July 2025

June brought both progress and pressure for European Hydrogen markets. This edition of Hydrogen Compass explores notable project delays and cancellations in Germany and the UK, alongside consolidation in the electrolyser manufacturing space. As RED III transport implementation draft targets take shape after missing a crucial May deadline, a fragmentation of the regulatory landscape is becoming clearer – reinforcing industry calls for more coherent policy to generate momentum.

The next edition will be published in August. In the meantime, if you have any comments or feedback, please do reach out to Jun Sasamura ([email protected]).

Corporate Developments

Market conditions stall major projects

June saw a number of setbacks for European hydrogen project development, with three major projects halted amid familiar challenges including unfavourable economics, policy uncertainty and inadequate government support.

EWE cancelled its 50MW electrolytic hydrogen project in Bremen after ArcelorMittal withdrew from its green steel initiative, despite being offered €1.3 billion in subsidies. The exit underscores the continued challenges of industrial decarbonisation in Europe, particularly due to the complex EU and national regulations such as RFNBO[1] rules. While EWE will continue its other Clean Hydrogen Coastline projects, it issued a call for urgent reforms on electricity prices, regulatory clarity, funding access and infrastructure to restore investor confidence.

LEAG similarly postponed its 100MW H2UB Boxberg project. The decision was partly driven by the German government’s abandonment of the Power Plant Safety act, which had proposed funding for 500MW of hydrogen-fired power capacity.

In the UK, Air Products suspended its £2 billion green ammonia import and hydrogen terminal at the Port of Immingham, despite receiving development consent to produce up to 76ktpa of hydrogen. Progress hinged on policy support, either through a UK subsidy scheme or direct government investment, neither of which materialised. While the company has not ruled out reviving the project, it stressed that that policy support to enable firm offtake commitments are necessary before it can proceed.

Electrolyser manufacturers are also facing pressure

Following Honeywell’s acquisition of Johnson Matthey’s Catalyst Technologies business in May, June reinforced the pressures facing hydrogen technology firms, accelerating sector consolidation.

Thyssenkrupp Nucera announced its acquisition of key assets, including intellectual property and a prototype test site in Denmark, from the bankrupt Green Hydrogen Systems. The acquisition strengthens its high-pressure alkaline capabilities and complements its existing alkaline and solid-oxide offerings. The deal is expected to close by late summer, pending court and creditor approval.

Meanwhile, insolvent electrolyser producer McPhy, received three bids from John Cockerill, Hynamics and Atawey. John Cockerill has emerged as the frontrunner, bolstered by its proposal to preserve jobs and integrate McPhy’s 1GW electrolyser facility into its wider manufacturing base. Hynamics also stands to gain from vertical integration, building on its existing relationship with McPhy.

Positive momentum for ITM Power

Despite broader industry challenges, ITM power made headway in June.

It signed a FEED contract with Uniper for the 120MW Humber H2ub project at Killingholme, using six 20MW POSDEIDON modules to supply hydrogen to Philips 66’s refinery. Shortlisted under the UK’s Hydrogen Allocation Round 2 (HAR 2), the project targets operation by 2029, pending final investment decision.

ITM also launched Hydrogenpulse, a Berlin-based subsidiary offering on-site ‘hydrogen as-a-service’ across Germany, the UK and the Nordics. Using its modular Neptune II electrolysers, ITM aims to bypass third-party developers and unlock smaller projects by delivering low-cost hydrogen with no upfront cost to customers.

Two notable projects begin operation

Ineratec’s Era One plant in Frankfurt is now commercially producing up to 2,500 tonnes of synthetic crude annually, using locally sourced hydrogen and biogenic CO2. Although not clear who the offtakers are, this marks a significant development for hydrogen derived e-fuels.

ABO Energy inaugurated a 5MW electrolytic hydrogen plant in Hesse, Germany, including a wind turbine and refuelling station. Supported by €12 million in public funding, it will produce up to 450 tonnes of certified renewable hydrogen per year.

While policy uncertainty and economic hurdles are stalling large-scale projects and driving consolidation for technology manufacturers, progress has been made. Companies like ITM Power are adapting with new business models and manufacturing capabilities, while smaller, decentralised projects are reaching commercial operation. For the sector to scale meaningfully, it is clear – although not new to hear – that sustained political commitment, and targeted funding and regulatory support will be essential.

