Offshore wind propels subsea cable demand

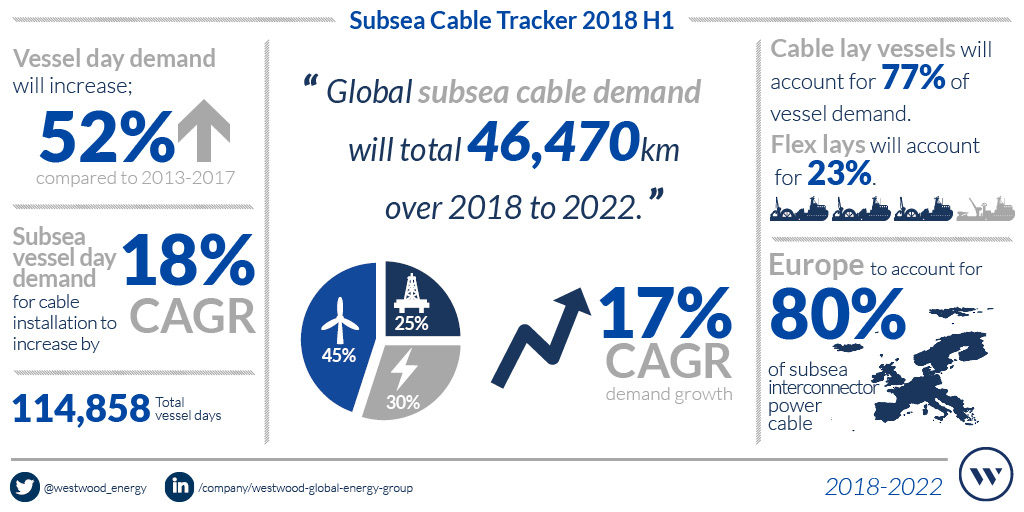

In the latest edition of Westwood’s Subsea Cable Tracker H1 report, global subsea cable demand is forecast to grow at a 17% CAGR, totalling 46,470 km over the 2018-2022 period. This represents a 71% growth compared to the 2013-2017 period.

This edition provides cable demand and vessel installation day demand for the offshore wind sector, the oil & gas sector, as well as for high and medium voltage interconnector market, with the latter being new to this report. The report provides specific project information that supports subsea cable installation activities over the 2018-2020 period.

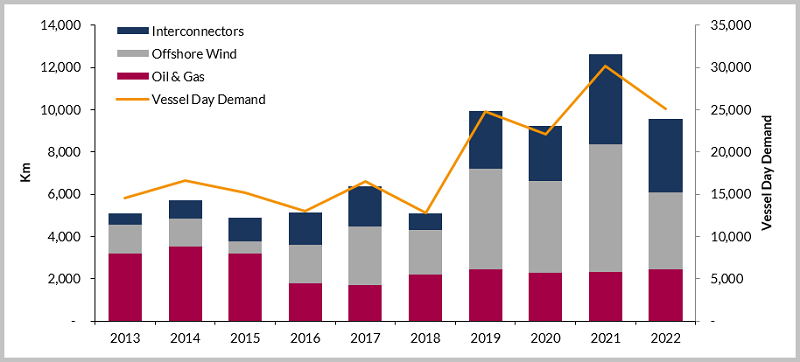

The forecast period will be marked by unprecedented levels of project sanctioning and implementation in the offshore wind and the subsea power interconnector sector. Asia Pacific and Europe will account for 81% of forecast installations, with both regions leading the way in terms of offshore wind developments, interconnector power cables driven by a need for reliable and diversified energy supply, as well as some major oil & gas projects.

Global Subsea Cable Installation Outlook by Sector & Vessel Day Demand, 2013-2022

Key H1 Report Conclusions

- Global subsea cable demand is forecast to total 46,470km over the 2018-2022 period.

- Offshore wind cable demand will grow at a 15% CAGR, accounting for 45% of forecast demand.

- Europe will account for 80% of subsea interconnector power cables driven by the need to develop an energy grid that is cost-effective, reliable and environmentally friendly.

- Westwood anticipates cable demand from the oil & gas sector to account for 25% of total cable demand, driven by long subsea tieback projects from major gas projects offshore Australia, East Africa and the Mediterranean Sea, as the industry emerges from a cyclical downturn.

- Global subsea cable installation vessel day demand will total 114,858 vessel days over the forecast period, a 52% increase on the 2013-2017 period.

- Cable-lay demand will account for 77% of vessel day demand, whilst ultra-deepwater activities will support flex-lay vessel day demand which will account for 23% of forecast vessel days.