Over the past 18 months, European governments have revised their national hydrogen strategies and targets. Project developers have followed suit by adjusting portfolios and scaling back investment to better reflect the challenging realities of today’s hydrogen market. This week’s Westwood Insight takes a closer look, plus your opportunity for free trial access to Westwood’s Hydrogen product.

Despite these pressures, some developers are making tangible progress. It’s not necessarily the most ambitious pipelines or the largest sanctioned projects that define leadership in the European hydrogen market. Instead, the developers who are prioritising near-term, deliverable projects, utilising existing capabilities, and securing early offtake are setting the standard.

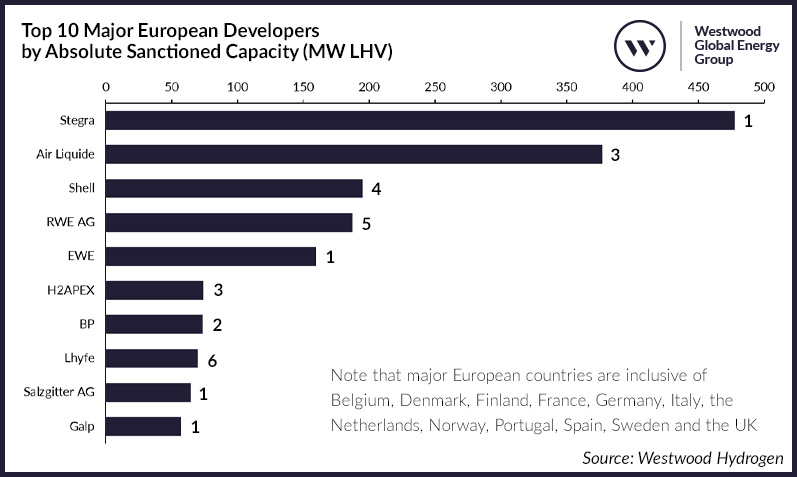

Looking at sanctioned project capacity alone, in many cases progress is limited to a single, well-supported project, while the broader pipeline remains undeveloped.

Figure 1: Top 10 Major European Developers by Absolute Sanctioned Capacity (MW LHV). Source: Westwood Hydrogen. Note: Values at end of bars denote number of projects. Major European countries are inclusive of Belgium, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Portugal, Spain, Sweden and the UK.

In fact, 71% of developers with sanctioned capacity have only one sanctioned project, which is backed by substantial (perhaps non-repeatable levels of) funding. This is the case for Stegra, whose Boden Steel Plant in Sweden tops all lead developers, but has benefitted from €6.5bn in public and EU funding. This highlights an exception, not the rule.

Positioning for Success

To better understand which developers are genuinely progressing, Westwood analysed project maturity and ambition using our Hydrogen database and Project Certainty feature*. By assessing the combination of sanctioned and ‘probable’ capacity within each developer’s total pipeline, we identified distinct strategic approaches and highlighted those best positioned to deliver over the coming decade.

Figure 2: Major European Developer’s Total Pipeline Capacity to 2035 (GW LHV) vs Percentage of Sanctioned & Probable Projects. Source: Westwood Hydrogen. Note: ‘Probable’ projects are those that have progressed sufficiently and have a higher likelihood of achieving FID.

Strategic Performers

Equinor is the sole developer in the ‘Strategic Performers’ quadrant, with approximately 1.8GW of probable capacity out of a near 3GW pipeline, positioning them away from the pack in terms of ambition and delivery. This is due to their unique strategy centred on CCS-enabled hydrogen. Rather than spreading resources across a broad pipeline, Equinor has shifted focus onto three major CCS-enabled projects, leveraging its existing strengths in CCS and oil and gas. This approach allows them to pursue larger, more complex projects, typical of CCS-enabled hydrogen, while maintaining a clear path to delivery.

Their strategy highlights how targeted, high-impact development can push the sector forward, even amid broader market uncertainty and potentially points to the companies scale back from its initial much larger ambition being the correct decision, allowing them to continue investment in more commercially viable opportunities.

Disciplined Builders

In the ‘Disciplined Builders’ quadrant, we see developers prioritising near-term project delivery on a smaller scale. This more realistic approach typically targets markets more ready for immediate decarbonisation, such as the chemicals and steel sectors. Three developers stand out: Renato PtX, Hynamics and Plug Power. Renato PtX has an entirely ‘probable’ 1.3GW (LHV) pipeline from Project Catalina, which is backed by EU funding, and has secured offtake through Fertiberia. Hynamics’ most mature projects include HyScale100 in Germany and the Borealis-Hynamic Green Ammonia Project in France – both targeting the chemicals sector and having secured industrial offtake.

