Quarterly Summary

Brent crude prices were stable during 3Q 2025, averaging US$68.9/bbl, a marginal improvement from the US$68.1/bbl average in the preceding quarter. Prices were supported by an escalation of geopolitical risks, including the intensification of Russian attacks in Ukraine; however, this was offset by continued supply-side pressure, with OPEC+ announcing plans to unwind an additional 1.92 mmbpd of crude production, while Latin American producers also reported higher output. With demand throughout 2025 lagging far behind the expectations at the start of the year, this has led to an oversupplied market of approximately 600 kbpd in the quarter. The continued return of OPEC+ crude, as well as continued growth from non-OPEC sources, is expected to keep pressure high in 1Q 2026, with oversupply potentially peaking at 3 mmbpd, the highest since 2020.

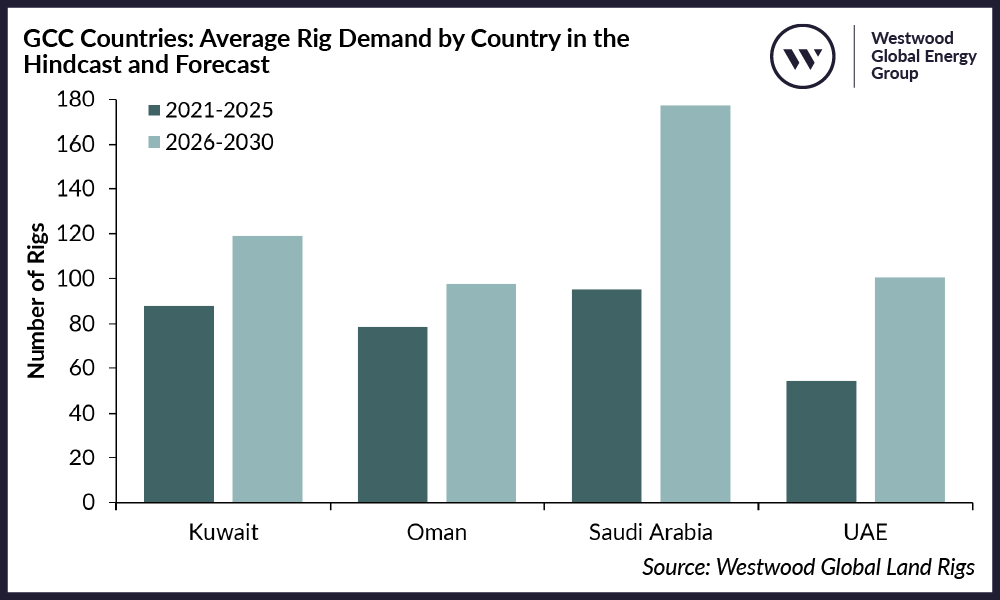

In Westwood’s recently published Global Land Drilling Outlook, a relatively flat outlook for the rig market is anticipated over the 2026-2030 period, with demand to average 4,219 rigs, a 4% improvement on the average of 4,063 units demanded between 2021 and 2025. The big four drilling markets: Canada, China, Russia and the US, are forecasted to account for 66% of this demand. However, elsewhere, the real growth stories are expected to be led by unprecedented demand growth in the Middle East. This region is anticipated to be the most buoyant global drilling market, led by activity in GCC member countries, where NOCs are advancing brownfield expansion projects and developing unconventional hydrocarbon resources. This will mean that an average of 495 rigs is expected to be operational across the four main GCC countries between 2026-2030, a 56% increment on 317 rigs in the hindcast.

Underlining the bullish outlook for the GCC was a raft of high-value contracts across the quarter under review. Saudi Arabia was at the forefront of contracting activity during the quarter, highlighted by Arabian Drilling’s extension of 15 rig contracts, four of which are confirmed to be with Aramco. Since then, there have been a series of oil-centric rig reactivation announcements in the Kingdom, from contractors such as ADES, Arabian Drilling, H&P, and SANAD, to sustain domestic crude production, with most of the suspended units expected to return in 2026. Thus, over the forecast period, Saudi Arabia is anticipated to lead demand among the GCC countries, with an average of 177 units required annually, followed by Kuwait with 119 units, and the United Arab Emirates and Oman with 101 and 98 rigs, respectively.

GCC Average Rig Demand by Country in the Hindcast and Forecast

Source: Westwood Global Land Drilling Rigs

The 3Q 2025 edition of the newsletter includes key updates on rig contracting activity, led by Arabian Drilling, which extended 15 contracts in Saudi Arabia. This edition also contains details on global oil and gas drilling, licensing, and field development activity, including the launch of a seven-block exploration and development bid round in Egypt and the signing of agreements to develop oil and gas fields in Iraq and India.

During 3Q 2025, there were also key developments in the geothermal market, highlighted by Grupo Enal’s award of a 30-year concession to develop resources in the Celaya area in Mexico. On the regulatory side, Colombia relaxed regulations on drilling gradient wells to boost early-stage exploration. At the same time, Daldrup & Söhne AG (Daldrup) was awarded two geothermal drilling contracts in Germany.

Lastly, M&A activity remained active during the quarter with a range of deals announced, predominantly in Latin America and North America. The most prominent transaction during 3Q 2025 was Crescent Energy’s acquisition of Vital Energy for US$3.1bn, creating a top-10 independent company in the USA.

Ben Wilby, Manager – Onshore Energy Services

[email protected]

Michela Francisco, Research Analyst – Onshore Energy Services

[email protected]