13th November 2017

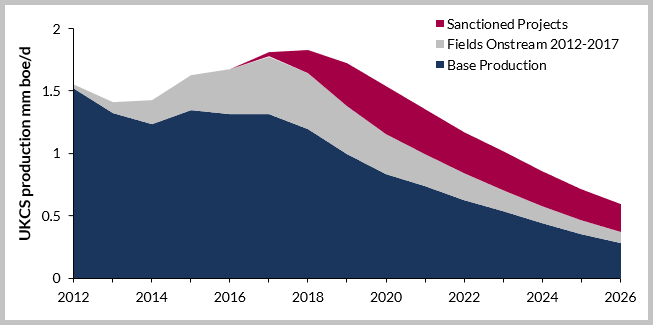

UKCS oil and gas production peaked in 1999 at over 4.6 mmboe/d but declined to 1.4 mmboe/d by 2013. During this time, the Brent oil price increased from US$17.9/bbl to US$108.6/bbl which stimulated investment in the UKCS to record highs of over US$85 billion (2010 to 2013). Between 2010 and 2014, 39 new fields were brought onstream and 2.6 billion boe was sanctioned for development resulting in production rising to a secondary peak of 1.9 mmboe/d expected in 2018, 500 mboe/d higher than 2013.

UKCS historic and future production profile

UKCS historic and future production profile

Source: Atlas, Westwood Global Energy

The number of new fields being sanctioned has reduced year-on-year since 2012, with just two projects approved to date in 2017. The combination of new projects coming off plateau, combined with background decline from mature fields, means total production from the UKCS is expected to fall rapidly in the early 2020s.

Westwood Global Energy Group (Westwood) estimates there is 8.5 billion boe of resources in 496 unsanctioned discoveries on the UKCS. But just 750 mmboe from 32 of these (9% of the entire discovered pool) are considered commercial by Westwood, based on a US$60/bbl oil price. A further 1.5 billion boe could become economic, but would require a commercial or technical innovation to bring costs down. One billion boe of this resource is contained within a handful of discoveries; Rosebank and Cambo, fractured basement discoveries on the Rona Ridge (all West of Shetland) and the HPHT Jackdaw discovery.

There is therefore very little development potential to arrest the near-term production decline. Some major projects, such as Rosebank, Cambo and Jackdaw, were in the planning or concept development stages in 2013 and became uneconomic with the low oil price. Due to the size of these projects, it would likely be the mid-2020s before first production, should commercial development options be realised.

Recent activity may yet stimulate firmer development activity in two of these projects; the Rosebank and Jackdaw which have combined resources estimated at 430 mmboe. The results of the tender for an FPSO for Rosebank, with submissions due by end March 2018, will be a key factor in determining the commercial viability of the development. The Tertiary, intra Basalt clastic reservoir will be challenging along with the marginal economics for a deepwater FPSO in the harsh conditions West of Shetland. It will be interesting how new partner INEOS, who acquired DONG’s equity, will influence the development plans for the field. Also, as announced on 2 November, Dyas has acquired Siccar Point’s 26% interest in Jackdaw. Shell has recently indicated that it is assessing the commercial and technical viability of its development opportunities in the UK.

The short-term increase in production is clearly positive, and quite a feat in a basin of this maturity, but a steep decline is to come. Companies and the government will need to look at how they can deliver commercial resources from the suite of discovered small pools and bring through the large, but more technically challenging discoveries.

Yvonne Telford, Senior Analyst, Northwest Europe Research

[email protected] or +44 (0)1224 502783