5th February 2018

Half of oil and gas fields are not producing to expectations when onstream, and a new Westwood study shows that this is mainly due to unexpected reservoir issues. 70% of the fields studied with limited appraisal were found not to perform to the development plan. Most of the subsurface risks identified could have been mitigated before the start of a project with more effective appraisal.

Westwood has benchmarked the appraisal programmes of 70 producing fields to understand how production performance is related to the effectiveness of appraisal in reducing subsurface uncertainties. Lessons learnt from this study show there is still room for improvements in appraisal practices that can increase the chance of success of future upstream projects.

There are a wide variety of appraisal practices across the industry and results are mixed. The efficiency and effectiveness of an appraisal programme is only apparent once the field comes on stream – often many years later – when a misunderstanding of the subsurface due to inadequate appraisal can have a catastrophic impact on production performance, reserves and value.

43 of the 70 fields in the dataset demonstrated deviations in reserves and/or production of greater than 10% above or below the plan at project sanction – due to unexpected subsurface issues. 50% of the fields were subject to 2P reserves revisions after production started. Average reserves changes were +68% for those requiring increases and -60% for those with decreases.

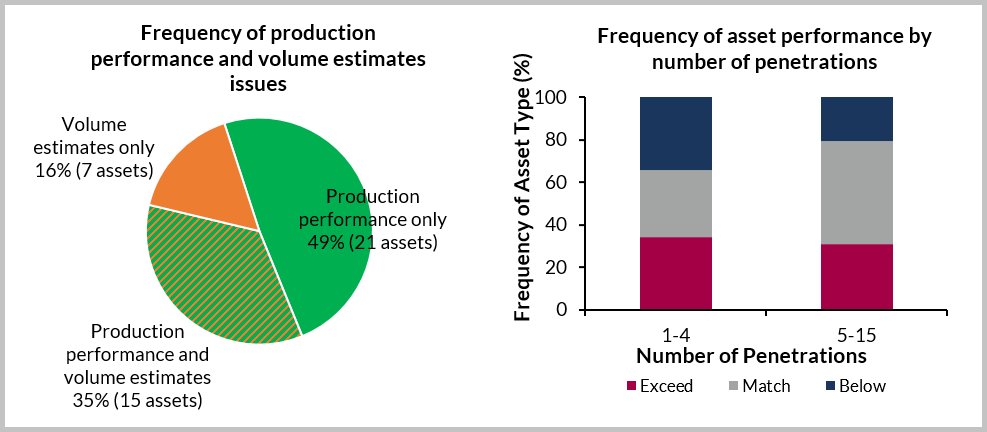

84% of the assets not matching expectations are reported to have suffered from issues related to reservoir production performance with 51% related to reservoir volume estimates (see figure below). The most common causes of non-performance were: a) inaccurate prediction of in-place hydrocarbon volumes (49%), b) inaccurate prediction of pressure support due to misdiagnosed connectivity between producers and the water injectors or water-leg (42%), and c) different reservoir quality than predicted (35%).

Frequency of reservoir production performance and volume estimates issues identified in the 43 non-performing fields (left) and frequency of asset performance type by number of reservoir penetrations (right).

Frequency of reservoir production performance and volume estimates issues identified in the 43 non-performing fields (left) and frequency of asset performance type by number of reservoir penetrations (right).

The appraisal benchmarking shows that field size, hydrocarbon phase, reservoir and trap types have little correlation with the effectiveness of the appraisal, with a similar proportion of fields matching, exceeding and below production expectations for all parameters. 70% of the fields with fewer than 5 reservoir penetrations were found to not perform as expected. The number of reservoir penetrations is important, but it is by no means the only contributing factor, as 52% of the fields with more than 5 penetrations also deviated from plan. Appraisal well location, the type of data acquired and the timing of the data acquisition were also found to have an impact on the effectiveness of appraisal.

The key lesson learned from the benchmarking study is how appraisal strategy impacts the field performance outcome. Appraisal efficiency can be improved through an appraisal programme that addresses the key uncertainties that will impact development design and field performance. Historically the appraisal phase of E&P projects has not had the attention it deserves. This study shows that this must change.

This is an extract from a new research report published in Westwood’s online Wildcat service entitled: ‘Appraisal efficiency – can it be improved?’

Pierrick Rouillard, Project Geoscientist, Global Exploration Research

[email protected] or +44 (0)20 3794 5375