Policy and Regulation

RFNBO rules under pressure again

The EU’s strict rules for renewable hydrogen production continue to draw criticism for stalling projects and driving costs upward. In June, the European Parliament passed a resolution urging the European Commission to revise its Delegated Act on RFNBOs. Although the Commission is not obligated to act, the calls follow a petition from twelve EU member states for reform.

Following this pressure, the Commission tasked consultancy ICF to conduct a ‘neutral’ study on the rules. While officially intended to support a 2028 statutory review of the Delegated Act, the Commission hinted that interim results could inform earlier adjustments if warranted. This, however, is provided any changes don’t disrupt regulatory stability.

RED III implementation strategies diverge

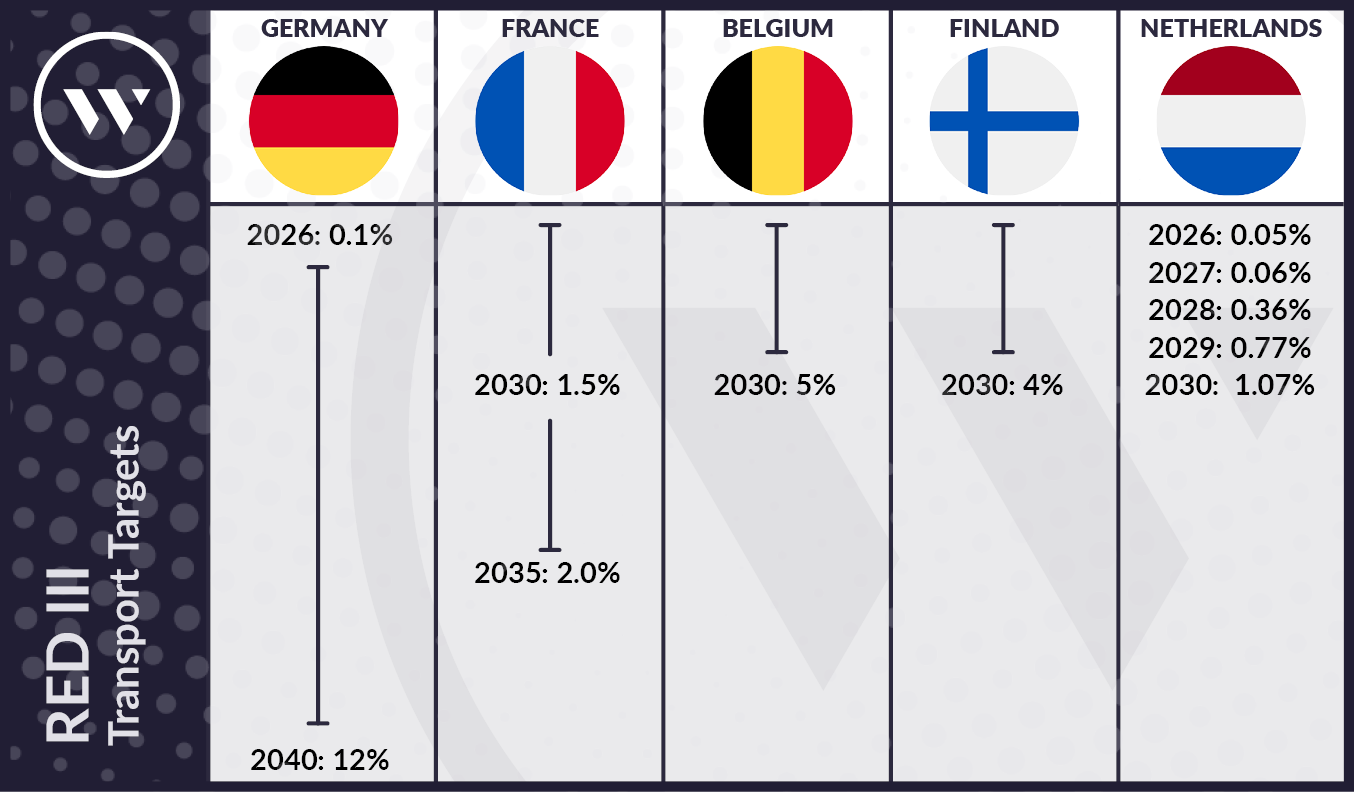

EU member states are taking diverging strategies on implementing the RED III[2] transport targets, which mandate at least 1% RFNBO-use by 2030, with some opting for more ambitious goals. However, as of July, no country has formally transposed these mandates into national law:

Thus far, the focus has been on setting transport targets, with Romania and Czechia the only countries proposing mandates for industrial hydrogen use. This hesitancy may reflect a reluctance among developers and offtakers to commit to a green premium for RFNBO hydrogen without corresponding penalties or incentives. Industry group Hydrogen Europe in June, even urged member states to introduce meaningful enforcement mechanisms, such as penalties to make compliance more attractive. Without these, they warn, RED III risks becoming ineffective, which may threaten both market adoption of renewable hydrogen and EU’s broader decarbonisation goals.

