Lower Costs Bring Renewed Deepwater Sanctioning

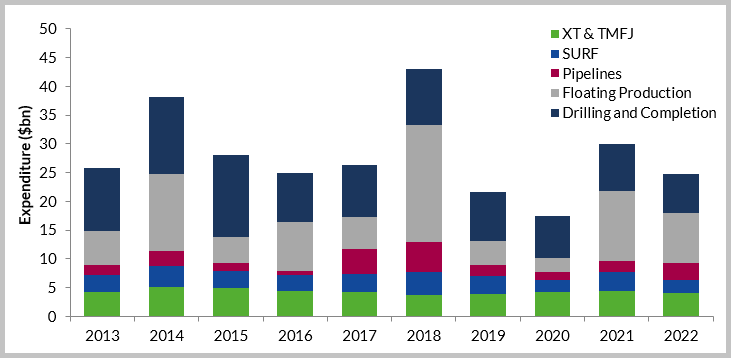

In the latest edition of World Deepwater Market Forecast Q1 report, Westwood expects global deepwater expenditure over 2018-2022 to total $136.8bn – a 4% decline compared to the 2013-2017 period.

In 2017 we have seen an upturn in orders that is expected to extend into 2018, improving the outlook for installation spend throughout the remainder of the forecast period. This upturn has been driven by a combination of lower supply-chain costs and an improvement in the oil price. In addition to price pressure through the supply chain from operators, many projects have also been re-engineered, and in some cases re-tendered. Expectations for supply chain pricing over the forecast period are relatively flat as a function of persistent over-supply in the rig and vessel markets.

World Deepwater Capex by Component 2013-2022

Contact us to access the latest World Deepwater Market Forecast databook.

Key Conclusions

- Over the forecast period, Africa and the Americas will continue to lead the deepwater market, accounting for 79% of forecast expenditure.

- FPSOs will continue to dominate the FPS market, with a total of 33 deepwater units (out of 41 FPS units in total) expected to be installed over the 2018-2022 period, representing 78% of FPS expenditure.

- Despite decline of only 6% in the number of wells drilled, total drilling and completion expenditure over the next five years will decline by 26% compared to the 2013-2017 period, due supressed rig day rates.

- Westwood anticipates line pipe expenditure to account for 10% of global deepwater expenditure over 2018-2022, driven by large export gas pipelines. However, this market remains susceptible to geopolitical tensions.

- The spike in expenditure over the 2017-2018 period is driven by a number of fast track projects, the installation of some large pipelines, as well as the delivery of delayed FPS units such as Total’s Kaombo and Petrobras’ P-74, P-75, and P-76 FPS units.

- Overall, Westwood expects to see a more stable market expenditure profile post-2020, with an increase in FEED and tendering activities. However, a competitive pricing structure is expected to remain in the near-term, which will limit Capex growth.

The World Deepwater Market Forecast 2018-2022 is presented using Westwood’s proprietary database, which analyses 107 deepwater projects expected to drive expenditure over the forecast period.

This market forecast is based on a thorough scrutiny of the data, which enables the forecasts to be built on a project-by-project basis, enabling Westwood to consider various market conditions which further complements the detailed evaluation of market activity and anticipated market development.