US Frac Sand Outlook – White Paper

A new white paper from Westwood investigates demand for proppant, total frac sand supply, and last mile trucking costs. The paper is intended to give you Westwood’s view and methodology, and key points from the paper include:

- Previous frac sand demand numbers from industry analysts contributed to over investment in frac sand mine development and subsequently excess frac sand supply.

- Companies must take 30 to 50 million tons of frac sand supply off the market in the next 12 to 18 months to ensure supply-demand balance.

- End-to-end mine to blender solutions will continue to present opportunities to cut costs and increase efficiencies for E&Ps and oilfield service companies.

Sand Matters, but Logistics Offers Competitive Advantage

Within the white paper, Westwood’s Unconventionals team looked at 118 mines actively producing frac sand across the Lower 48 that produce over 140 million tons of frac sand and have a nameplate capacity of over 200 million tons of frac sand. Delivering the sand to the well site is a critical component of the supply chain.

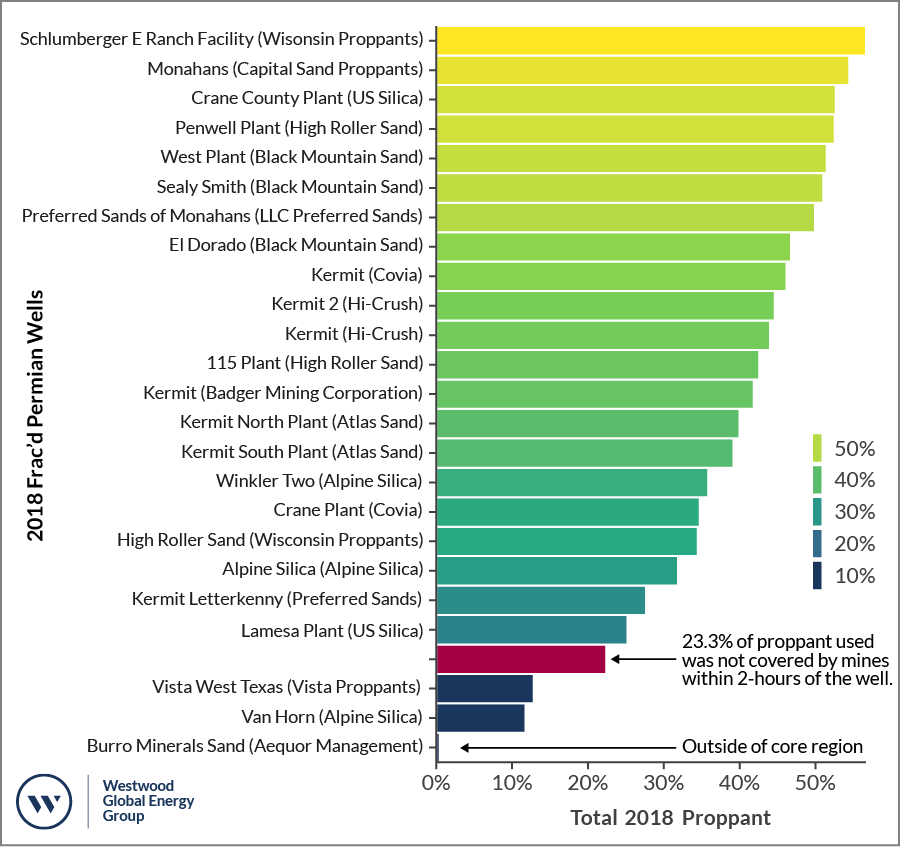

Logistics and last mile trucking are essential to delivering sand to the blender on time at a low cost. Location is key to the success of in-basin mines, especially in the Permian. There are seven in-basin Permian mines within 50% of the total frac sand consumed, based on 2018 frac sand volumes. As core acreage expands and contracts, nearby frac sand locations will gain advantages for efficiency and cost savings.

Source: Energent

All the publicly listed sand companies have in-basin mines that exceed 40% of the total proppant covered. Private equity-backed sand companies are distributed across 25% to 55% coverage.

There are, no doubt, current market challenges facing the frac sand and logistics companies. Distance and delivery charges for frac sand will continue to come under pressure as E&Ps reduce costs. With logistics and frac sand company margins so low, how will companies position themselves in a cost-focused market?

For more insights on the proppants market, as well as an introduction to the methodology, considerations, and other key findings, request access to the Frac Sand Outlook white paper now using the form below.

Todd Bush, Head of US Unconventionals

[email protected] or +1 (281) 846 4425