While national governments are beginning to set clearer draft targets under RED III, the EU’s rigid RFNBO rules remain a significant barrier to scaling renewable hydrogen projects. Momentum is building for reform, but without timely adjustments, market confidence and conversion of project pipelines could continue to erode.

Key European Project Watch

| Project | Update |

| Meltaus | Vetyalfa’s renewable energy project in Meltaus, Rovaniemi, which combines wind and solar power with a 50MW hydrogen plant to produce e-fuels, is moving forward with the land use planning process. On 28 May 2025, the participation and assessment scheme was published, launching the public consultation phase. Stakeholders can submit feedback until 30 June. |

| Kristinestad PtX | Koppö Energia has received a building permit for its Kristinestad Ptx project, granted by the Technical Board of Kristinestad. The joint venture — owned by CPC Finland and the Prime Green Energy Infrastructure Fund — plans to install a 200MW electrolyser powered by 500MW of onshore wind and utilise CO₂ from a nearby waste facility to produce and export 164,000 tonnes/year of green methanol from the port of Kristinestad to Central European maritime and chemicals sectors. The plant is expected to come online in 2028. |

| GET H2 Project | Evonik has completed a 50km hydrogen pipeline in western Germany as part of the GET H2 project, connecting Marl Chemical Park and BP’s Ruhr Oel refinery in Gelsenkirchen. The project includes 41km of refurbished gas pipelines and 13km of new hydrogen pipelines. Though Marl will not produce much hydrogen itself, it is linked to large electrolyser sites in Lingen expected to be operational by 2027. RWE and BP are developing renewable hydrogen production projects in the area, with future supply aimed at replacing grey hydrogen and supporting industrial demand. |

| Compostilla Green E-fuels | RIC Energy has secured 28 hectares of land at the Bayo industrial estate in León, for its €700mn Compostilla green e-fuels project, shortly after receiving €81mn from Spain’s €1.2bn Hydrogen Valleys programme. The facility will host 220MW of alkaline electrolysers to produce 36,000 tonnes of renewable hydrogen annually, which will be used to make e-kerosene for aviation using CO₂ captured from a nearby biomass plant. Under the subsidy award RIC must obtain an environmental permit by October 2026 and take FID by December 2026, though production is not expected before 2030. The company also signed an MoU with Siemens to support the project’s technical development and explore financing solutions. |

| Karmsund-HydePoint | Karmsund Hydrogen announced that it is partnering with HydePoint to develop a 20MW electrolysis project in Karmsund, Norway. The project is expected to produce more than 3ktpa of renewable hydrogen for local industrial players and to decarbonise maritime transport through the production of clean shipping fuels. The project is expected to be operational in 2028. |

| Port of Rauma e-NG | Tree Energy Solutions and CPC Finland have formed a joint venture, Luoto Energia, to develop a 500MW renewable hydrogen and e-methane (e-NG) project at the Port of Rauma in western Finland. The 20-hectare facility aims to produce around 60,000 tonnes of renewable hydrogen, which can be converted into over 125,000 tonnes of e-methane using biogenic CO₂ sourced from Finnish emitters. The project targets decarbonising hard-to-electrify sectors such as maritime and heavy-industry, with e-methane to be liquified and shipped, and some hydrogen potentially transported via the proposed Nordic Hydrogen Route pipeline. The site benefits from fast-track permitting and a valid zoning plan, with pre-FEED planned for 2026 and FID by 2028. Finland’s early adoption of the EU RED III directive and its supportive regulatory environment for RFNBOs position it as a frontrunner in synthetic fuels development. |

Jun Sasamura, Manager – Hydrogen

[email protected]

[1] Renewable Fuel of Non-Biological Origin (RFNBO) outlined in the EU’s first Renewable Energy Directive

[2] Renewable Energy Directive III (RED III) includes a requirement for industries (ammonia/chemicals production, oil refining and steel) to source 42% of their hydrogen from renewable sources by 2030. It also includes a 1% requirement of all transport fuels to be RFNBO compliant by 2030.