Report Summary

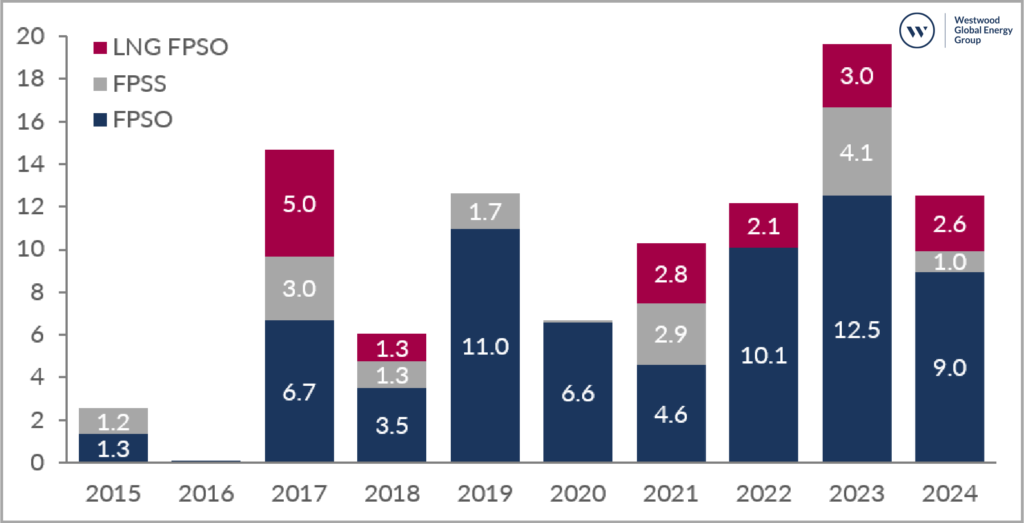

Westwood Energy’s World Floating Production Systems Market May 2020 provides an outlook on the number of units and the value of orders expected over the 2020-2024 period. The report highlighted that sector recovery from the 2015-2016 downturn is expected to stutter in 2020 with $13bn of EPC awards already deferred. FPS order value is down in 2020, but still above 2016. The recent crash in oil prices and logistical challenges posed by COVID-19 have significantly impacted the offshore sector. Westwood now expects up to $7bn of FPS EPC contracts to be awarded in 2020 – 67% less than the $20bn potential as of February 2020. $2bn of FPS EPC contracts have already been awarded and an additional $5bn of contracts are expected to be announced this year. E&Ps could use the oil price crash to ‘reset’ recent FPS cost creep. EPC cost rationalisation has played a key role in improving offshore project economics in a $60/bbl world.

Figure 1: Global FPS EPC contract awards ($billions)

During 2H2019, numerous packages were re-tendered due to higher than expected cost quotes as suppliers looked to push pricing. E&Ps have already reacted by widening the tender list for FPS awards (opening the door for new & re-entrants, such as Yinson entering Brazil floater market with the Marlim revitalization FPSO award) but the slowdown in FIDs due to macro headwinds could also allow the market to cooldown and stop cost creep. The cool-down in orders may allow E&Ps to reassert bargaining power and curtail recent cost inflation. The cost of FPSO throughput capacity has fallen from an average of $15.2k/boepd in 2012-14 to $7.8k/boepd since 2016. Recent increase in awards and backlogs of leading contractors such as MODEC & SBM (70% of awarded throughput since 2016) has now flowed through to an uptick in EPC costs that threaten project viability even in at $60/bbl.

FLNG has been long-heralded as the future of the FPS market. However, potential over-investment in liquefication capacity in the past decade led Japanese LNG prices to crash from $14/mmbtu in 2014 to average $4.2 in 1Q2020 – severely undermining investor confidence. Westwood’s base case outlook for FLNG awards over the 2020-24 period has now been reduced to 7 units compared to 12 in 4Q2019. This translates to a reduction of 33.3 mmpta of LNG throughput capacity.

Contents

Key Messages

Report Summary

Industry Overview

- Review of Macro Fundamentals

- Recent EPC Awards

- Industry Performance

- Major Leasing Contractors

- FPSO Cost Analysis

Market Outlook

- GLobal FPS Market Outlook

- Major Upcoming EPC Contracts

- Global LNG FPSO Activity

- Market Outlook: Africa

- Market Outlook: Asia Pacific

- Market Outlook: Latin America

- Market Outlook: Rest of the World

- Global FSRU Market Outlook

Appendix

Please complete the form below to reach out to us.