26th February 2018

The West of Shetland (WoS) region is not a new province, but it is still one which is under-explored, at least by UKCS standards. Exploration in the region commenced in 1972 and since then a total of 160 exploration well programmes have been conducted (just 6% of total UKCS exploration).

Geologically the WoS region is challenging with multiple periods of burial and exhumation, and with Paleocene Basalt complicating geological models and inhibiting seismic imaging in some sub-basins. In terms of exploration performance, the WoS region performs poorly in comparison to other UKCS basins. Since 2008, there have been just four commercial discoveries from 23 programmes, giving a 17% commercial success rate (CSR). Finding costs are the highest in the UKCS at US$14/boe and although average discovery size is above the other basins (35 mmboe compared to the UK average of 25 mmboe), they do not compensate for the costs associated with the region. But the area holds a substantial prize. Resources from undeveloped discoveries are estimated at 2.4 billion boe and risked Yet-To-Find volumes are estimated to be 1.9 billion boe. However, there are many challenges in developing WoS resources.

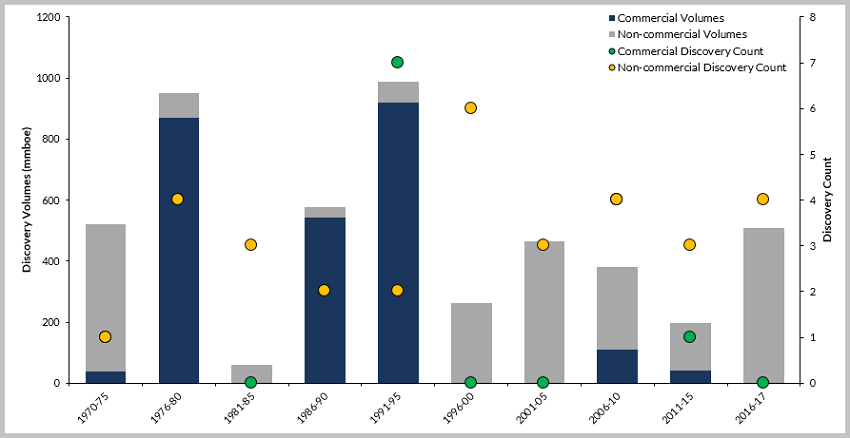

Figure 1: WoS Number of Discoveries and Associated Volumes

Figure 1: WoS Number of Discoveries and Associated Volumes

Source: Westwood Atlas

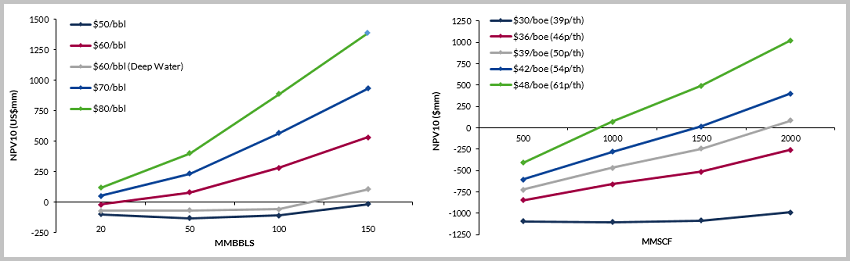

Infrastructure access to pre-existing facilities is difficult to achieve. Most of the oil facilities are either full or incapable of handling any more water. Any future gas development would be required to piggyback into the Laggan/Tormore flowlines, a technically challenging prospect, or build a dedicated line to the Shetland Gas Plant, a commercially fraught venture. The region has some of the harshest deepwater conditions, which makes developments commercially challenging. Westwood has examined the economics of tie-back developments for a variety of resource types and sizes. The conclusion is that at current price assumptions (US$60/bbl, 50p/therm) c. 50 mmbbl is required for a project to breakeven for oil in shallow water. This increases to c. 150 mmbbl for deepwater projects, off the continental shelf. Gas is even more challenging given the discovered resource to date is in deep water. Westwood estimates for a tie-back to break even, c. 2 tcf is required. Standalone projects are difficult to make work and larger resource volumes, increased commodity prices and/or a reduction in costs will be required.

Figure 2: Shallow water oil tieback economics with one Deep Water example

Figure 2: Shallow water oil tieback economics with one Deep Water example

Figure 3: Gas tieback economics in Deep Water.

Source: Westwood Atlas

However, there is potential to successfully develop assets in the region – BP continues to demonstrate this, with world class projects such as the Quad 204 redevelopment and Clair Ridge, which have benefitted from relatively shallow water and large resource sizes. More recently Hurricane has had success in the relatively untested Basement play and the Extended Production System at Lancaster is progressing. New money has also entered the region through private equity backed Siccar Point which is chasing success at Cambo with appraisal drilling and exploration of the Lyon prospect in 2018. Westwood estimates that between 2018 and 2020, production in the region will ramp up before plateau and decline. The challenge for E&P companies will be to offset this decline and it is likely that new innovative technological solutions, new plays being targeted and/or cluster developments will all be part of the solution required to crack this difficult province.

John Corr, Manager Northwest Europe Consulting

[email protected] or +44 (0)20 3794 5376