Investment in Asia, Middle East to lift global Oilfield equipment sector

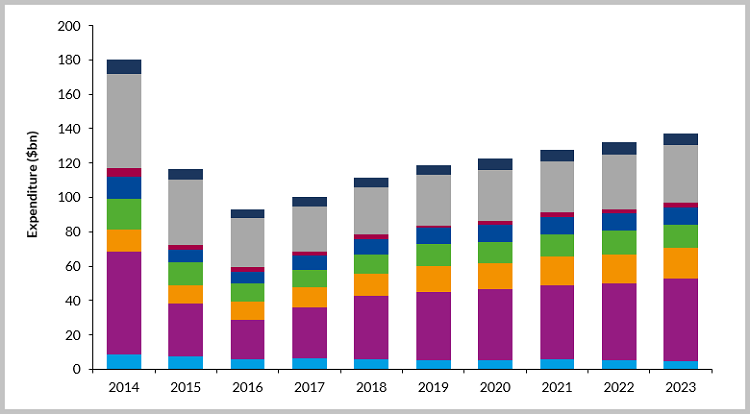

In the first quarter of 2019, oil prices have steadied at above $60/bbl (Brent), supported by signs of tightening supply following OPEC production cuts and the end to waivers on US sanctions on Iran. However, continued growth in crude output from the USA’s onshore plays remains a downside risk to prices. Despite the uncertainty, investment continues to recover within the OFE sector, from a low of $93bn in 2016 to $119bn in 2019. Based on current expectations, industry revenue is expected to continue to increase into the 2020s, with oilfield equipment expenditure forecast to peak at $137bn in 2023.

Global Oilfield Equipment Expenditure by Region

Key Conclusions:

- Global expenditure of $640bn over 2019-2023; a $38bn uplift on the 2014-2018 period.

- Latin America supported by onshore activity in Argentina’s Vaca Muerta, continued development of Brazil’s offshore pre-salt and Guyana’s entry into the oil & gas sector via the Stabroek block.

- Middle East bolstered by increases in activity at several Saudi Arabian offshore developments and brownfield production investment in Iraq.

- China to bolster growth in Asia, as the country solidifies efforts to reduce reliance on hydrocarbon imports.

- North American forecast expenditure to total $217bn, driven by continued high investment in US unconventional plays.

- Despite improving utilisation and dayrates in the offshore rig market, the number of new orders will not be sufficient to offset the backlog from pre-2014.

Latin America is set for notable growth over the forecast, with expenditure peaking at $14bn in 2022. Onshore, Argentina’s Vaca Muerta is a promising market. Several supermajors, including ExxonMobil, Petronas, and Total, have targeted the play as a source of future production growth. Argentina’s expenditure will be driven largely by tubular goods and pumps, as well as pressure & flow equipment, with onshore OFE expenditure expected to increase by 45% to $2.2bn over the forecast. Another of the region’s bright spots is Guyana, where the Stabroek block discoveries will transform the South American country’s oil & gas sector. Up to five FPSOs are due to be deployed over the forecast and will see Guyana’s oilfield equipment expenditure increase to nearly $1bn in 2022. Continued activity in Brazil’s pre-salt will also bolster the region, with FPS expenditure dominating the country’s OFE market.

In the Middle East, several production increases offshore Saudi Arabia will see the region’s expenditure grow at a 5% CAGR to $18bn by 2023. Westwood expects a significant number of fixed platforms to be deployed across the Berri, Marjan, and Zuluf fields, with tenders anticipated within the next two quarters, supporting growth in the OFE sector. With Basrah Oil Company’s $2.4bn Common Seawater Supply Project now in motion, Iraq is set to increase oil production through several brownfield developments including West Qurna-2, Rumaila and Zubair, leading to OFE expenditure close to pre-downturn levels.

With the highest levels of onshore drilling activity, North America is expected to lead the global oilfield equipment sector over 2019-2023. This has been almost entirely driven by the re-emergence of the US unconventional market, where strong growth continues despite takeaway capacity issues in the prolific Permian basin. Despite a continuation of pipeline capacity challenges in Canada, North America will remain the biggest player in the oilfield equipment market over the forecast, with expenditure reaching $48bn by 2023.

Despite the recent improvement to the utilisation and dayrate outlook for the offshore rig market, the expected number of new orders will not be sufficient enough to offset the declining backlog from pre-2014. As a result, Westwood forecasts a fall in rig equipment expenditure, despite an improved supply-demand picture.

The overall outlook for the oilfield equipment market is optimistic, with investment continuing to recover from the nadir of 2016. For the remainder of 2019 and beyond, the outlook is relatively strong, with a series of project sanctioning decisions expected to lead to improvements in both the onshore and offshore oilfield equipment sectors.

The World Oilfield Equipment Market Forecast offers unique insight into over 50 different equipment types across the upstream and midstream sectors and is an essential product for business planners and those looking to make informed investment decisions. Drawing from Westwood’s SECTORS product and a wide-range of other internal databases (including land drilling rigs, helicopters, and upstream infrastructure), the World Oilfield Equipment Market Forecast also takes account of the latest macro-economic trends through daily updated databases and explicit commodity price, global inflation, and supply chain pressure inputs.