Over the 2019-2023 forecast, Westwood expects the DWS sector to continue to experience a modest improvement, with international markets beginning to see stronger growth rates in the coming years.

Though there is a positive trend overall, significant oversupply remains in many service lines. This, combined with strict capital discipline from operators, has kept pricing down and a return to the highs of 2013-2014 is not anticipated at any point over the forecast period. Focus in the near-term will be the onshore market, where project lead-times to first oil are short and risk is more manageable.

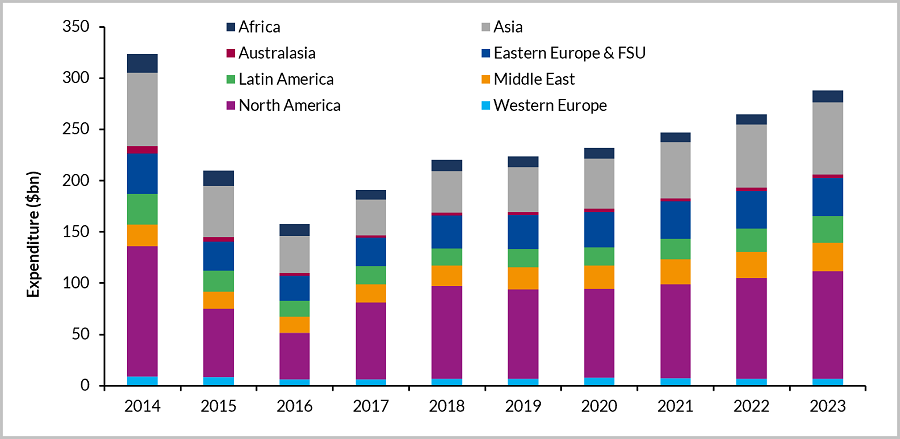

Global drilling and well services expenditure by service line 2014-2023

Global drilling and well services expenditure by service line 2014-2023

Key Conclusions:

- Total expenditure over 2019-2023 will amount to $1.3tn, a 14% increase compared to 2014-2018. The US, China and Russia will represent over 50% of this.

- Outside of the US, China has replaced Russia as the country with the highest level of expenditure, due to the government’s plans to reduce reliance on hydrocarbon imports.

- Latin America is anticipated to grow strongly, driven by continued offshore activity in Brazil and the emergence of Guyana’s oil & gas sector.

- At 29% of total expenditure, rig & crew represents the largest proportion of the market, totalling $358bn over the forecast.

- Stimulation to account for 19% ($236bn) of total expenditure over the forecast, with US onshore accounting for 82% of the total.

North America is expected to have the highest regional expenditure, representing 37% of the total. The majority will be US-focused, where onshore drilling activity is expected to increase at a 1.2% CAGR over the forecast. Canada will depend almost entirely on increasing pipeline takeaway capacity, including progress associated with the expansion to the Trans Mountain Pipeline.

China is set for notable growth in onshore drilling activity over the forecast, as the government aims to reduce China’s dependence on energy imports. To achieve this, the country is expected to target unconventional plays, which typically requires more intensive drilling and carry higher associated development costs than conventional plays.

Offshore, the emergence of Guyana’s oil & gas sector will support spend significantly. Between 2019-2023, Westwood expects over 73 subsea wells to be drilled in the country. Over the same period, a resurgent Brazil will see over 200, high cost, subsea wells drilled, boosting Latin American offshore expenditure to $51bn.

The World Drilling & Well Services Market Forecast offers unique insight into over 20 different service lines and is an essential product for business planners and those looking to make informed investment decisions.