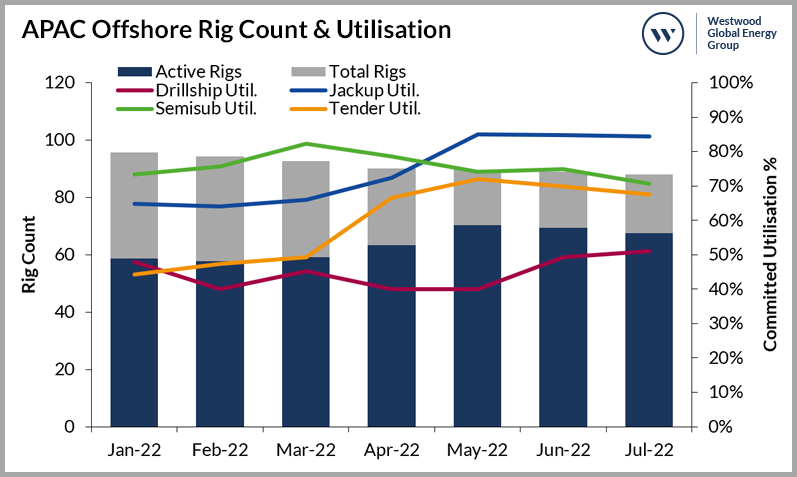

Figure 1: APAC Offshore Rig Count & Utilisation

Data considers Southeast Asia & Australia

Source: RigLogix, Westwood Analysis

Figure 1 demonstrates significant changes, in particular for jackups and tender-assisted rigs. From March 2022, shortly after the Russian invasion of Ukraine, notice the ramping up of committed jackups. Marketed utilisation is now near 90% and as it stands, we should see further improving utilisation, potentially hitting 95% by the end of the year.

APAC at a closer glance

Floating Rigs

In Southeast Asia, there are only three active drillships, two of which are working, with Transocean’s Dhirubhai Deepwater KG2 being the lone stacked unit. However, the rig could be departing the area for a contract elsewhere soon.

Dayrates for new drillship fixtures this year have been in the $220,000 range, but it is understood that upcoming rates are likely to be closer to $270,000, not including managed pressure drilling (MPD) services, a premium that can add $50,000 or more to the rate.

There are presently 12 semisubmersibles (semi) in the APAC region. Seven are in Southeast Asia and five of those are marketed. Four of the five units are working, but only two have contracts that extend beyond 2022. As for dayrates, only three new semi contracts have been signed this year, with dayrates still below $200,000.

In Southeast Asia, RigLogix data shows 16 rig requirements in the rig enquiry stage, but only six of the 16 will last more than 100 days. These numbers ensure no rig supply growth and could even drive a rig or two out of the region.

All five semis offshore Australia are currently working and while one of those will go idle in July, three of the five are spoken for into 2024. Of the three new semi contracts signed in 2022, the most recent fixture hit $379,000, well above the previous high of $265,000.

As for rig requirements in Australia needing a floating rig, there are currently over 17, with seven of those lasting over 100 days. With five semis in the area, some of those will have to try and string together short-term contracts with some idle time expected should all five remain there.

Jackups

The APAC jackup market on the surface may not seem as exciting as it should be given where oil prices are, but marketed utilisation in 2022 has improved by 12% and now stands at 90%. However, the number is a bit misleading and warrants a closer look. Of the 45 marketed rigs in Southeast Asia that are contracted or committed, six are destined for Saudi Arabia. In addition to those six, there are another four newbuilds that are also slated to move there. By the end of 2022 or early 2023, 15 jackups will have departed Southeast Asia for contracts with Saudi Aramco.

As for dayrates, a recent contract award for Borr Drilling’s Saga got the attention of the market with a four-year deal at a rate reportedly just below $105,000. More recently, Valaris announced a four-year contract for the Valaris 115 with the same operator in the same rate range. However, dayrates for recent shorter-term contract awards have been wide-ranging, from as low as $67,000 to as high as $90,000. In Australia, 2022 fixtures have seen rates in a much tighter range of $112,000-$118,000, the higher number just recently being fixed.

The APAC region currently has over 40 programmes in some stage of rig enquiry, including 13 in Australia alone, quite a number given that there are only two jackups in country. In Southeast Asia, the largest number of jackup requirements are in Malaysia, followed by Indonesia and Vietnam.

The need for a Safety Case and high operating expenses and unions makes Australia a very difficult market to penetrate. The Noble Tom Prosser and Valaris 107 are the two primary rigs operating here, while the Valaris 249 recently began work offshore New Zealand. It is understood that the rigs may try to enter the Australia market in February 2023 when that contract ends.

Tender-Assist Rigs

Southeast Asia is now the lone region in the world where tender-assist barge type rigs operate. There are currently 14 of these rigs in the region. Nine of the 12 are working or committed for work, providing 75% utilisation. Much of the work with these rigs is carried out offshore Thailand for state oil company PTTEP, which will employ eight of the nine committed units. The contracts are a mixture of long-term (three year) and shorter-term (five month) contracts driven by Thailand’s need to boost gas production.

One unit currently in China will be going to Myanmar at the end of the year, and there are rumours than one more may enter the APAC market from West Africa. There is a potential of utilisation to surpass the 90% threshold later this year.

Little data is available regarding dayrates, but sources suggest fixtures are likely in the $50,000-$65,000 range. However, overall rates in the tender market for existing contracts range from as low as $48,000 to as high as $75,000.

Rising inflation is having a direct impact on operating costs. Increased travel fares will only accelerate the use of local crews and supplies where possible. As a result, rig owners are seeking adjustments to dayrates, but so far, we have yet to hear if any have been successful. The increase in hiring and using local crews could present a good opportunity for training to come to the forefront in an effort to address this in the long term.

Terry Childs, Head of Riglogix

[email protected]

Paul Ezekiel, Senior Rig Analyst

[email protected]