The key takeaway is that developers are focusing on achievable capacity and demonstrating their ability to build it. In doing so, they will build confidence not only in their capacity to produce hydrogen but also in the sector’s growth potential, which further supports the progress and bankability of hydrogen projects.

Overstretched Developers

Considering the developers in the ‘Overstretched Developers’ quadrant, two distinct strategic approaches emerge.

1. Mega Project Focused

The first approach comprises those pursuing mega-scale, flagship hydrogen projects, often as sole developers or within large consortia. This includes developers such as EET Hydrogen and Hive Energy, who are leading single projects with capacities of 3.5GW and 2.2GW (LHV), respectively. NortH2, with the largest by pipeline capacity at over 9GW (LHV) epitomises this approach. However, these large-scale efforts face similar challenges, including extended timelines, delayed online dates, and a necessity for further market maturity to secure offtake agreements.

2. Portfolio Diversification

The second camp focuses on a multi-project, multi-country approach. Developers like Uniper, RWE and Air Liquide are building diversified portfolios, often 10+ projects spread across key hydrogen hubs such as the UK and Germany. The approach appears to hedge against political and commercial risks in any single market. While geographically expansive, the average project size tends to be smaller, with this group showing relatively better early-stage progress. When looking more granularly, of the 43 projects from developers in this section, only six are CCS-enabled, from Uniper and Air Liquide.

For electrolytic projects, while scale remains a long-term goal, a nearer term focus on portfolio diversity and smaller scale electrolytic hydrogen projects are emerging as a more commercially viable and scalable pathway in the current market conditions.

Emerging and Underperforming

Notable developers fall into the ‘Emerging and Underperforming’ quadrant, reflecting recent strategic scale-backs in hydrogen.

In 2Q Statkraft delayed its 2GW electrolyser target to 2035 and halted further investment into new hydrogen projects. Meanwhile, BP has made a major strategic shift in the last few years. Once targeting a 40% reduction in oil and gas output by 2030 and planning annual hydrogen investments of $0.5bn, the company has since cancelled 18 early-stage hydrogen projects. Its strategy now focuses on securing 5-10 FIDs by 2030, with a near-term focus on CCS-enabled hydrogen hubs such as H2Teeside in the UK. BP and Statkraft’s lower placement in the scoring reflects the fact that much of their pipeline is not yet considered ‘probable’, which perhaps explains their renewed emphasis on prioritising and advancing fewer, more deliverable projects. These moves underscore a broader trend across Europe of ambition giving way to targeted execution of deliverable projects.

Lhyfe, however, is the most active developer in Westwood’s Hydrogen database with 23 projects at some stage of development – not exactly underperforming. Six projects have been sanctioned and one large scale project is categorised as ‘probable’. Their 1.6GW (LHV) pipeline is also of note. Lhyfe’s strategy is one of deliberate step-by-step scale up from smaller 5-10MW projects, moving to larger-scale projects such as their 300MW Torpshammar project in Sweden. This strategy should enable them to de-risk larger projects, as they have demonstrated expertise at a smaller scale. As a result of this, Lhyfe is at the more ambitious end of this quadrant. However, its smaller projects, which have been sanctioned, are outweighed by their larger projects that have yet to assign electrolyser partners and offtakers, penalising them in this analysis.

Disciplined Approach Defines Today’s Leaders

A conclusion we can draw from our analysis is that for most developers, the challenge is not about building an ambitious pipeline. Those that have a large pipeline are often overstretched geographically or stuck in the complexity of large-scale project delivery in today’s market environment. Equinor stands alone due to its unique focused approach on a group of hydrogen projects.

Instead, a ‘Disciplined Builder’ approach demonstrates that a project can be delivered under current market constraints. These developers are:

- Focusing on a manageable scale to maintain commercial stability

- Building momentum through staged delivery

- Aligning production pathways with internal capabilities

- Securing industrial offtake early

While large-scale strategic ambition will be essential in the long-term, current dynamics are more favourable towards smaller-scale, de-risked solutions. Early execution in a focused and robust pipeline is what defines success now, before developers can consider pushing onwards and building capacity.

Ben Clark, Senior Analyst – Hydrogen & CCUS

[email protected]

Arthur James, Analyst – Hydrogen

[email protected]

*Westwood’s Hydrogen Project Certainty feature gives users a risk-based view of projects and pipelines, assessing developments that have not yet reached the EPCI stage. Each project is evaluated across six categories spanning the entire value chain and classified into four statuses: Risked, Possible, Probable and Sanctioned.

Unlock Europe’s Hydrogen Insights

Free Product Trial for a Limited Time Only

Trial Period: Monday 15th September – Friday 17th October 2025

Discover the full power of Westwood’s Hydrogen product with a free trial and gain exclusive insights into Europe’s rapidly evolving hydrogen market.